3 High-Ownership Growth Stocks With Up To 45% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and mixed economic signals, the U.S. indices have shown resilience with the S&P 500 and Nasdaq Composite posting gains, driven by sectors like utilities and real estate, while tech stocks received a boost from positive earnings surprises. In this environment, growth companies with high insider ownership can offer compelling opportunities as they often align management interests with shareholders and demonstrate confidence in their business strategies, making them worth exploring for potential revenue growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

Yijiahe Technology (SHSE:603666)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yijiahe Technology Co., Ltd. focuses on the research, development, design, and sale of intelligent robots in China with a market cap of CN¥3.90 billion.

Operations: Revenue Segments (in millions of CN¥):

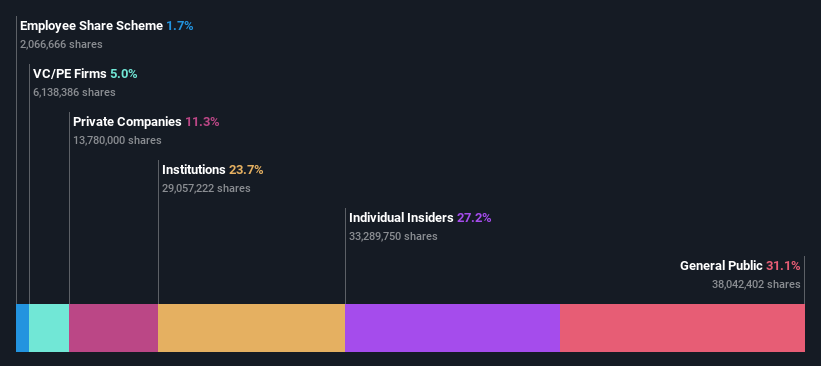

Insider Ownership: 39.3%

Revenue Growth Forecast: 32.2% p.a.

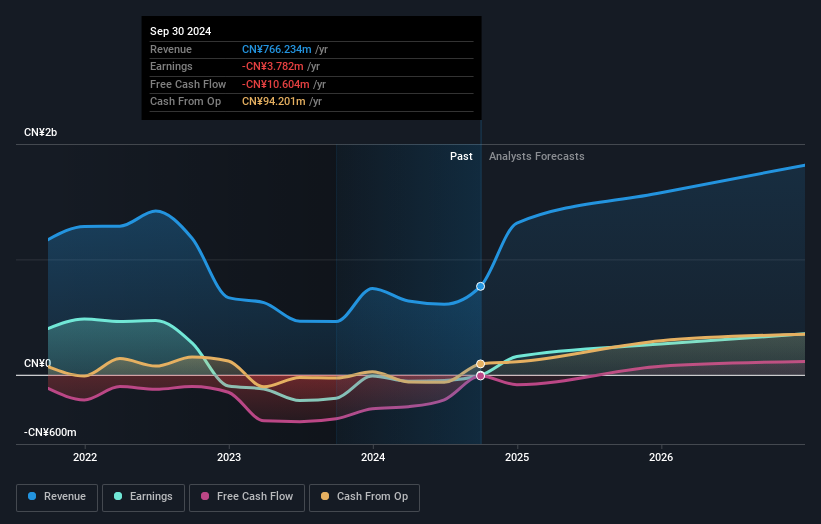

Yijiahe Technology is experiencing significant insider ownership changes, with a recent acquisition of a 5.90% stake for approximately CNY 170 million. Despite reporting a net loss of CNY 85.03 million for the first half of 2024, the company is forecasted to achieve substantial revenue growth at 32.2% per year, outpacing the market average. Although its share price has been highly volatile recently, Yijiahe is expected to become profitable within three years with earnings growing annually by over 71%.

- Take a closer look at Yijiahe Technology's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Yijiahe Technology is priced higher than what may be justified by its financials.

Yangtze Optical Electronic (SHSE:688143)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yangtze Optical Electronic Co., Ltd. focuses on the R&D, production, and sale of special optical fibers and cables, photoelectric systems, and optoelectronic systems in China with a market cap of CN¥2.91 billion.

Operations: The company generates revenue from its Scientific & Technical Instruments segment, amounting to CN¥252.63 million.

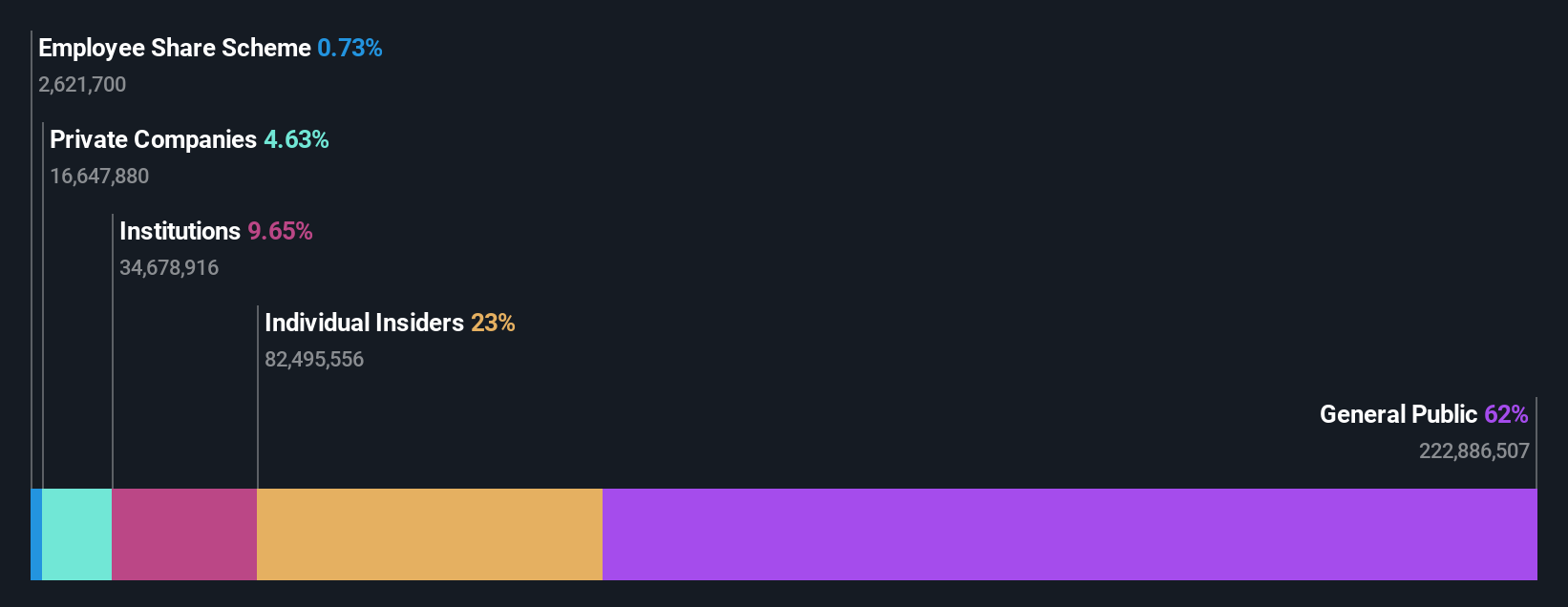

Insider Ownership: 27.7%

Revenue Growth Forecast: 45% p.a.

Yangtze Optical Electronic exhibits potential for growth with forecasted revenue and earnings increases of 45% and 63.8% annually, respectively, surpassing market averages. Despite a recent buyback of shares worth CNY 11.21 million, insider trading activity remains minimal over the past three months. Recent earnings showed modest improvement in net income to CNY 15.18 million amid lower profit margins compared to last year. The company's share price has been highly volatile recently, reflecting market uncertainty.

- Unlock comprehensive insights into our analysis of Yangtze Optical Electronic stock in this growth report.

- In light of our recent valuation report, it seems possible that Yangtze Optical Electronic is trading beyond its estimated value.

Fujian Yuanli Active CarbonLtd (SZSE:300174)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Yuanli Active Carbon Co., Ltd. is a company that manufactures and sells activated carbon in China, with a market capitalization of CN¥5.46 billion.

Operations: Fujian Yuanli Active Carbon Co., Ltd. generates its revenue primarily from the manufacture and sale of activated carbon within China.

Insider Ownership: 22.8%

Revenue Growth Forecast: 23.5% p.a.

Fujian Yuanli Active Carbon Ltd. demonstrates growth potential with earnings forecasted to increase by 20.86% annually, though slightly below the broader market's expectations. Revenue is expected to grow significantly at 23.5% per year, outpacing the market average. The company recently completed a share buyback of CNY 49.99 million, indicating confidence in its valuation with a price-to-earnings ratio of 20.1x, lower than the market's average of 33.5x.

- Dive into the specifics of Fujian Yuanli Active CarbonLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Fujian Yuanli Active CarbonLtd implies its share price may be too high.

Taking Advantage

- Delve into our full catalog of 1486 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300174

Fujian Yuanli Active CarbonLtd

Manufactures and sells activated carbon in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.