Liaoning Oxiranchem,Inc. (SZSE:300082) Soars 32% But It's A Story Of Risk Vs Reward

Liaoning Oxiranchem,Inc. (SZSE:300082) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

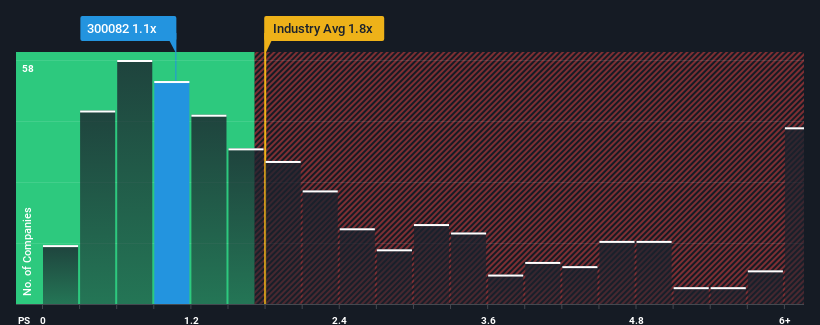

Even after such a large jump in price, Liaoning OxiranchemInc may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.1x, since almost half of all companies in the Chemicals industry in China have P/S ratios greater than 1.8x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Liaoning OxiranchemInc

What Does Liaoning OxiranchemInc's Recent Performance Look Like?

Liaoning OxiranchemInc hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Liaoning OxiranchemInc's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Liaoning OxiranchemInc?

The only time you'd be truly comfortable seeing a P/S as low as Liaoning OxiranchemInc's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. As a result, revenue from three years ago have also fallen 44% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 23% over the next year. Meanwhile, the rest of the industry is forecast to expand by 24%, which is not materially different.

With this in consideration, we find it intriguing that Liaoning OxiranchemInc's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Liaoning OxiranchemInc's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for Liaoning OxiranchemInc remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Liaoning OxiranchemInc (including 1 which shouldn't be ignored).

If these risks are making you reconsider your opinion on Liaoning OxiranchemInc, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300082

Liaoning OxiranchemInc

Engages in the research and development, production, and sale of high-end and ethylene oxide derivative fine chemicals in China.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives