Market Might Still Lack Some Conviction On Baotou Dongbao Bio-Tech Co.,Ltd (SZSE:300239) Even After 37% Share Price Boost

Baotou Dongbao Bio-Tech Co.,Ltd (SZSE:300239) shareholders have had their patience rewarded with a 37% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.2% over the last year.

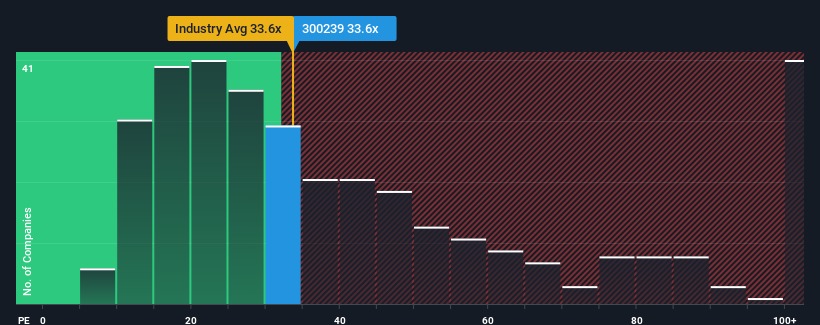

In spite of the firm bounce in price, it's still not a stretch to say that Baotou Dongbao Bio-TechLtd's price-to-earnings (or "P/E") ratio of 33.6x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 34x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Baotou Dongbao Bio-TechLtd's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Baotou Dongbao Bio-TechLtd

How Is Baotou Dongbao Bio-TechLtd's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Baotou Dongbao Bio-TechLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.8%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 389% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Baotou Dongbao Bio-TechLtd is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Baotou Dongbao Bio-TechLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Baotou Dongbao Bio-TechLtd revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Baotou Dongbao Bio-TechLtd with six simple checks on some of these key factors.

You might be able to find a better investment than Baotou Dongbao Bio-TechLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Baotou Dongbao Bio-TechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300239

Baotou Dongbao Bio-TechLtd

Engages in the research and development, production, and sale of gelatin, collagen, and additional products in the People’s Republic of China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success