As global markets navigate a complex landscape marked by cautious earnings reports and mixed economic signals, technology stocks have shown both resilience and volatility. With the Nasdaq Composite recently hitting record intraday highs before retreating, investors are keenly observing high-growth tech stocks that demonstrate strong fundamentals and potential for sustained innovation amidst these dynamic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Beijing Infosec TechnologiesLtd (SHSE:688201)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Infosec Technologies Co., Ltd. specializes in developing and providing application security products in China, with a market capitalization of approximately CN¥3.22 billion.

Operations: Beijing Infosec Technologies Co., Ltd. focuses on the development and provision of application security products within China. The company generates revenue primarily through its specialized security solutions, catering to various sectors that require robust cybersecurity measures.

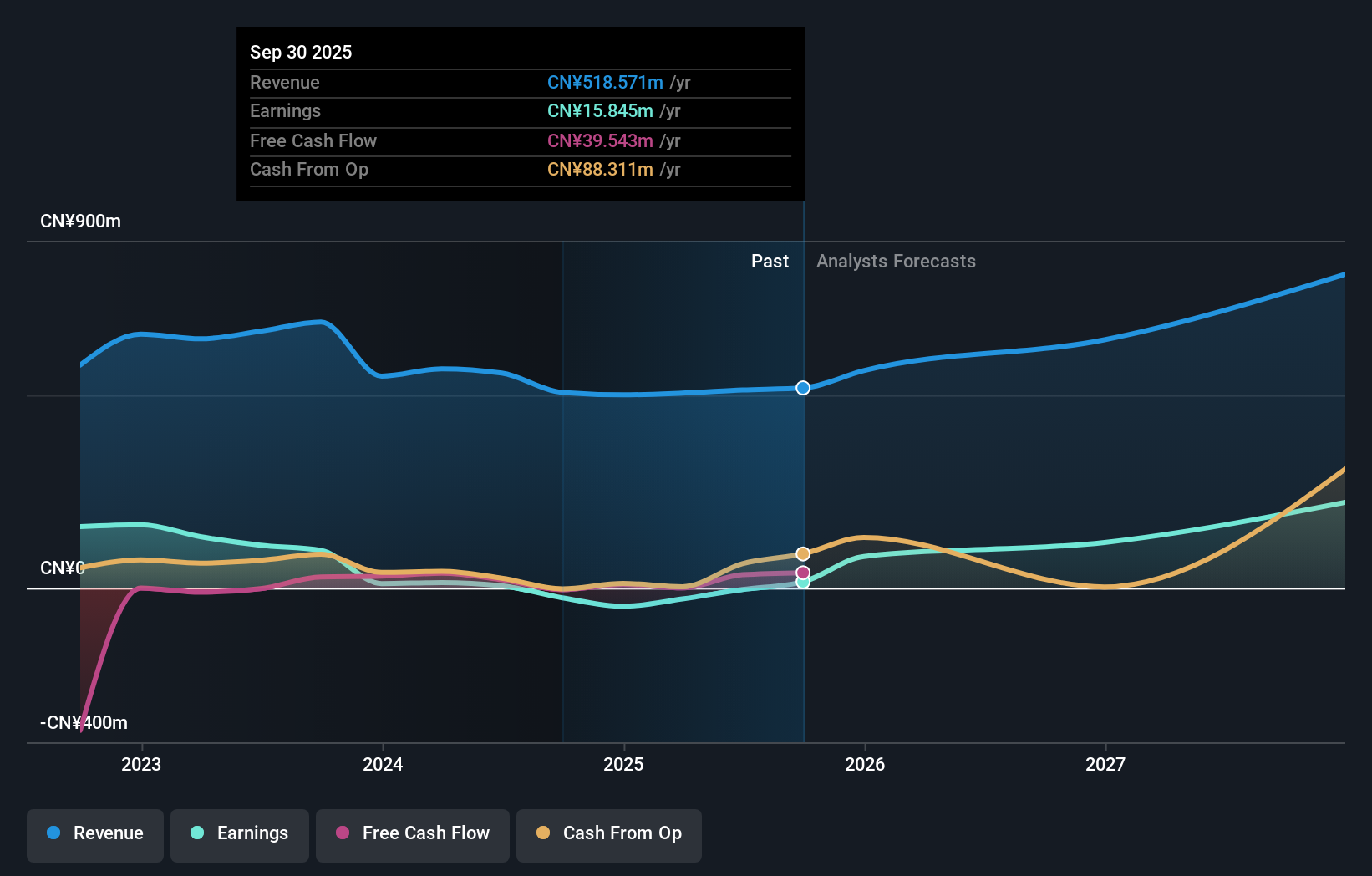

Despite recent setbacks with a reported revenue drop to CNY 300.13 million from CNY 342.65 million and an increased net loss of CNY 49.03 million, Beijing Infosec Technologies Ltd is navigating through turbulent waters with strategic focus on innovation and market adaptation. The company's commitment to R&D is evident as it aims to pivot its operations towards more lucrative sectors within tech, aligning with industry shifts towards enhanced cybersecurity measures and AI integration. With earnings forecasted to grow by a staggering 124.62% annually, the firm is poised for a potential turnaround, underpinned by its efforts to exceed the Chinese market's average revenue growth rate of 14% per year at an anticipated rate of 19.5%. This strategic pivot could position Beijing Infosec not just for recovery but also for significant competitive advantage in high-demand tech sectors.

- Delve into the full analysis health report here for a deeper understanding of Beijing Infosec TechnologiesLtd.

Learn about Beijing Infosec TechnologiesLtd's historical performance.

State Power Rixin Technology (SZSE:301162)

Simply Wall St Growth Rating: ★★★★★☆

Overview: State Power Rixin Technology Co., Ltd. offers data services and application solutions for the global energy industry, with a market capitalization of CN¥4.17 billion.

Operations: State Power Rixin Technology Co., Ltd. specializes in delivering data services and application solutions tailored for the energy sector on a global scale. The company's operations are supported by its market capitalization of approximately CN¥4.17 billion, reflecting its position within the industry.

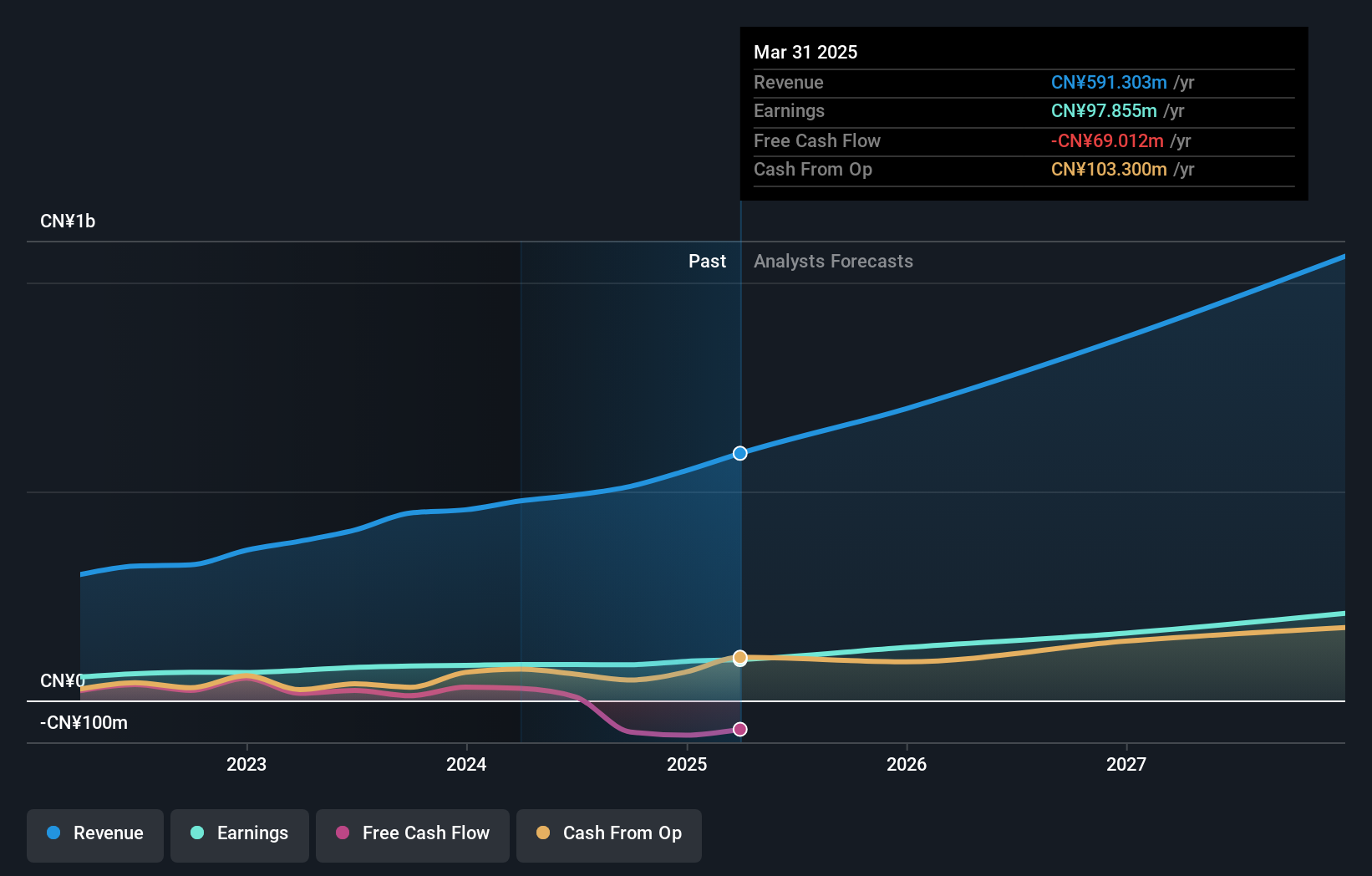

State Power Rixin Technology has demonstrated robust financial health with a notable increase in sales, jumping from CNY 308.74 million to CNY 364.78 million year-over-year for the nine months ended September 2024. This growth is complemented by a consistent rise in net income, reflecting a strategic alignment with market demands and operational efficiencies. The company's commitment to innovation is underscored by its R&D investments, which are pivotal in driving future revenue streams and maintaining competitive advantage in the fast-evolving tech landscape. With revenues expected to grow at an impressive rate of 25.3% per year, significantly outpacing the Chinese market's average of 14%, State Power Rixin is well-positioned to capitalize on emerging technological trends and expand its market footprint.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market capitalization of ¥119.54 billion.

Operations: Medley, Inc. generates revenue primarily from its Human Resource Platform Business, contributing ¥17.87 billion, and its Medical Platform Business, which adds ¥6.09 billion. The company's focus on these segments highlights its dual emphasis on recruitment and medical services within Japan and the United States markets.

Medley, Inc. stands out in the tech sector with its strategic focus on R&D, channeling 30.4% of its revenue into research and development efforts to spur innovation and maintain a competitive edge. This investment has catalyzed a projected annual earnings growth of 30.36%, significantly outpacing the average market forecast. Additionally, Medley's recent board decision to acquire Offshore Inc., aims to expand its technological capabilities and market reach, potentially enhancing future revenue streams which are expected to grow at an impressive rate of 25% annually.

- Get an in-depth perspective on Medley's performance by reading our health report here.

Understand Medley's track record by examining our Past report.

Next Steps

- Navigate through the entire inventory of 1289 High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Infosec TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688201

Beijing Infosec TechnologiesLtd

Develops and provides application security products in China.

Reasonable growth potential with adequate balance sheet.