In a week marked by significant economic data and earnings reports, global markets saw mixed performances, with small-cap stocks demonstrating resilience compared to their larger counterparts. Amidst this backdrop of cautious optimism and market volatility, investors are increasingly seeking opportunities in lesser-known stocks that may offer promising potential for growth. Identifying such gems often involves looking beyond surface-level metrics to understand the underlying fundamentals that can thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Jiangsu Lianhuan Pharmaceutical (SHSE:600513)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Lianhuan Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, producing and distributing pharmaceuticals, preparations, and active pharmaceutical ingredients (API) both domestically and internationally, with a market cap of CN¥2.79 billion.

Operations: The company generates revenue through the sale of pharmaceuticals, preparations, and active pharmaceutical ingredients (API) in domestic and international markets.

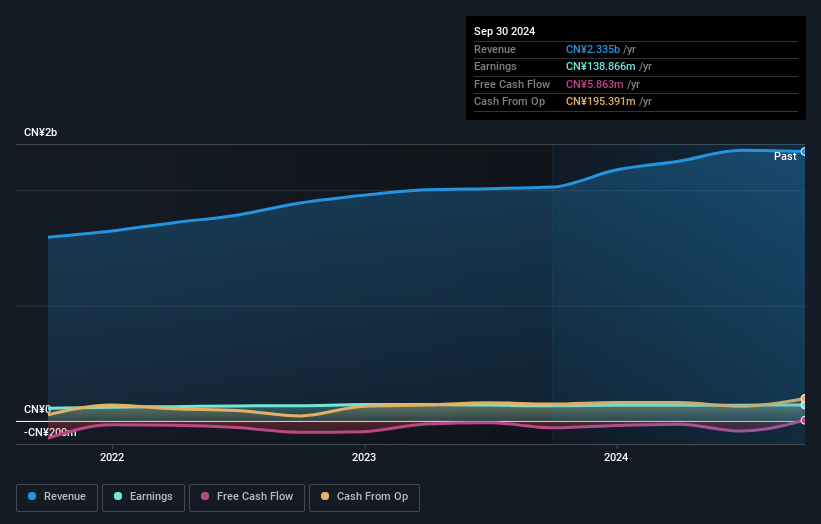

Jiangsu Lianhuan Pharmaceutical, a smaller player in the pharmaceutical industry, has shown promising signs with earnings growth of 6.1% over the past year, outpacing the sector's -1.2%. The company's price-to-earnings ratio is 22.1x, which is attractive compared to the broader CN market at 35.4x. With a satisfactory net debt to equity ratio of 38.6%, financial stability seems solid as interest payments are well covered by EBIT at 6.9x coverage. Recent nine-month results show sales reaching CNY 1.64 billion from CNY 1.48 billion last year and net income rising slightly to CNY 92.7 million from CNY 88.84 million, indicating steady progress in its operations.

Xiamen Solex High-tech Industries (SHSE:603992)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Solex High-Tech Industries Co., Ltd. operates in the high-tech sector and has a market capitalization of CN¥8.19 billion.

Operations: Xiamen Solex High-Tech Industries Co., Ltd. generates its revenue primarily from the high-tech sector, contributing to its market capitalization of CN¥8.19 billion.

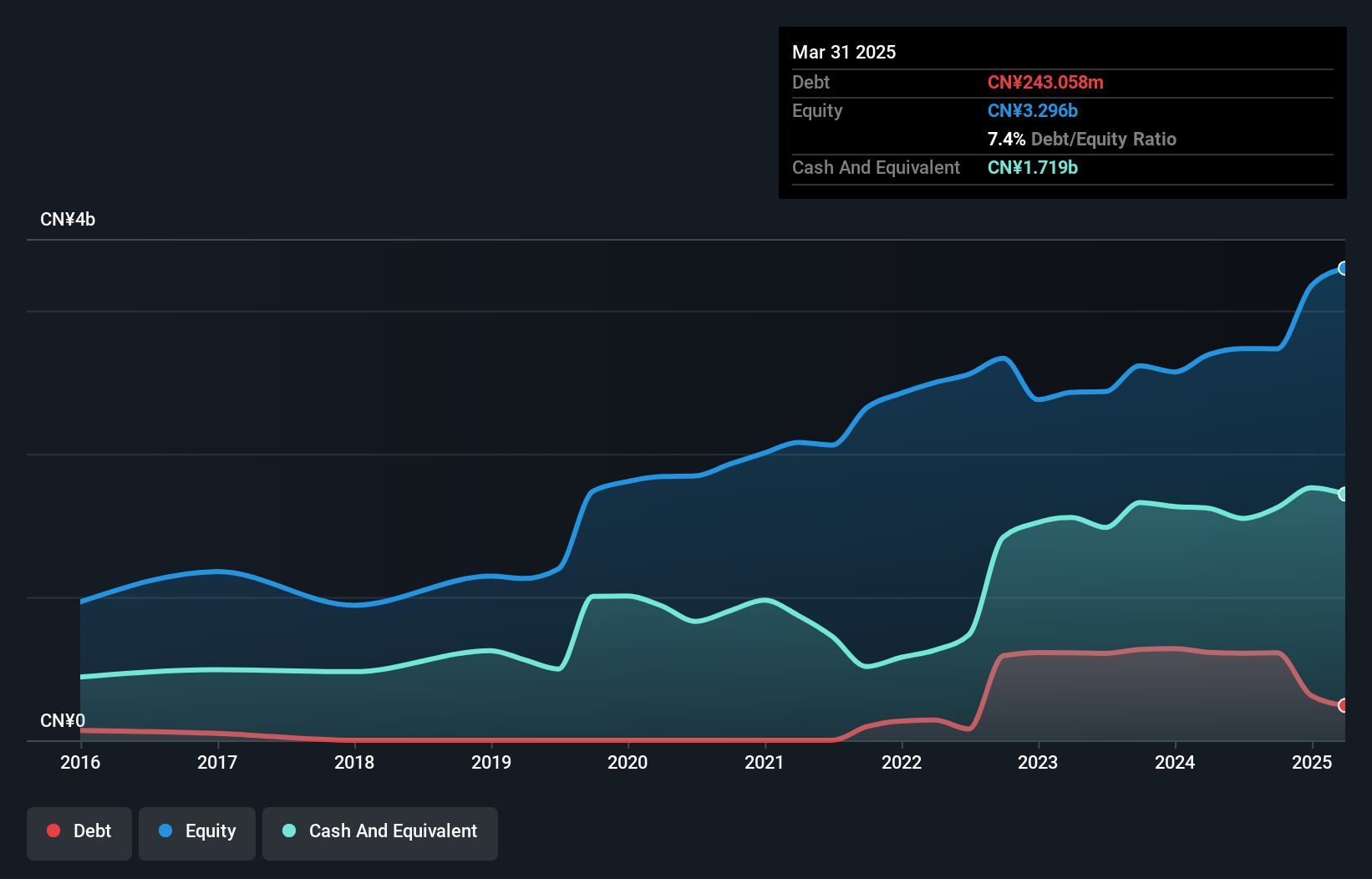

Xiamen Solex, a player in the high-tech industry, showcases solid financial health with earnings growing by 9.7% over the past year and a price-to-earnings ratio of 22.4x, which is favorable compared to the CN market's 35.4x. The company has more cash than total debt, indicating prudent financial management. Recent results for nine months ending September 30, 2024, show stable revenue at CNY 2.19 billion and net income of CNY 320.72 million up from CNY 304 million last year. Earnings per share improved slightly to CNY 0.79 from CNY 0.76 previously, reflecting consistent performance amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Xiamen Solex High-tech Industries.

Understand Xiamen Solex High-tech Industries' track record by examining our Past report.

Shanxi Huhua Group (SZSE:003002)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanxi Huhua Group Co., Ltd. operates in China, focusing on the research, development, production, sale, import, export, and service of civil explosive products with a market capitalization of CN¥4.30 billion.

Operations: The company's primary revenue streams include industrial explosives and explosive equipment, generating CN¥350.57 million and CN¥652.82 million, respectively. Blasting services contribute an additional CN¥148.70 million to the overall revenue mix.

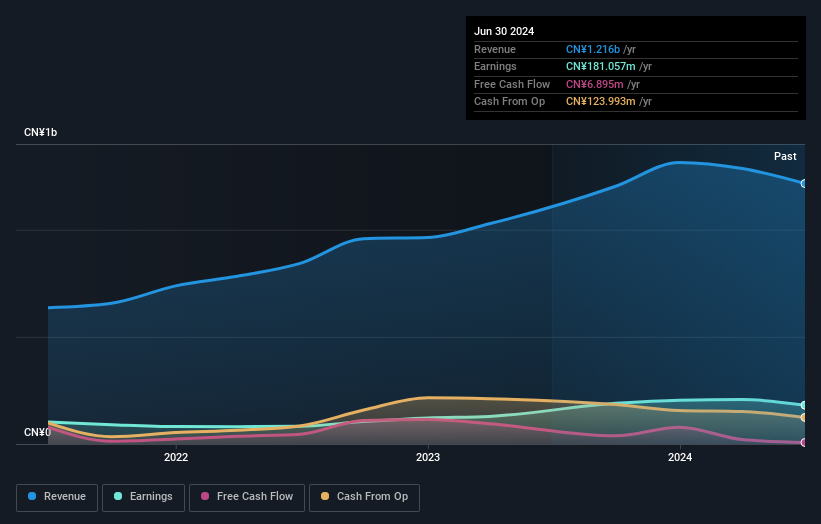

Shanxi Huhua Group, a smaller player in the chemicals sector, has shown impressive earnings growth of 13.7% over the past year, outpacing the industry average of -4.1%. The company reported half-year sales of CNY 486.82 million and net income of CNY 62.54 million, reflecting a decrease from last year's figures but still maintaining profitability with basic earnings per share at CNY 0.31. With a price-to-earnings ratio of 24.5x below the CN market average, it seems attractively valued for investors seeking potential opportunities in this space despite its recent revenue challenges and increased debt to equity ratio from 0% to 0.4% over five years.

- Get an in-depth perspective on Shanxi Huhua Group's performance by reading our health report here.

Examine Shanxi Huhua Group's past performance report to understand how it has performed in the past.

Key Takeaways

- Access the full spectrum of 4718 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603992

Xiamen Solex High-tech Industries

Xiamen Solex High-Tech Industries Co., Ltd.

Excellent balance sheet with proven track record and pays a dividend.