- China

- /

- Basic Materials

- /

- SZSE:300737

Even With A 31% Surge, Cautious Investors Are Not Rewarding Keshun Waterproof Technolgies Co.,Ltd.'s (SZSE:300737) Performance Completely

Keshun Waterproof Technolgies Co.,Ltd. (SZSE:300737) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

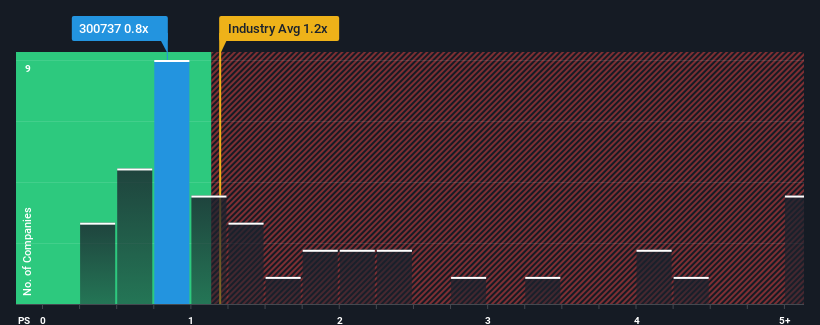

In spite of the firm bounce in price, there still wouldn't be many who think Keshun Waterproof TechnolgiesLtd's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in China's Basic Materials industry is similar at about 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Keshun Waterproof TechnolgiesLtd

What Does Keshun Waterproof TechnolgiesLtd's Recent Performance Look Like?

Keshun Waterproof TechnolgiesLtd has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Keshun Waterproof TechnolgiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Keshun Waterproof TechnolgiesLtd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Keshun Waterproof TechnolgiesLtd's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.9%. This means it has also seen a slide in revenue over the longer-term as revenue is down 3.6% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 21% over the next year. With the industry only predicted to deliver 7.6%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Keshun Waterproof TechnolgiesLtd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Keshun Waterproof TechnolgiesLtd's P/S Mean For Investors?

Keshun Waterproof TechnolgiesLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Keshun Waterproof TechnolgiesLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Keshun Waterproof TechnolgiesLtd (1 is a bit unpleasant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Keshun Waterproof TechnolgiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300737

Keshun Waterproof TechnolgiesLtd

Keshun Waterproof Technology Co.,Ltd. engages in the research and development, production, and sale of new building waterproof materials.

Fair value with moderate growth potential.

Market Insights

Community Narratives