Stock Analysis

- China

- /

- Metals and Mining

- /

- SZSE:300337

Yinbang Clad MaterialLtd (SZSE:300337) shareholders are still up 123% over 5 years despite pulling back 7.5% in the past week

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. One great example is Yinbang Clad Material Co.,Ltd (SZSE:300337) which saw its share price drive 121% higher over five years. But it's down 7.5% in the last week. However, this might be related to the overall market decline of 2.8% in a week.

While the stock has fallen 7.5% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Yinbang Clad MaterialLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

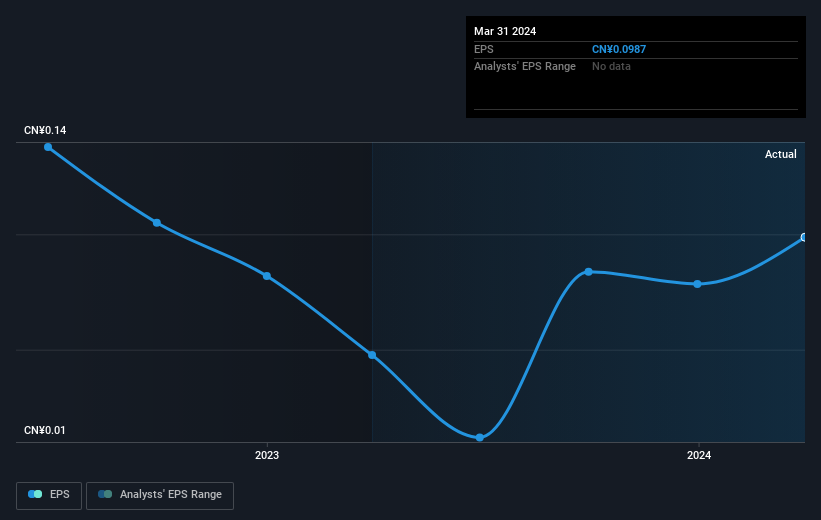

During the last half decade, Yinbang Clad MaterialLtd became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Yinbang Clad MaterialLtd share price is up 21% in the last three years. During the same period, EPS grew by 24% each year. This EPS growth is higher than the 6% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat. Of course, with a P/E ratio of 71.39, the market remains optimistic.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Yinbang Clad MaterialLtd's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Yinbang Clad MaterialLtd has rewarded shareholders with a total shareholder return of 7.3% in the last twelve months. Of course, that includes the dividend. However, that falls short of the 17% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Yinbang Clad MaterialLtd better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Yinbang Clad MaterialLtd you should be aware of, and 2 of them don't sit too well with us.

We will like Yinbang Clad MaterialLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300337

Yinbang Clad MaterialLtd

Researches, develops, produces, and sells aluminum clad and multi-metal clad materials in China.

Proven track record low.