Ningbo Color Master Batch Co., Ltd. (SZSE:301019) Shares Fly 30% But Investors Aren't Buying For Growth

The Ningbo Color Master Batch Co., Ltd. (SZSE:301019) share price has done very well over the last month, posting an excellent gain of 30%. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

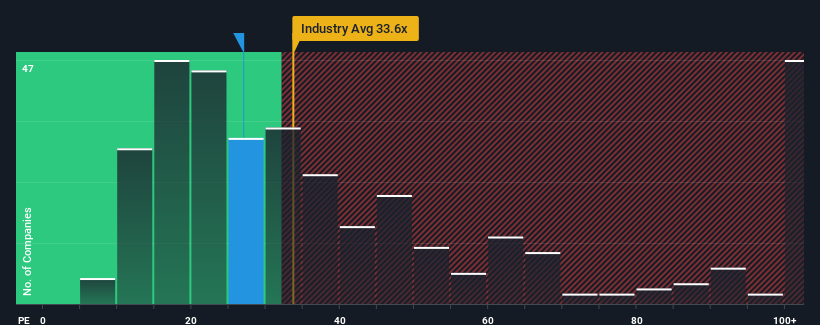

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Ningbo Color Master Batch as an attractive investment with its 27x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

The earnings growth achieved at Ningbo Color Master Batch over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Ningbo Color Master Batch

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Ningbo Color Master Batch's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 30% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's an unpleasant look.

In light of this, it's understandable that Ningbo Color Master Batch's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

Ningbo Color Master Batch's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Ningbo Color Master Batch revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - Ningbo Color Master Batch has 3 warning signs (and 1 which is significant) we think you should know about.

Of course, you might also be able to find a better stock than Ningbo Color Master Batch. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Color Master Batch might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301019

Ningbo Color Master Batch

Engages in the research and development, production, and sale of plastic coloring products in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives