Anhui Hyea Aromas Co., Ltd.'s (SZSE:300886) 36% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Anhui Hyea Aromas Co., Ltd. (SZSE:300886) shares have been powering on, with a gain of 36% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.7% over the last year.

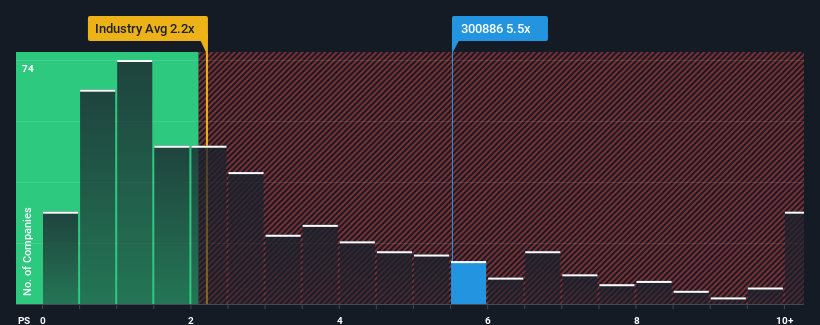

Following the firm bounce in price, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Anhui Hyea Aromas as a stock to avoid entirely with its 5.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Anhui Hyea Aromas

How Anhui Hyea Aromas Has Been Performing

Revenue has risen firmly for Anhui Hyea Aromas recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Anhui Hyea Aromas, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Anhui Hyea Aromas?

In order to justify its P/S ratio, Anhui Hyea Aromas would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. The strong recent performance means it was also able to grow revenue by 44% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 21% shows it's noticeably less attractive.

In light of this, it's alarming that Anhui Hyea Aromas' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Shares in Anhui Hyea Aromas have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Anhui Hyea Aromas revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware Anhui Hyea Aromas is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300886

Anhui Hyea Aromas

Engages in the research and development, production, and sale of fine chemicals.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026