Global's Leading Insider-Owned Growth Stocks In September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cut expectations and optimism surrounding artificial intelligence, major U.S. stock indexes have reached new record highs, reflecting investor confidence despite ongoing inflation concerns. In this environment of economic flux, growth companies with high insider ownership can offer unique insights into potential market opportunities, as insiders' stakes often signal strong belief in the company's future prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Underneath we present a selection of stocks filtered out by our screen.

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EO Technics Co., Ltd. is a global manufacturer and supplier of laser processing equipment, with a market cap of ₩2.67 trillion.

Operations: The Semiconductor Machine Division contributes ₩352.78 billion to the company's revenue.

Insider Ownership: 30.7%

EO Technics is poised for significant earnings growth, with forecasts predicting a 30.8% annual increase over the next three years, outpacing the KR market's 23.2%. However, its revenue growth of 15.8% per year lags behind the desired 20%, though it still surpasses the KR market average of 7.1%. Despite low expected return on equity at 12.7%, substantial insider ownership may align management interests with shareholders'.

- Navigate through the intricacies of EO Technics with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, EO Technics' share price might be too optimistic.

Smoore International Holdings (SEHK:6969)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions, with a market cap of approximately HK$117.97 billion.

Operations: The company's revenue primarily stems from the sale of APV and vaping devices and components, amounting to approximately CN¥12.73 billion.

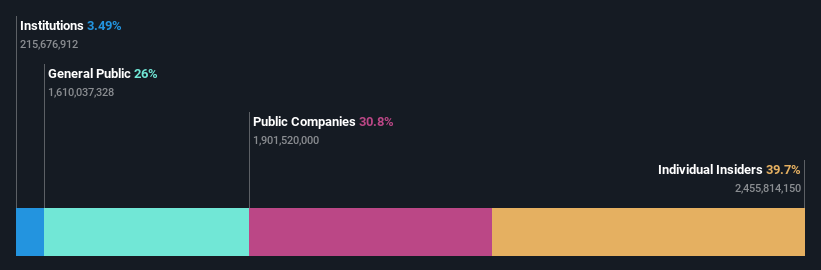

Insider Ownership: 39.7%

Smoore International Holdings shows promising growth potential with earnings forecasted to grow 33.6% annually, surpassing the Hong Kong market's 12.4%. Revenue is expected to increase by 13.4% per year, outpacing the market average of 8.5%, though below the ideal 20%. Despite a decline in net profit margin from last year and a low return on equity forecast at 8.6%, insider ownership may align management interests with those of shareholders effectively.

- Click to explore a detailed breakdown of our findings in Smoore International Holdings' earnings growth report.

- Our valuation report here indicates Smoore International Holdings may be overvalued.

Hubei DinglongLtd (SZSE:300054)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Dinglong Co., Ltd. specializes in the research, development, production, and service of circuit design, semiconductor materials, and printing and copying general consumables with a market cap of CN¥30.22 billion.

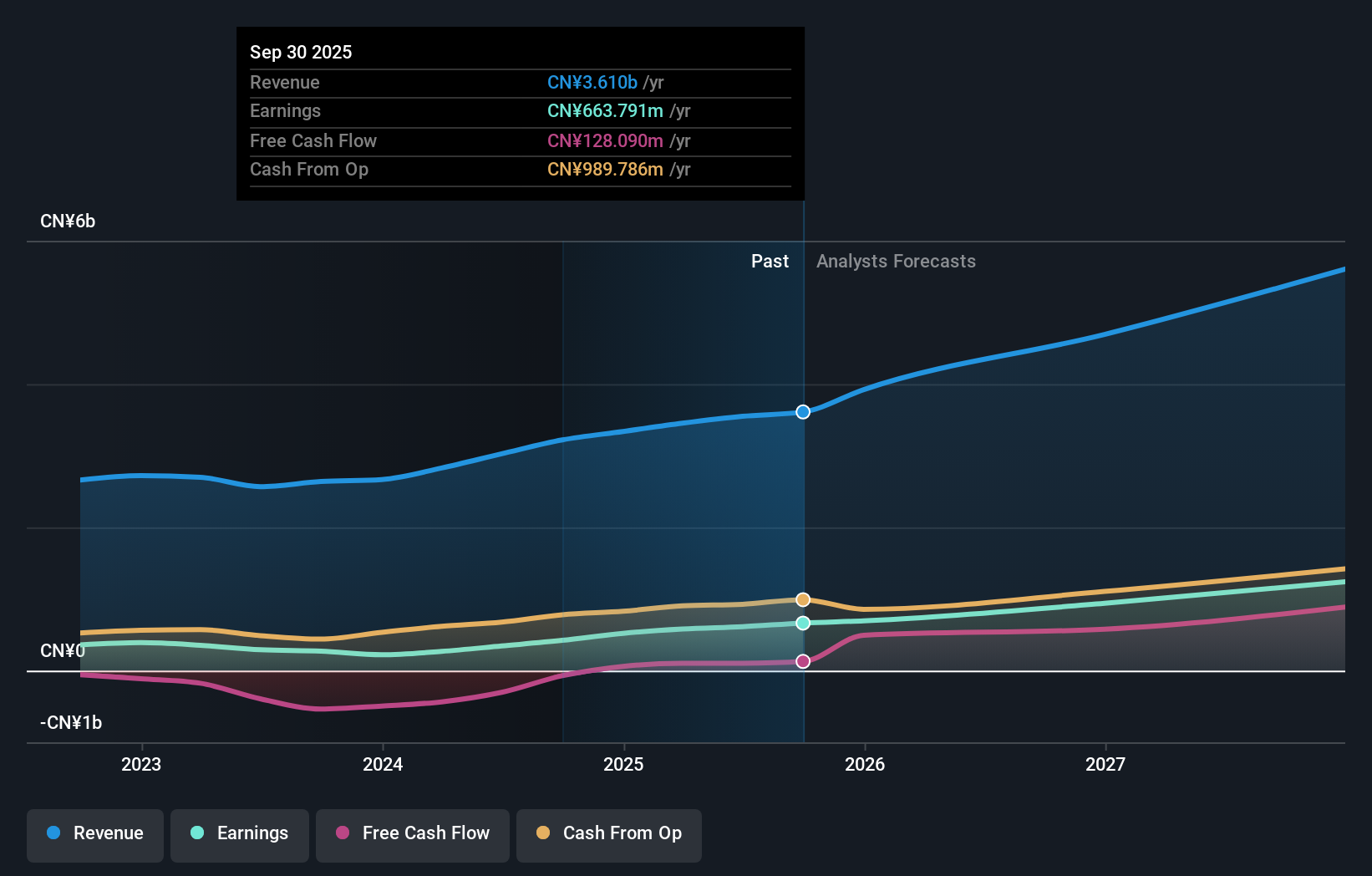

Operations: The company generates revenue of CN¥3.52 billion from its photoelectric imaging display and semiconductor process materials industry segment.

Insider Ownership: 29.6%

Hubei Dinglong Ltd. demonstrates robust growth potential with earnings forecasted to increase significantly at 28.5% annually, outpacing the Chinese market's 26.6%. Recent earnings results show a notable improvement, with net income rising from CNY 217.84 million to CNY 311.04 million year-over-year for the first half of 2025. While revenue growth is projected at a slower pace of 18.9%, it still exceeds the market average of 14%.

- Dive into the specifics of Hubei DinglongLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Hubei DinglongLtd implies its share price may be too high.

Turning Ideas Into Actions

- Embark on your investment journey to our 843 Fast Growing Global Companies With High Insider Ownership selection here.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hubei DinglongLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300054

Hubei DinglongLtd

Engages in research, development, production, and service of circuit design, semiconductor materials, printing and copying general consumables.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives