JinFu Technology Co., Ltd. (SZSE:003018) Stock Catapults 33% Though Its Price And Business Still Lag The Market

JinFu Technology Co., Ltd. (SZSE:003018) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

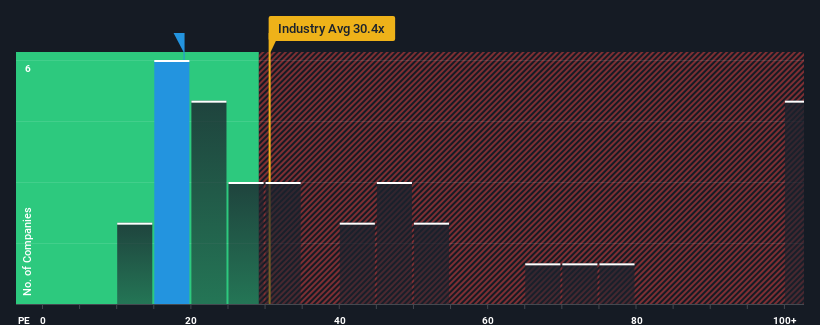

Although its price has surged higher, JinFu Technology may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.9x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at JinFu Technology over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for JinFu Technology

How Is JinFu Technology's Growth Trending?

In order to justify its P/E ratio, JinFu Technology would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.4%. The last three years don't look nice either as the company has shrunk EPS by 15% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 41% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that JinFu Technology is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On JinFu Technology's P/E

JinFu Technology's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that JinFu Technology maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for JinFu Technology (1 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on JinFu Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003018

JinFu Technology

Primarily engages in the research and development, production, and sales of plastic packaging products in China and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026