Beijing Gehua Catv Network Co.,Ltd. (SHSE:600037) Investors Are Less Pessimistic Than Expected

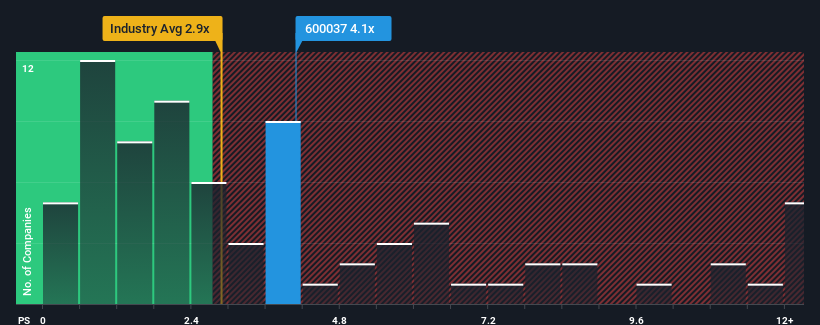

When you see that almost half of the companies in the Media industry in China have price-to-sales ratios (or "P/S") below 2.9x, Beijing Gehua Catv Network Co.,Ltd. (SHSE:600037) looks to be giving off some sell signals with its 4.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Beijing Gehua Catv NetworkLtd

How Beijing Gehua Catv NetworkLtd Has Been Performing

Beijing Gehua Catv NetworkLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Gehua Catv NetworkLtd will help you uncover what's on the horizon.How Is Beijing Gehua Catv NetworkLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Beijing Gehua Catv NetworkLtd would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 2.2% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 6.2% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 3.5% as estimated by the lone analyst watching the company. That's shaping up to be materially lower than the 14% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Beijing Gehua Catv NetworkLtd's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Beijing Gehua Catv NetworkLtd trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Beijing Gehua Catv NetworkLtd with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Gehua Catv NetworkLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600037

Beijing Gehua Catv NetworkLtd

Engages in the construction, management, operation, and maintenance of cable radio and television networks in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives