- China

- /

- Electronic Equipment and Components

- /

- SZSE:002869

Insider-Favored Growth Companies To Consider In October 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and sector-specific fluctuations, the U.S. indices have shown resilience, with small-cap and mid-cap stocks outperforming their larger counterparts. In this environment, growth companies with significant insider ownership can offer unique insights into potential opportunities, as insiders often invest where they see long-term value amidst evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Shenzhen Genvict Technologies (SZSE:002869)

Simply Wall St Growth Rating: ★★★★★☆

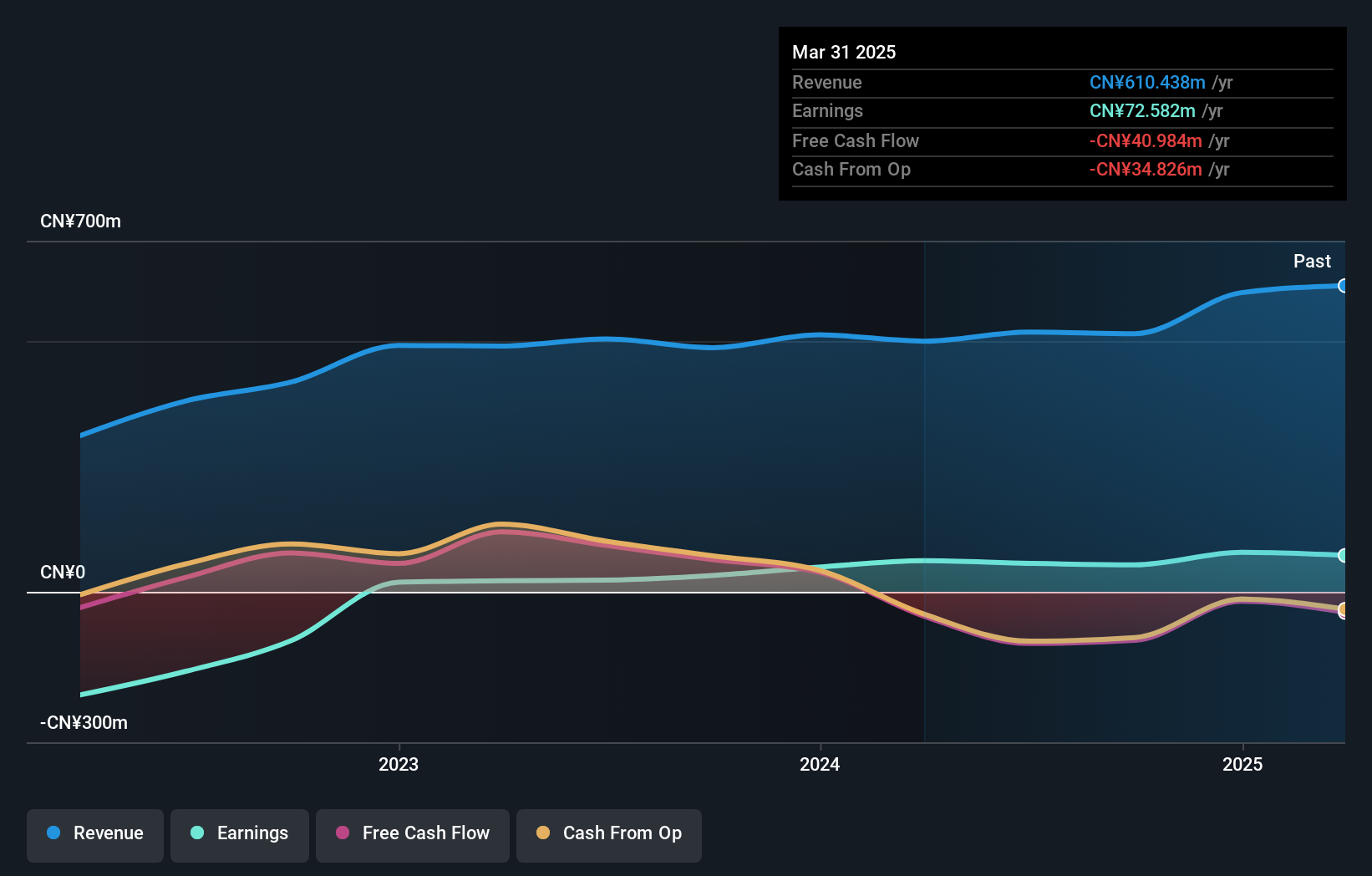

Overview: Shenzhen Genvict Technologies Co., Ltd. and its subsidiaries focus on the research, development, and industrialization of smart transportation technology in China, with a market cap of CN¥5.39 billion.

Operations: The company's revenue is primarily derived from the Intelligent Traffic Industry segment, amounting to CN¥518.02 million.

Insider Ownership: 20.6%

Revenue Growth Forecast: 32.1% p.a.

Shenzhen Genvict Technologies has shown significant growth, with net income rising to CNY 15.56 million for the half year ending June 2024, compared to CNY 8.18 million a year ago. Revenue is projected to grow at an impressive rate of over 30% annually, outpacing the broader Chinese market's growth expectations. Despite high volatility in its share price and low forecasted return on equity of 5.4%, the company maintains strong earnings momentum without substantial insider trading activity recently reported.

- Unlock comprehensive insights into our analysis of Shenzhen Genvict Technologies stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen Genvict Technologies shares in the market.

Jade Bird Fire (SZSE:002960)

Simply Wall St Growth Rating: ★★★★☆☆

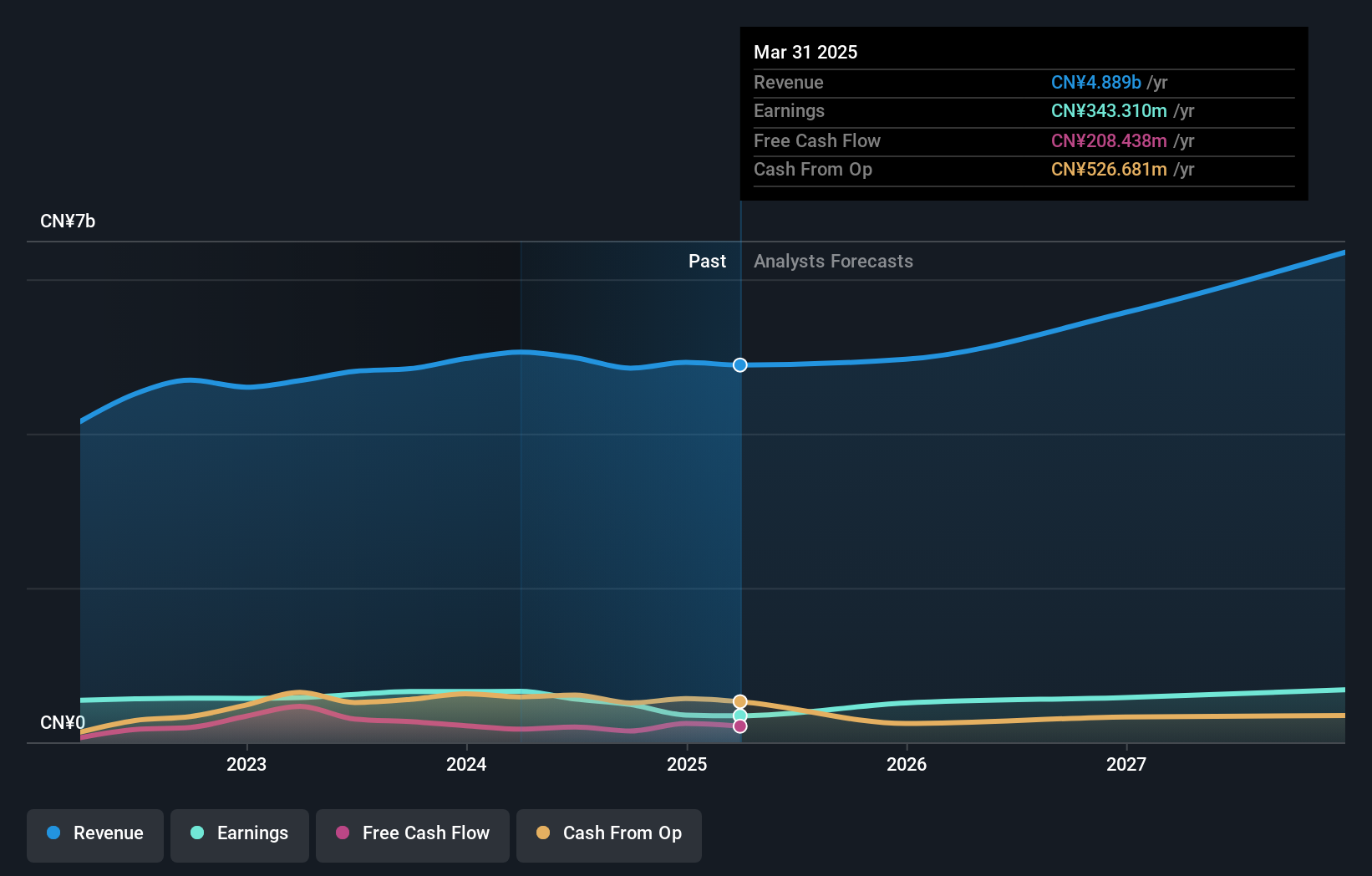

Overview: Jade Bird Fire Co., Ltd. develops, manufactures, and sells professional fire safety electronic products and systems both in China and internationally, with a market cap of CN¥7.81 billion.

Operations: Jade Bird Fire Co., Ltd.'s revenue is derived from the development, manufacturing, and sales of fire safety electronic products and systems across domestic and international markets.

Insider Ownership: 22.9%

Revenue Growth Forecast: 16.4% p.a.

Jade Bird Fire is set for robust growth, with revenue and earnings projected to outpace the Chinese market at 16.4% and 24.3% annually, respectively. Despite a recent decline in net income to CNY 188.95 million for H1 2024, the company trades at a significant discount to its fair value. Recent share buybacks totaling CNY 88.31 million indicate management's confidence in future prospects, though dividend sustainability remains questionable due to insufficient free cash flow coverage.

- Dive into the specifics of Jade Bird Fire here with our thorough growth forecast report.

- Our expertly prepared valuation report Jade Bird Fire implies its share price may be lower than expected.

Lucky Harvest (SZSE:002965)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lucky Harvest Co., Ltd. operates in China, focusing on the research, development, production, and sale of precision stamping dies and structural metal parts, with a market cap of CN¥5.84 billion.

Operations: The company's revenue segments include CN¥1.12 billion from the metal products industry, CN¥5.09 billion from automotive manufacturing, and CN¥95.68 million from computer, communications, and other electronic equipment manufacturing.

Insider Ownership: 33.1%

Revenue Growth Forecast: 20.3% p.a.

Lucky Harvest demonstrates strong growth potential, with earnings and revenue expected to surpass the Chinese market's average annual growth rates at 26.8% and 20.3%, respectively. Despite past shareholder dilution, the company offers good relative value with a price-to-earnings ratio of 14.1x, below the market average. Recent earnings showed improvement with net income rising to CNY 176.65 million for H1 2024, although dividend coverage by free cash flow remains inadequate.

- Click here and access our complete growth analysis report to understand the dynamics of Lucky Harvest.

- According our valuation report, there's an indication that Lucky Harvest's share price might be on the cheaper side.

Make It Happen

- Navigate through the entire inventory of 1486 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002869

Shenzhen Genvict Technologies

Engages in the research, development, and industrialization of smart transportation technology in China.

Flawless balance sheet with high growth potential.