- China

- /

- Basic Materials

- /

- SZSE:002785

Health Check: How Prudently Does Xiamen Wanli Stone StockLtd (SZSE:002785) Use Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Xiamen Wanli Stone Stock Co.,Ltd (SZSE:002785) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Xiamen Wanli Stone StockLtd

How Much Debt Does Xiamen Wanli Stone StockLtd Carry?

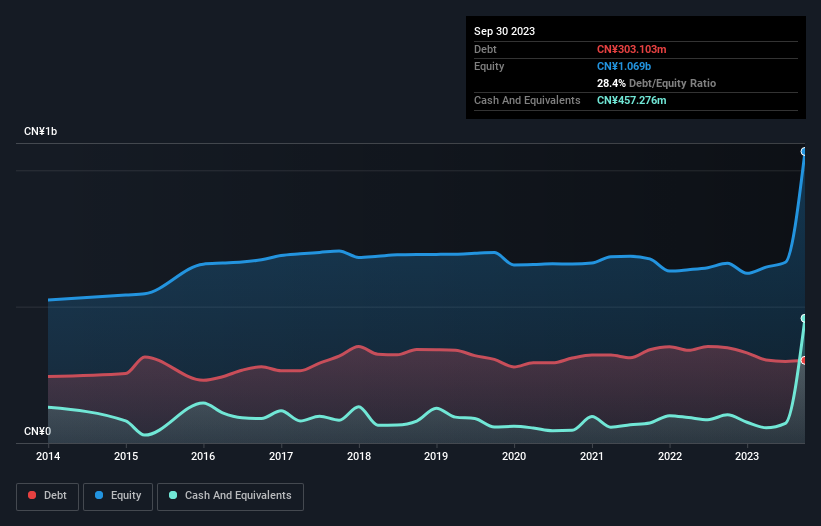

You can click the graphic below for the historical numbers, but it shows that Xiamen Wanli Stone StockLtd had CN¥303.1m of debt in September 2023, down from CN¥349.1m, one year before. But on the other hand it also has CN¥457.3m in cash, leading to a CN¥154.2m net cash position.

How Healthy Is Xiamen Wanli Stone StockLtd's Balance Sheet?

We can see from the most recent balance sheet that Xiamen Wanli Stone StockLtd had liabilities of CN¥687.5m falling due within a year, and liabilities of CN¥11.1m due beyond that. Offsetting this, it had CN¥457.3m in cash and CN¥687.1m in receivables that were due within 12 months. So it actually has CN¥445.7m more liquid assets than total liabilities.

This short term liquidity is a sign that Xiamen Wanli Stone StockLtd could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Xiamen Wanli Stone StockLtd has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Xiamen Wanli Stone StockLtd's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Xiamen Wanli Stone StockLtd wasn't profitable at an EBIT level, but managed to grow its revenue by 3.4%, to CN¥1.3b. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Xiamen Wanli Stone StockLtd?

While Xiamen Wanli Stone StockLtd lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow CN¥9.0m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Xiamen Wanli Stone StockLtd has 1 warning sign we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002785

Xiamen Wanli Stone StockLtd

Develops, processes, and installs stone products, building stones, stone carving crafts, and mineral products The company offers slab, cut-to-size, countertop, vanity top, windowsill, wall cladding, special shaped stone, garden and landscaping stone, sculpture, monument, slate, mosaic, sink, quartz, granite and marble tile, and faucet products.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success