- China

- /

- Renewable Energy

- /

- SZSE:000690

Global Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of escalating geopolitical tensions and fluctuating economic data, investors are keenly observing the impact on various sectors. Penny stocks, though often considered a relic of past market eras, continue to offer intriguing opportunities for growth at lower price points. With strong balance sheets and solid fundamentals, these smaller or newer companies can present a compelling mix of affordability and potential upside in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.22 | HK$763.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.99 | £448.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.45 | SGD182.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$3.19 | A$735.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.27 | SGD8.93B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.35 | A$149.47M | ✅ 3 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 5,608 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Guangdong Baolihua New Energy Stock (SZSE:000690)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the energy sector, focusing on new energy solutions, with a market cap of approximately CN¥9.27 billion.

Operations: The company generates its revenue primarily from operations within China, amounting to CN¥7.76 billion.

Market Cap: CN¥9.27B

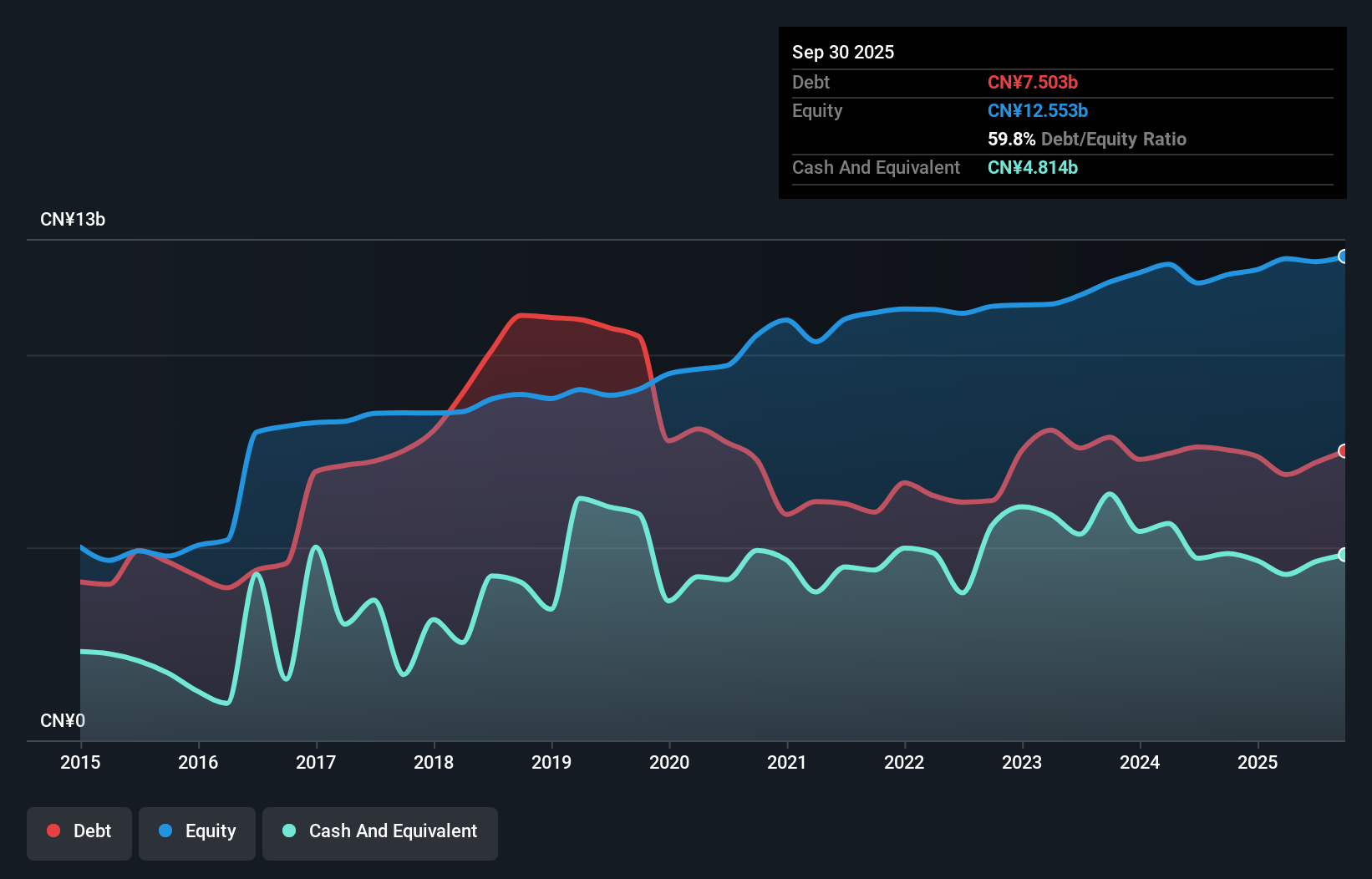

Guangdong Baolihua New Energy Stock Co., Ltd. presents a mixed picture for investors interested in penny stocks. The company has a market cap of approximately CN¥9.27 billion, with recent revenues of CN¥1.98 billion for Q1 2025, indicating substantial operations within China. Its net income improved to CN¥299.48 million from the previous year, but earnings have declined by an average of 18.1% over the past five years, and recent growth was negative compared to industry averages. Despite these challenges, its debt levels have decreased significantly over five years and are well covered by operating cash flow at 26%.

- Take a closer look at Guangdong Baolihua New Energy Stock's potential here in our financial health report.

- Explore Guangdong Baolihua New Energy Stock's analyst forecasts in our growth report.

Modern Avenue Group (SZSE:002656)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modern Avenue Group Co., Ltd. operates retail outlets worldwide and has a market cap of CN¥1.81 billion.

Operations: Modern Avenue Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥1.81B

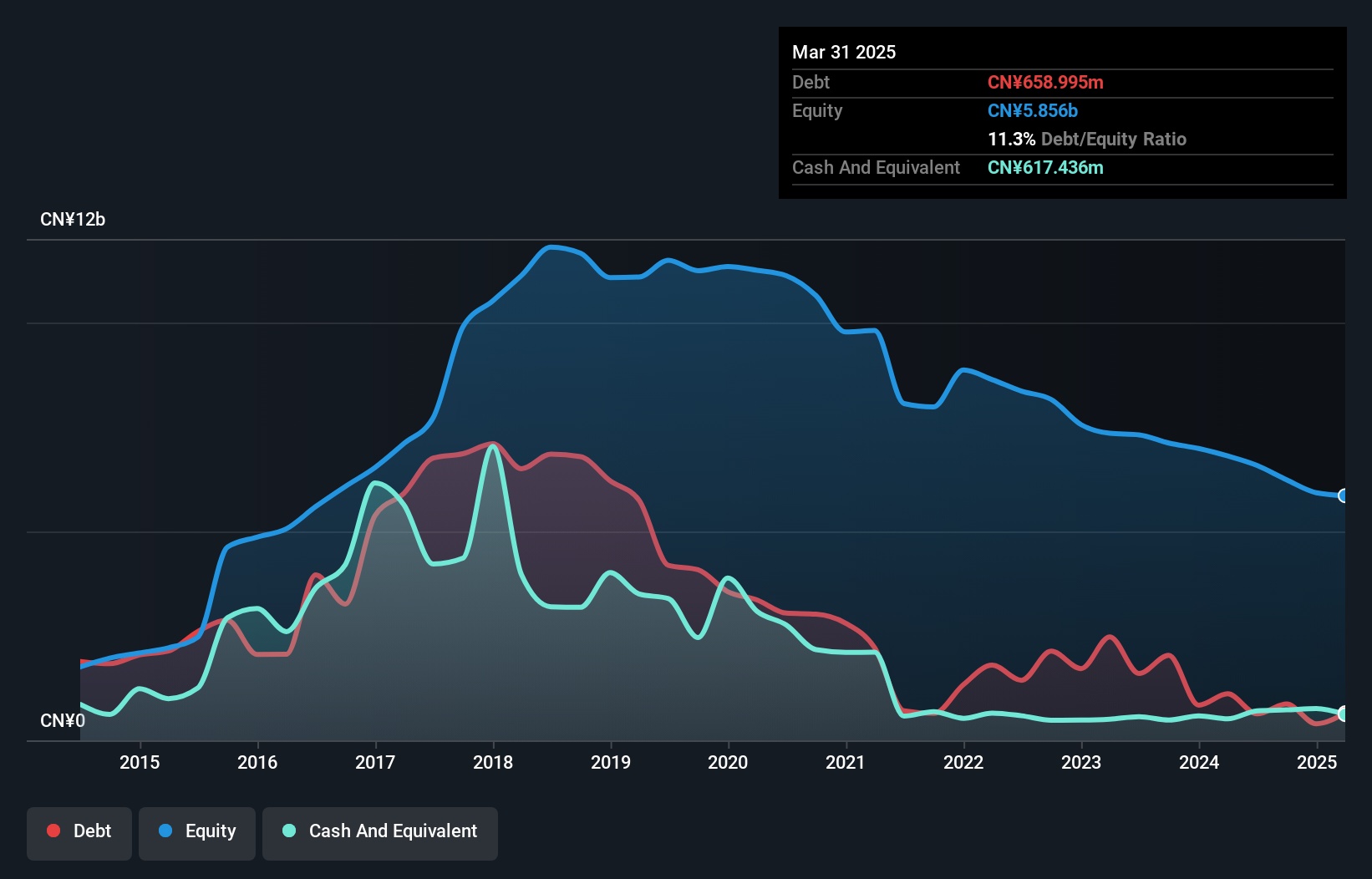

Modern Avenue Group Co., Ltd. offers an intriguing case for penny stock investors with its CN¥1.81 billion market cap and recent financial turnaround. The company reported Q1 2025 sales of CN¥91.74 million, a significant increase from the previous year, alongside a net income of CN¥3.72 million compared to a prior loss. Despite being unprofitable overall, it has reduced losses by 71.9% annually over five years and maintains positive free cash flow with no debt burden, supported by sufficient short-term assets to cover liabilities and an experienced management team averaging 4.4 years in tenure.

- Click here to discover the nuances of Modern Avenue Group with our detailed analytical financial health report.

- Explore historical data to track Modern Avenue Group's performance over time in our past results report.

Beijing Haixin Energy TechnologyLtd (SZSE:300072)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Haixin Energy Technology Co., Ltd. operates in the energy technology sector and has a market cap of CN¥7.43 billion.

Operations: No revenue segments have been reported for this company.

Market Cap: CN¥7.43B

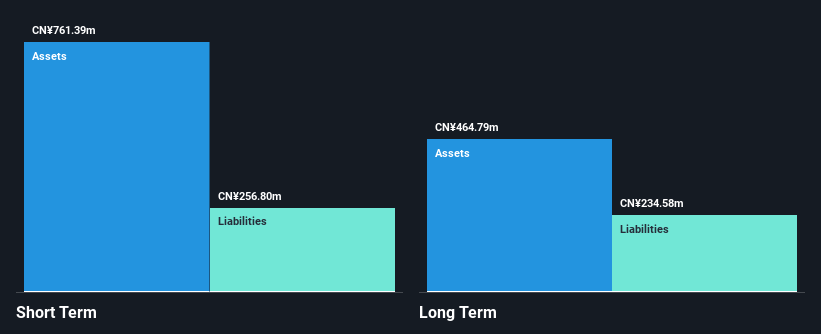

Beijing Haixin Energy Technology Co., Ltd. presents a complex picture for investors with its CN¥7.43 billion market cap and declining financial performance. The company reported a significant drop in sales to CN¥2.43 billion for 2024, down from the previous year, alongside a net loss of CN¥954.37 million, reflecting ongoing challenges despite reducing losses over five years by 2.4% annually. While short-term assets cover both short and long-term liabilities comfortably, the firm remains unprofitable with negative return on equity and high volatility; however, debt levels are satisfactory at a net debt to equity ratio of 0.7%.

- Unlock comprehensive insights into our analysis of Beijing Haixin Energy TechnologyLtd stock in this financial health report.

- Learn about Beijing Haixin Energy TechnologyLtd's future growth trajectory here.

Taking Advantage

- Click this link to deep-dive into the 5,608 companies within our Global Penny Stocks screener.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000690

Guangdong Baolihua New Energy Stock

Guangdong Baolihua New Energy Stock Co., Ltd.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives