- China

- /

- Electrical

- /

- SZSE:300207

3 Asian Growth Companies With High Insider Ownership And 27% Revenue Growth

Reviewed by Simply Wall St

As global markets react to shifting economic data and interest rate speculation, Asian markets have seen a mix of optimism and caution, particularly with the recent pause in U.S.-China tariffs providing a temporary boost to investor sentiment. In this environment, stocks that combine robust revenue growth with high insider ownership can be particularly appealing as they may indicate strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.8% | 54.4% |

| Techwing (KOSDAQ:A089030) | 19.1% | 68% |

| Synspective (TSE:290A) | 12.8% | 48.9% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 24.3% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 35.3% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 43.7% |

We'll examine a selection from our screener results.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★☆☆

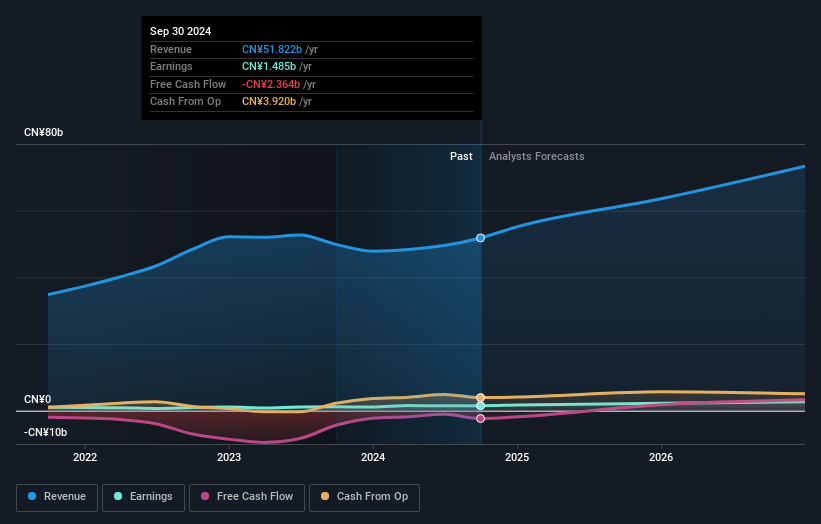

Overview: Servyou Software Group Co., Ltd. and its subsidiaries offer financial and tax information services in China, with a market cap of CN¥22.17 billion.

Operations: Servyou Software Group Co., Ltd. generates revenue primarily from providing financial and tax information services in China.

Insider Ownership: 22.7%

Revenue Growth Forecast: 19.7% p.a.

Servyou Software Group shows robust growth potential with earnings forecast to grow significantly at 47.65% annually, outpacing the Chinese market average. Despite recent volatility in share price and a decline in net income for the first half of 2025, revenue increased to CNY 922.41 million from CNY 814.48 million year-on-year, indicating resilience. However, large one-off items have impacted financial results, and insider trading activity remains unreported over the last three months.

- Get an in-depth perspective on Servyou Software Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Servyou Software Group is trading beyond its estimated value.

Sunwoda ElectronicLtd (SZSE:300207)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunwoda Electronic Co., Ltd is involved in the research, development, design, production, and sale of lithium-ion battery modules with a market cap of CN¥40.31 billion.

Operations: Sunwoda Electronic Co., Ltd generates its revenue primarily through the research, development, design, production, and sale of lithium-ion battery modules.

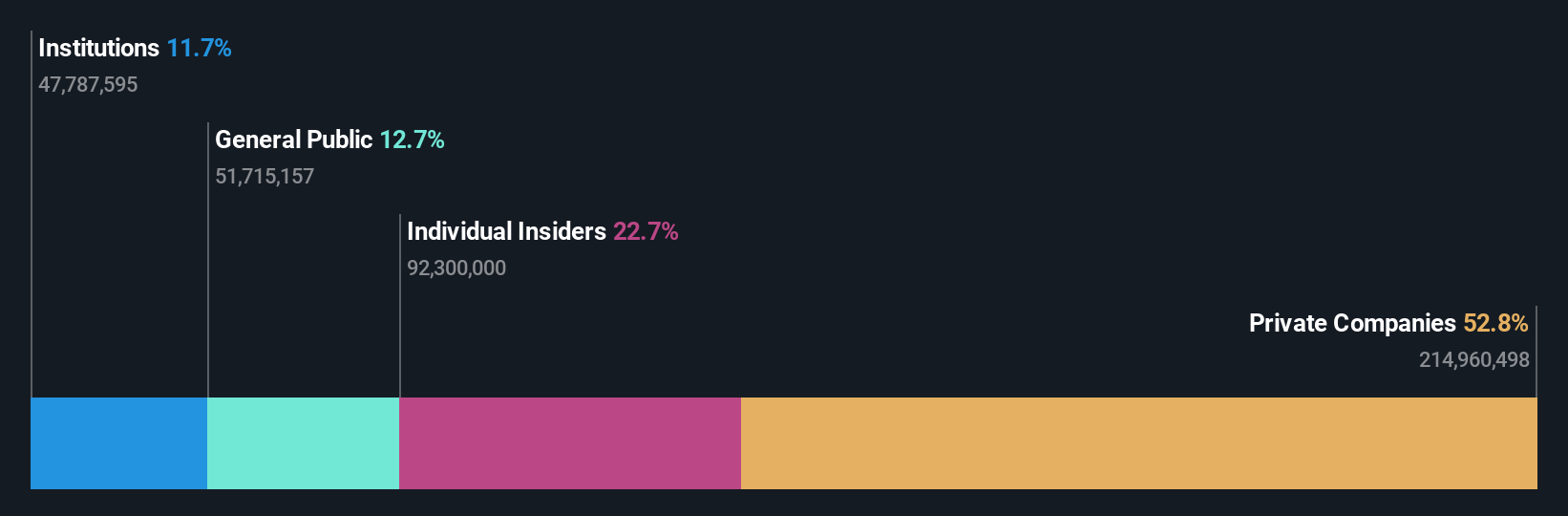

Insider Ownership: 28.4%

Revenue Growth Forecast: 16.6% p.a.

Sunwoda Electronic Ltd. is poised for growth, with earnings forecasted to increase significantly by 25.57% annually, surpassing the Chinese market average of 24.3%. The company trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Recent developments include approval for H-share issuance and listing on the Hong Kong Stock Exchange, signaling potential expansion opportunities. However, low forecasted Return on Equity (9.7%) and unsustainable dividend coverage are concerns.

- Click here and access our complete growth analysis report to understand the dynamics of Sunwoda ElectronicLtd.

- Upon reviewing our latest valuation report, Sunwoda ElectronicLtd's share price might be too pessimistic.

Hubei Feilihua Quartz Glass (SZSE:300395)

Simply Wall St Growth Rating: ★★★★★☆

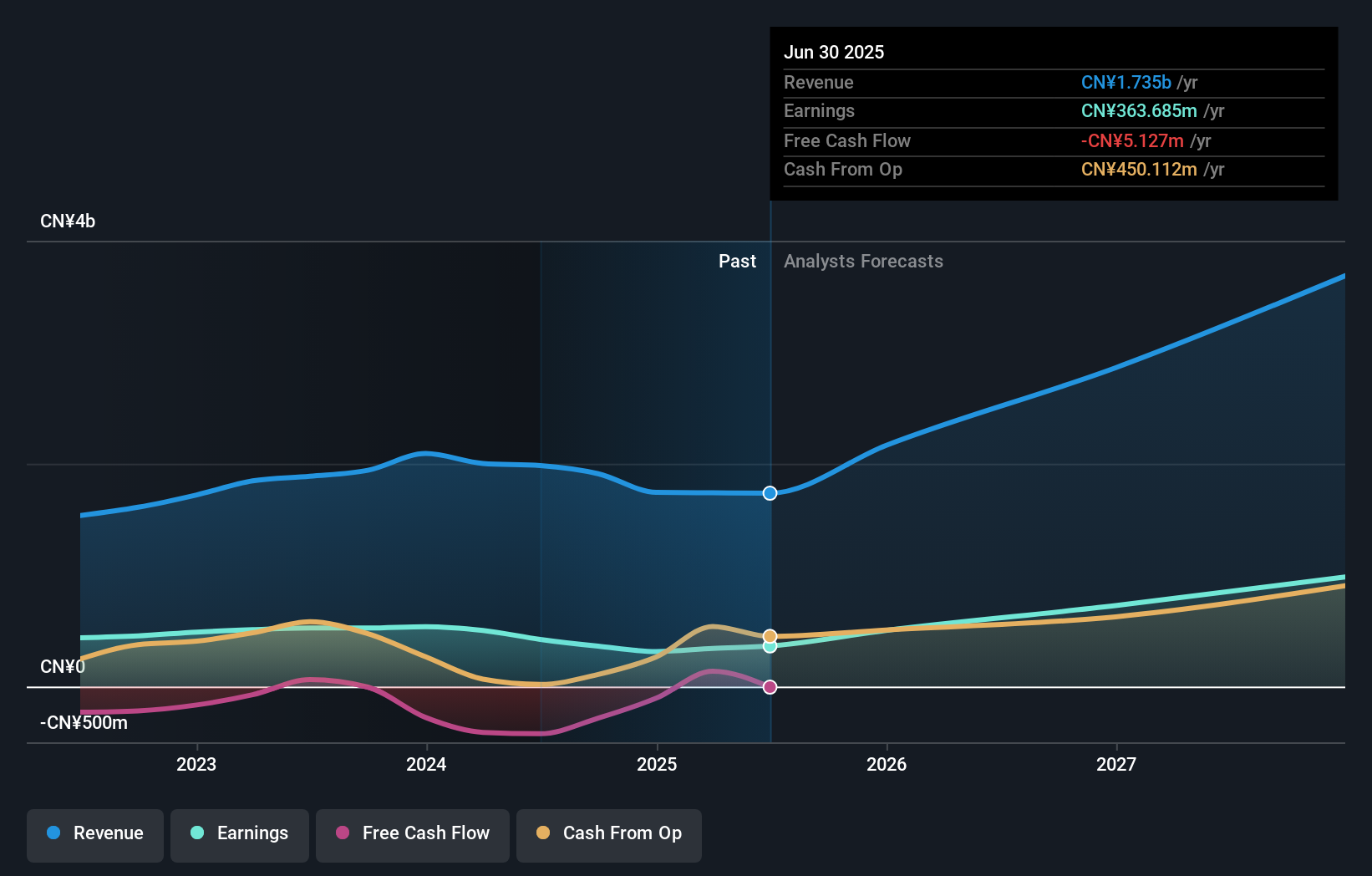

Overview: Hubei Feilihua Quartz Glass Co., Ltd. is involved in the research, development, and production of quartz material and quartz fiber products globally, with a market cap of CN¥48.63 billion.

Operations: The company generates revenue primarily from the Non-Metallic Mineral Products Industry, amounting to CN¥1.70 billion.

Insider Ownership: 18%

Revenue Growth Forecast: 27.5% p.a.

Hubei Feilihua Quartz Glass is experiencing rapid growth, with earnings projected to rise significantly at 38.2% annually, outpacing the Chinese market's 24.3%. Revenue is also expected to grow robustly at 27.5% per year. Despite a volatile share price recently and a forecasted Return on Equity of 15.3%, the company is advancing its strategic initiatives through a new restricted stock incentive plan discussed in an upcoming shareholders meeting, indicating strong internal confidence in future prospects.

- Unlock comprehensive insights into our analysis of Hubei Feilihua Quartz Glass stock in this growth report.

- According our valuation report, there's an indication that Hubei Feilihua Quartz Glass' share price might be on the expensive side.

Summing It All Up

- Unlock our comprehensive list of 596 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Curious About Other Options? Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300207

Sunwoda ElectronicLtd

Engages in the research and development, design, production, and sale of lithium-ion battery modules.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives