Shenzhen Capchem Technology Co., Ltd.'s (SZSE:300037) P/E Is Still On The Mark Following 25% Share Price Bounce

Despite an already strong run, Shenzhen Capchem Technology Co., Ltd. (SZSE:300037) shares have been powering on, with a gain of 25% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.2% over the last year.

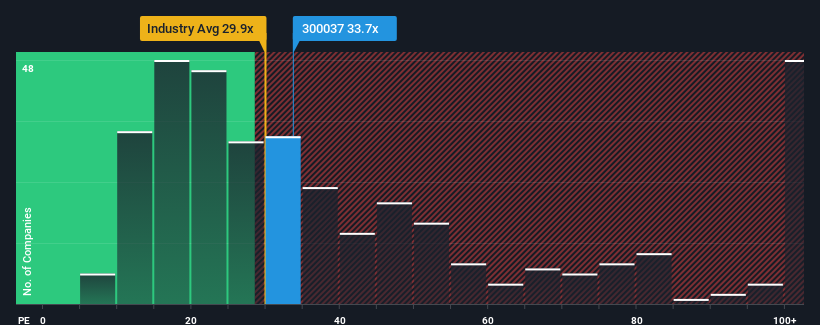

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Shenzhen Capchem Technology as a stock to potentially avoid with its 33.7x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Shenzhen Capchem Technology has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Shenzhen Capchem Technology

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Shenzhen Capchem Technology would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. Regardless, EPS has managed to lift by a handy 28% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 31% per annum over the next three years. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

With this information, we can see why Shenzhen Capchem Technology is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shenzhen Capchem Technology shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shenzhen Capchem Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shenzhen Capchem Technology that you need to be mindful of.

You might be able to find a better investment than Shenzhen Capchem Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300037

Shenzhen Capchem Technology

Researches and develops, produces, sells, and services electronic chemicals products and functional materials in China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives