- Japan

- /

- Construction

- /

- TSE:1885

Exploring Three Undiscovered Gems For Potential Portfolio Growth

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks, driven by expectations of economic growth and tax reforms following the recent election, small-cap stocks have shown promising movement, with the Russell 2000 Index leading gains despite not reaching record highs. Amid this dynamic market environment, identifying lesser-known stocks with strong fundamentals and growth potential can be key to enhancing portfolio performance.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Citra Tubindo | NA | 9.17% | 14.32% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Focus Lighting and Fixtures | 12.21% | 36.42% | 77.11% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Longkou Union Chemical (SZSE:301209)

Simply Wall St Value Rating: ★★★★★★

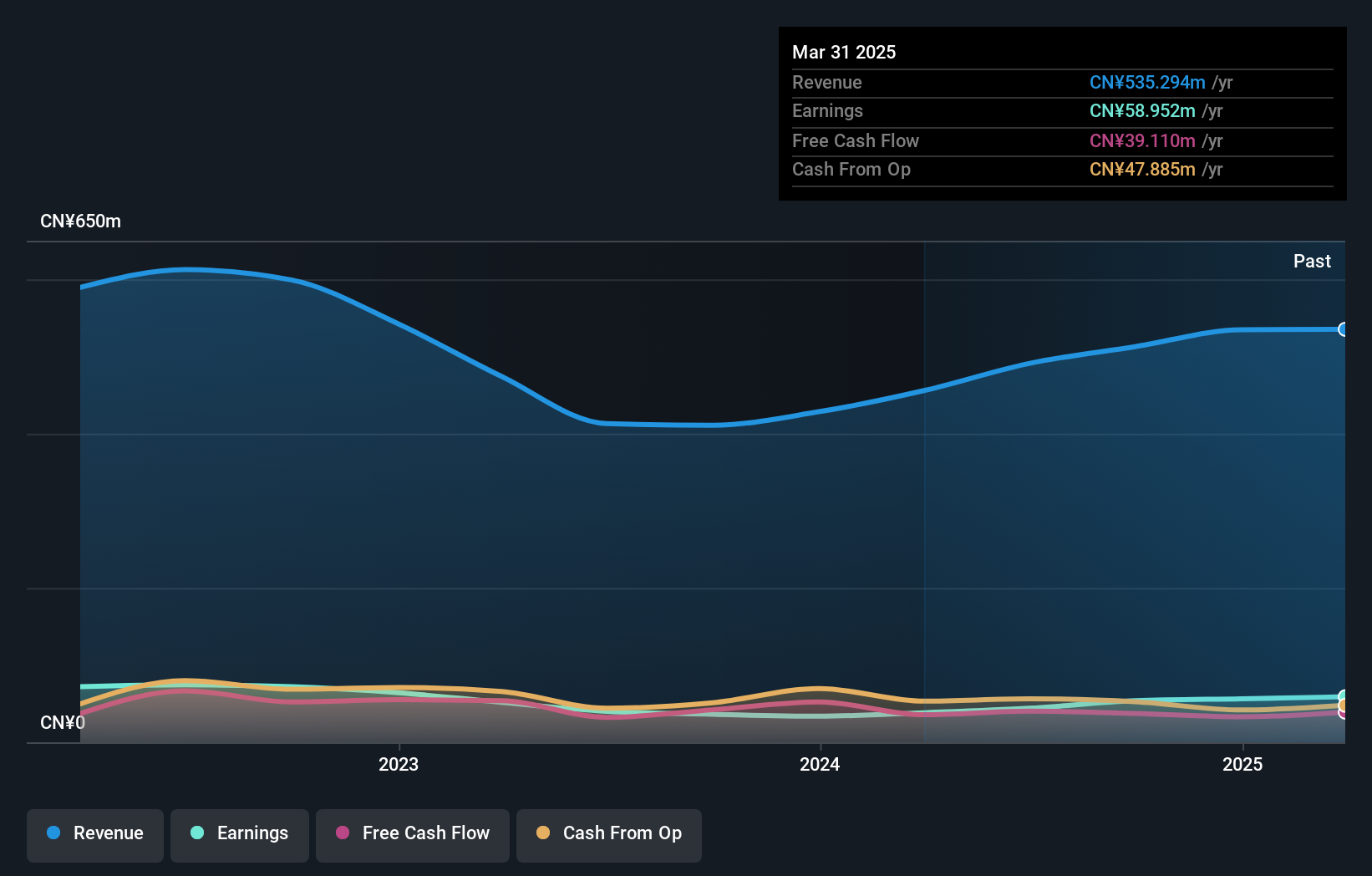

Overview: Longkou Union Chemical Co., Ltd. is involved in the production and sale of organic pigments both in China and internationally, with a market cap of CN¥2.26 billion.

Operations: The company generates revenue primarily from the sale of organic pigments. Its financial performance is highlighted by a net profit margin trend that reflects its operational efficiency.

Longkou Union Chemical, a dynamic player in the chemical sector, has shown impressive financial resilience. The company reported a notable increase in sales to CNY 392.72 million for the nine months ending September 2024, up from CNY 308.33 million the previous year. Net income also rose significantly to CNY 44.08 million from CNY 24.12 million, reflecting strong operational performance with basic earnings per share climbing to CNY 0.551 from CNY 0.3015 last year. Over five years, its debt-to-equity ratio improved dramatically from 37.9% to just 3.6%, indicating robust financial management and positioning it well within its industry context for continued growth potential.

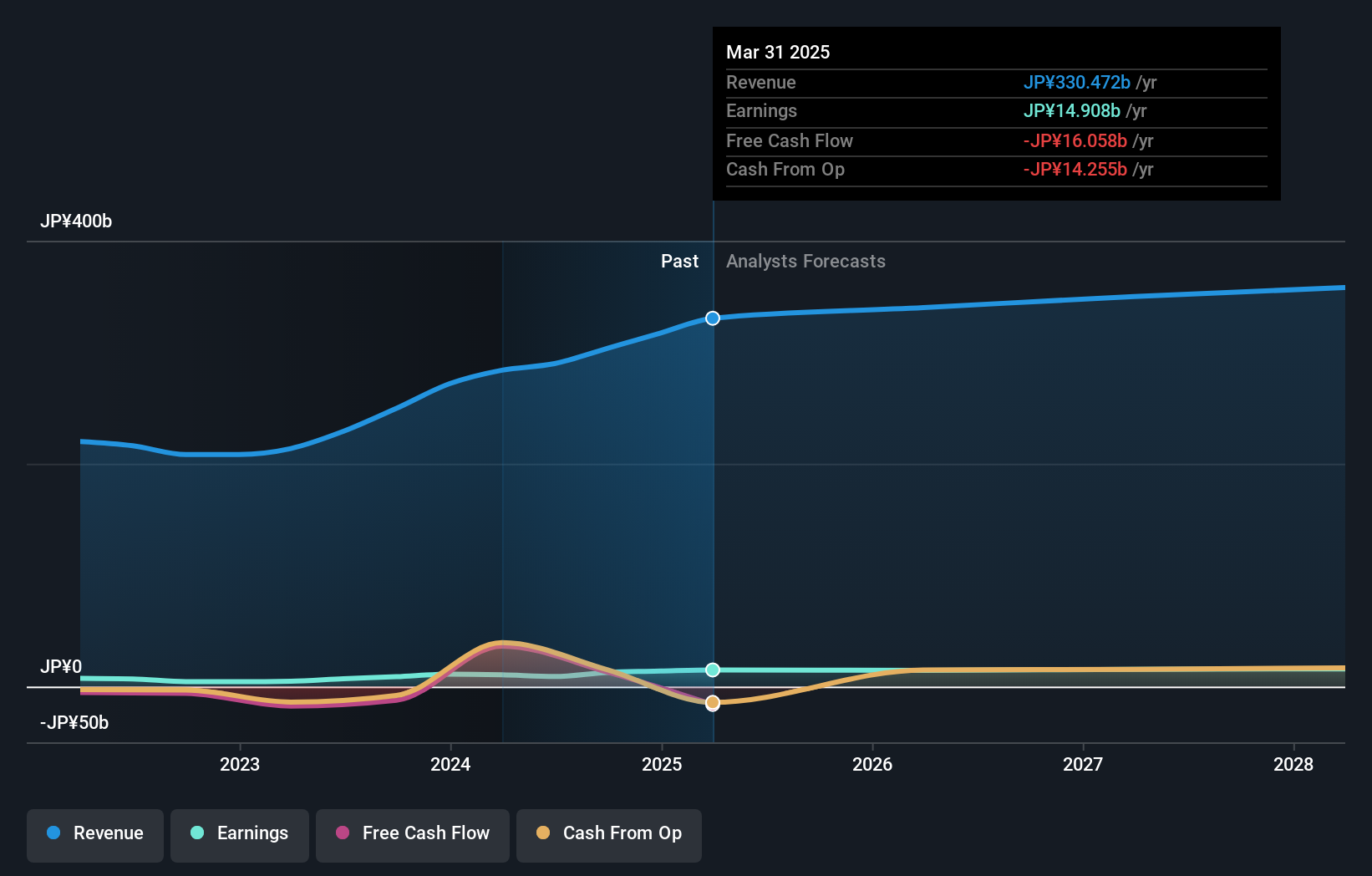

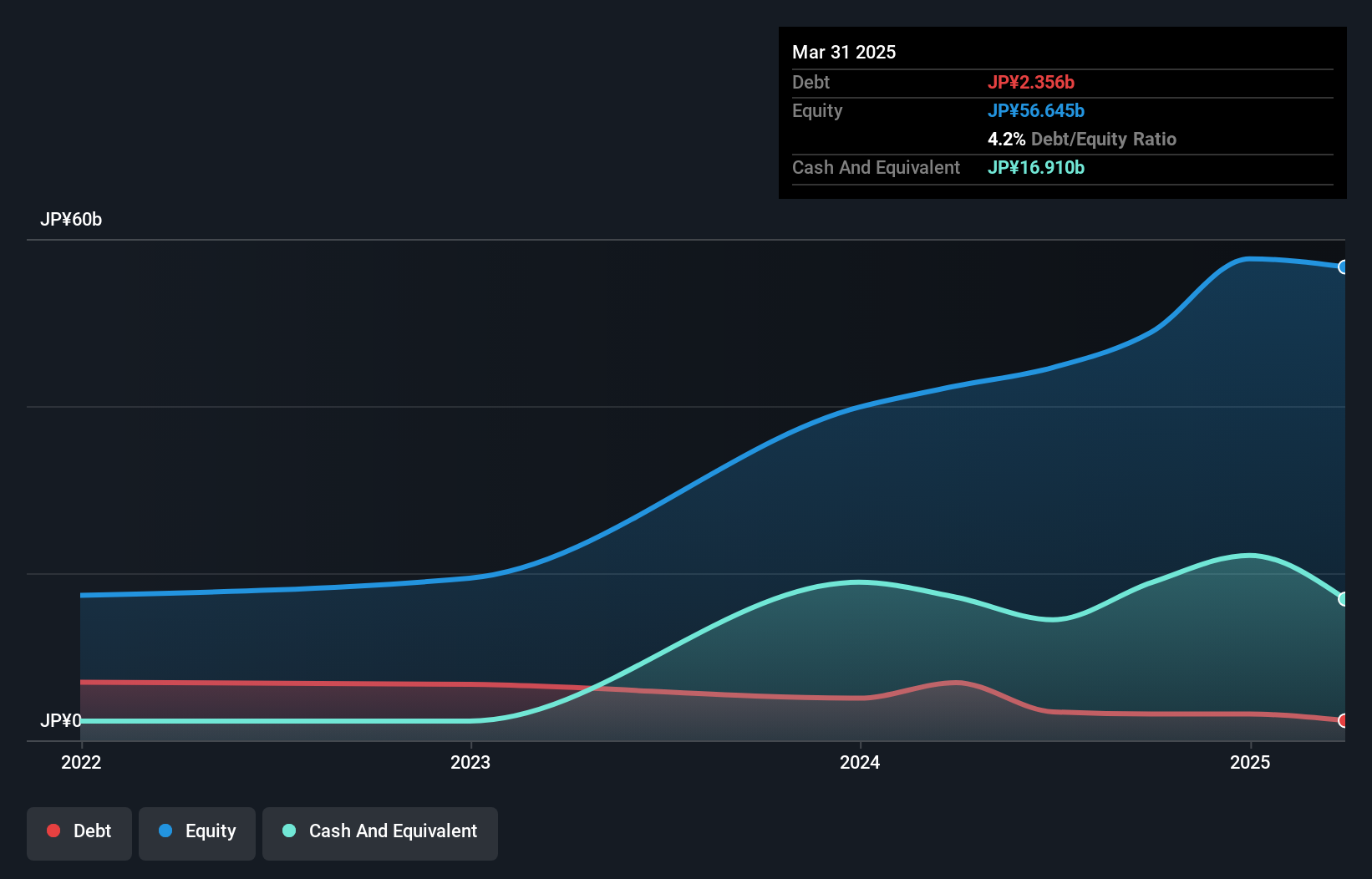

TOA (TSE:1885)

Simply Wall St Value Rating: ★★★★★★

Overview: TOA Corporation offers construction and engineering services in Japan with a market cap of ¥77.30 billion.

Operations: The company generates revenue primarily from construction and engineering services. Its net profit margin is 2.5%, reflecting the efficiency of its operations in converting revenue into actual profit.

TOA Corporation, a promising player in the construction sector, has demonstrated impressive financial health with earnings growing 27.8% over the past year, outpacing the industry’s 26.6%. Trading at 85.5% below its estimated fair value suggests it offers good relative value compared to peers. The company boasts high-quality past earnings and maintains an appropriate debt level with more cash than total debt, which likely supports its robust interest coverage ratio. Despite recent fluctuations in working capital and capital expenditures around A$4 million, TOA's positive free cash flow indicates strong operational efficiency and potential for future growth.

- Click here to discover the nuances of TOA with our detailed analytical health report.

Assess TOA's past performance with our detailed historical performance reports.

Integral (TSE:5842)

Simply Wall St Value Rating: ★★★★★☆

Overview: Integral Corporation is a private equity firm that focuses on management buyouts, turnarounds, leveraged buyouts, mezzanine financing, and other minority investments with a market cap of ¥1.29 billion.

Operations: Integral generates revenue primarily from its investment activities, with reported revenues of ¥17.37 billion.

Integral's recent developments suggest a promising yet volatile investment landscape. The company's earnings surged by 84% over the past year, outpacing the Capital Markets industry's 31%. Its interest payments are comfortably covered by EBIT at an impressive 216 times, indicating strong financial health. Integral trades at about 7% below its estimated fair value, presenting potential for value investors. However, share price volatility remains a concern. Recent board meetings focused on expanding into real estate investments and leadership changes with Shigehiro Nishioka's appointment as Partner could influence strategic direction positively in future endeavors.

- Navigate through the intricacies of Integral with our comprehensive health report here.

Gain insights into Integral's past trends and performance with our Past report.

Turning Ideas Into Actions

- Explore the 4666 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1885

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026