Fujian Yuanli Active Carbon Co.,Ltd. (SZSE:300174) Stock Rockets 36% But Many Are Still Ignoring The Company

The Fujian Yuanli Active Carbon Co.,Ltd. (SZSE:300174) share price has done very well over the last month, posting an excellent gain of 36%. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

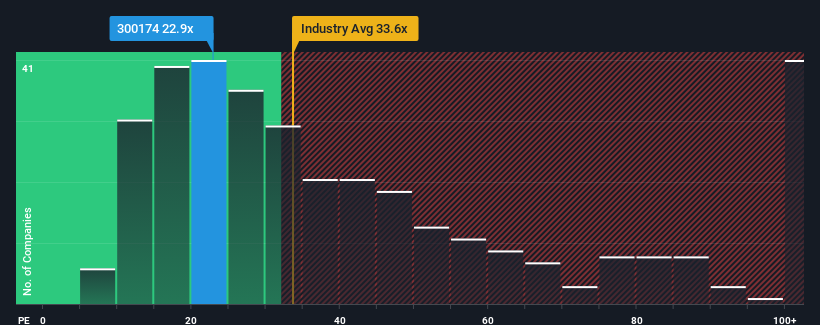

Although its price has surged higher, Fujian Yuanli Active CarbonLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.9x, since almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 64x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been pleasing for Fujian Yuanli Active CarbonLtd as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Fujian Yuanli Active CarbonLtd

How Is Fujian Yuanli Active CarbonLtd's Growth Trending?

Fujian Yuanli Active CarbonLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 13% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 97% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 18% per annum as estimated by the dual analysts watching the company. With the market predicted to deliver 19% growth per year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Fujian Yuanli Active CarbonLtd is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Fujian Yuanli Active CarbonLtd's P/E

Fujian Yuanli Active CarbonLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Fujian Yuanli Active CarbonLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Fujian Yuanli Active CarbonLtd you should know about.

If you're unsure about the strength of Fujian Yuanli Active CarbonLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300174

Fujian Yuanli Active CarbonLtd

Engages in the manufacture and sale of activated carbon in China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives