Getting In Cheap On Crystal Clear Electronic Material Co.,Ltd (SZSE:300655) Might Be Difficult

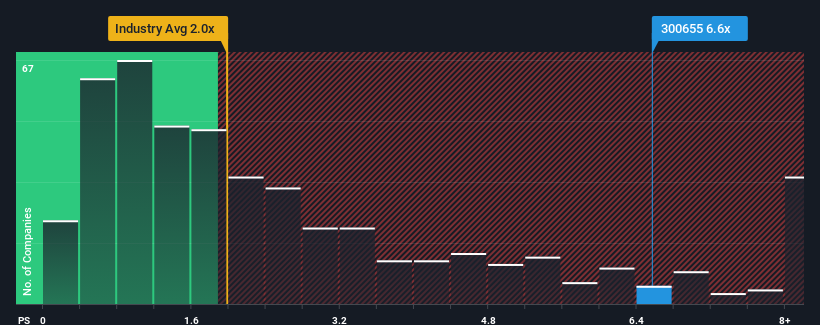

When you see that almost half of the companies in the Chemicals industry in China have price-to-sales ratios (or "P/S") below 2x, Crystal Clear Electronic Material Co.,Ltd (SZSE:300655) looks to be giving off strong sell signals with its 6.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Crystal Clear Electronic MaterialLtd

How Crystal Clear Electronic MaterialLtd Has Been Performing

Crystal Clear Electronic MaterialLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Crystal Clear Electronic MaterialLtd.Is There Enough Revenue Growth Forecasted For Crystal Clear Electronic MaterialLtd?

The only time you'd be truly comfortable seeing a P/S as steep as Crystal Clear Electronic MaterialLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 6.4% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 37% over the next year. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

With this information, we can see why Crystal Clear Electronic MaterialLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Crystal Clear Electronic MaterialLtd's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Crystal Clear Electronic MaterialLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Crystal Clear Electronic MaterialLtd that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300655

Crystal Clear Electronic MaterialLtd

Engages in the research and development, manufacturing, and sales of various chemicals, lithium battery materials, and photoresists in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives