Time Publishing and Media Co., Ltd.'s (SHSE:600551) Share Price Boosted 27% But Its Business Prospects Need A Lift Too

The Time Publishing and Media Co., Ltd. (SHSE:600551) share price has done very well over the last month, posting an excellent gain of 27%. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

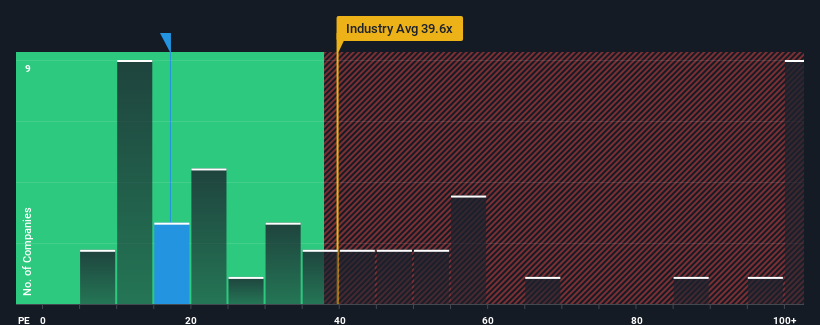

Even after such a large jump in price, Time Publishing and Media's price-to-earnings (or "P/E") ratio of 17.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 60x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Earnings have risen firmly for Time Publishing and Media recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Time Publishing and Media

Is There Any Growth For Time Publishing and Media?

In order to justify its P/E ratio, Time Publishing and Media would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 26% last year. The strong recent performance means it was also able to grow EPS by 112% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 39% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Time Publishing and Media's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Time Publishing and Media's P/E?

Time Publishing and Media's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Time Publishing and Media maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Time Publishing and Media that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Time Publishing and Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600551

Time Publishing and Media

Time Publishing and Media Co., Ltd. publishes various books and periodicals in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives