Zhe Jiang Dayang Biotech Group Co., Ltd.'s (SZSE:003017) Shares Bounce 31% But Its Business Still Trails The Market

Zhe Jiang Dayang Biotech Group Co., Ltd. (SZSE:003017) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

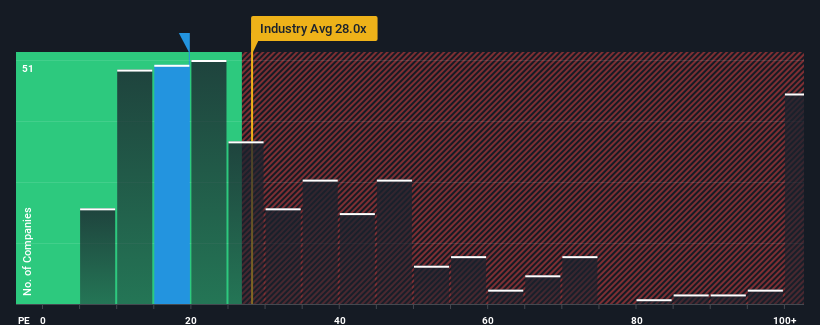

In spite of the firm bounce in price, Zhe Jiang Dayang Biotech Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.7x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's exceedingly strong of late, Zhe Jiang Dayang Biotech Group has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Zhe Jiang Dayang Biotech Group

Is There Any Growth For Zhe Jiang Dayang Biotech Group?

In order to justify its P/E ratio, Zhe Jiang Dayang Biotech Group would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 45% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 45% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's an unpleasant look.

With this information, we are not surprised that Zhe Jiang Dayang Biotech Group is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Despite Zhe Jiang Dayang Biotech Group's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zhe Jiang Dayang Biotech Group maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Zhe Jiang Dayang Biotech Group (1 doesn't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Zhe Jiang Dayang Biotech Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhe Jiang Dayang Biotech Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003017

Zhe Jiang Dayang Biotech Group

Operates as a chemical raw material manufacturing company in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives