Discovering Guizhou Zhongyida And 2 Other Promising Small Caps In Asia

Reviewed by Simply Wall St

In the current landscape, Asian markets are navigating a complex environment marked by ongoing trade tensions and economic adjustments, with small-cap stocks often reflecting these broader dynamics. As investors seek opportunities in this evolving market, identifying promising small-cap companies like Guizhou Zhongyida can be key to uncovering potential growth stories that align with shifting economic indicators and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CMC | 0.07% | 2.92% | 8.37% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.94% | 1.09% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 1.64% | 15.30% | ★★★★★★ |

| Center International GroupLtd | 17.61% | 0.53% | -25.53% | ★★★★★★ |

| Saison Technology | NA | 1.35% | -9.69% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 7.79% | 10.01% | ★★★★★★ |

| KNJ | 75.75% | 8.26% | 43.04% | ★★★★★☆ |

| Nippon Care Supply | 16.37% | 10.41% | 0.50% | ★★★★☆☆ |

| Jiangxi Jiangnan New Material Technology | 70.94% | 21.41% | 14.67% | ★★★★☆☆ |

| Lan Fa Textile | 47.00% | -13.74% | 4.93% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Guizhou Zhongyida (SHSE:600610)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guizhou Zhongyida Co., Ltd is engaged in the production and sale of fine chemical products in China, with a market capitalization of CN¥9.47 billion.

Operations: The company generates revenue through the production and sale of fine chemical products. It has a market capitalization of CN¥9.47 billion.

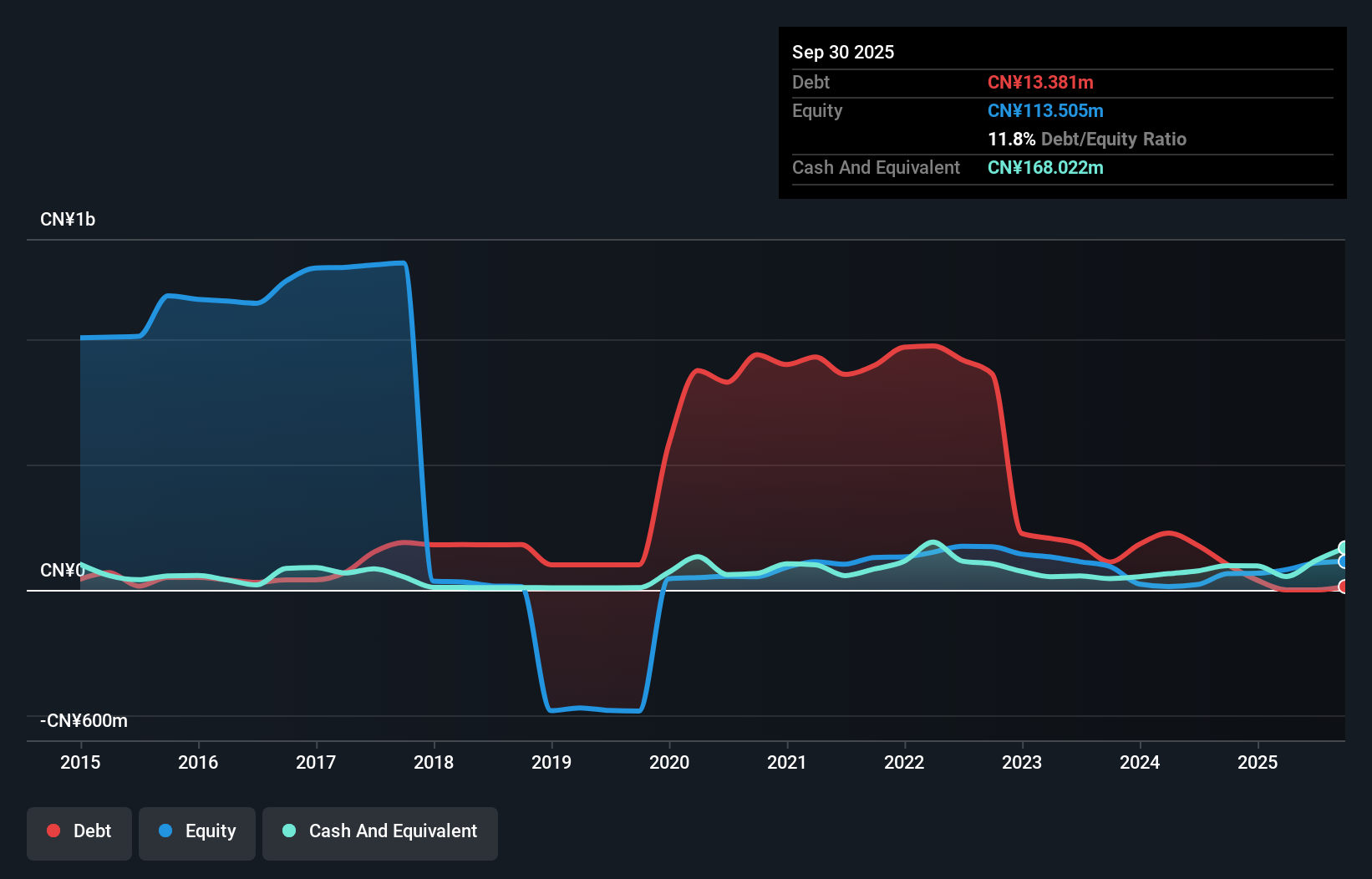

Guizhou Zhongyida, a relatively small player in the chemicals sector, has recently turned profitable with a net income of CNY 39.53 million for the first half of 2025, contrasting sharply with last year's loss of CNY 15.73 million. The company's debt to equity ratio impressively dropped from 1535.3% to just 0.1% over five years, indicating significant financial restructuring. Despite trading at about 65.5% below its estimated fair value, interest coverage remains an area to watch as EBIT only covers interest payments by a factor of 2.4x, which is less than ideal for robust financial health.

Jiangxi Selon Industrial (SZSE:002748)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangxi Selon Industrial Co., Ltd. engages in the research, development, production, marketing, and sale of fine chemical products both in China and internationally with a market capitalization of CN¥3.36 billion.

Operations: The primary revenue stream for Jiangxi Selon Industrial comes from the chemical industry, contributing CN¥2.02 billion, while the thermal power industry adds CN¥3.61 million. The company has a market capitalization of CN¥3.36 billion.

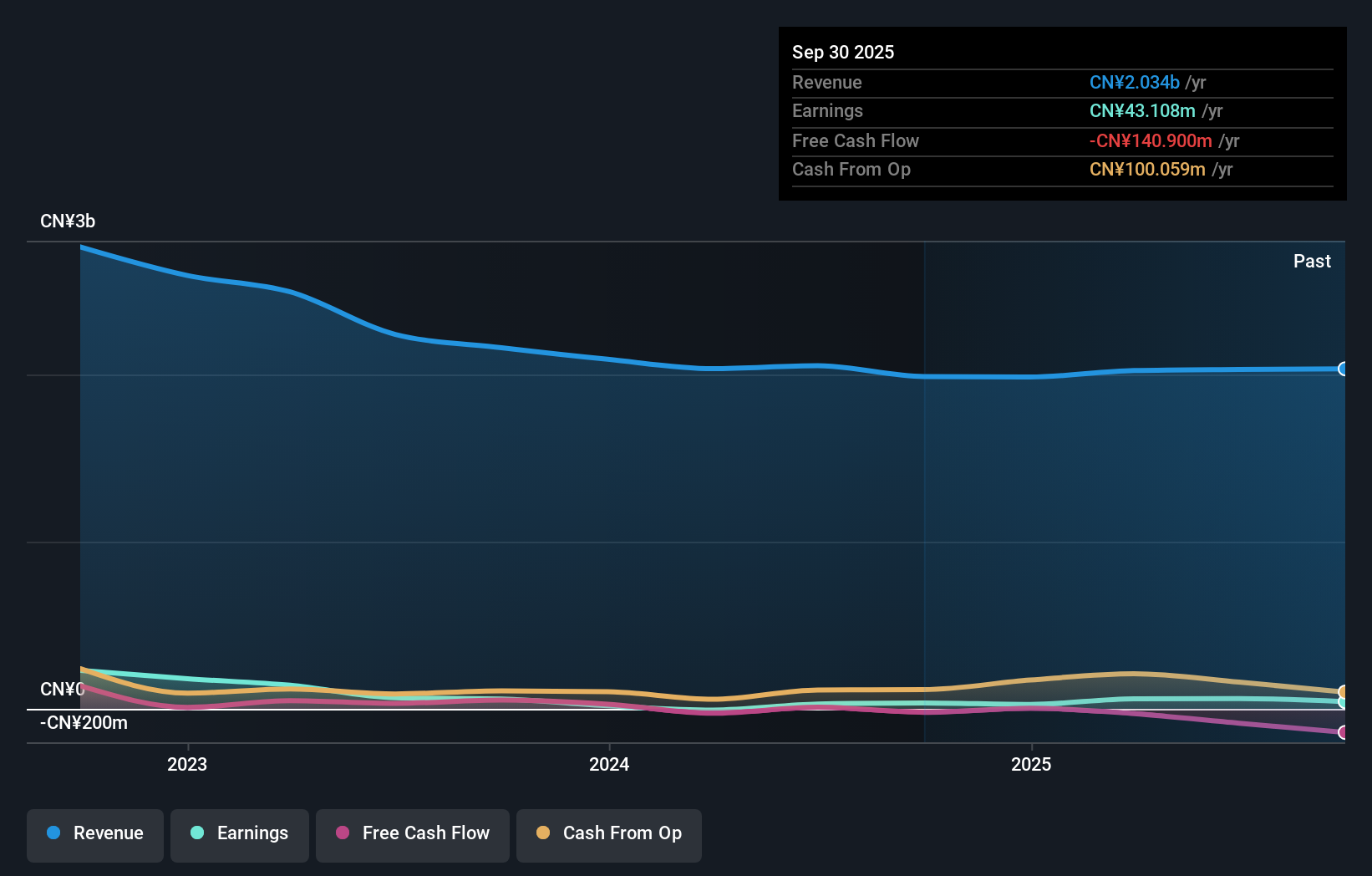

Jiangxi Selon Industrial, a nimble player in the chemicals sector, has shown remarkable earnings growth of 116.6% over the past year, outpacing industry norms. Despite a large one-off loss of CN¥27.6 million impacting recent results, the company's net income surged to CN¥40.65 million for the half-year ending June 2025 from CN¥5.15 million previously. With an EBIT that covers interest payments 9.4 times over and a net debt to equity ratio trimmed from 54% to 30% in five years, its financial health seems robust enough to weather volatility and capitalize on future opportunities within its market segment.

- Unlock comprehensive insights into our analysis of Jiangxi Selon Industrial stock in this health report.

Understand Jiangxi Selon Industrial's track record by examining our Past report.

Shandong Kaisheng New MaterialsLtd (SZSE:301069)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shandong Kaisheng New Materials Co., Ltd. is involved in the research, development, production, and sale of fine chemical products and new polymer materials across Mainland China, Japan, South Korea, the United States, and internationally with a market cap of CN¥10.52 billion.

Operations: Shandong Kaisheng New Materials Co., Ltd. generates revenue through the sale of fine chemical products and new polymer materials. The company's net profit margin is a key financial metric to consider when evaluating its financial performance.

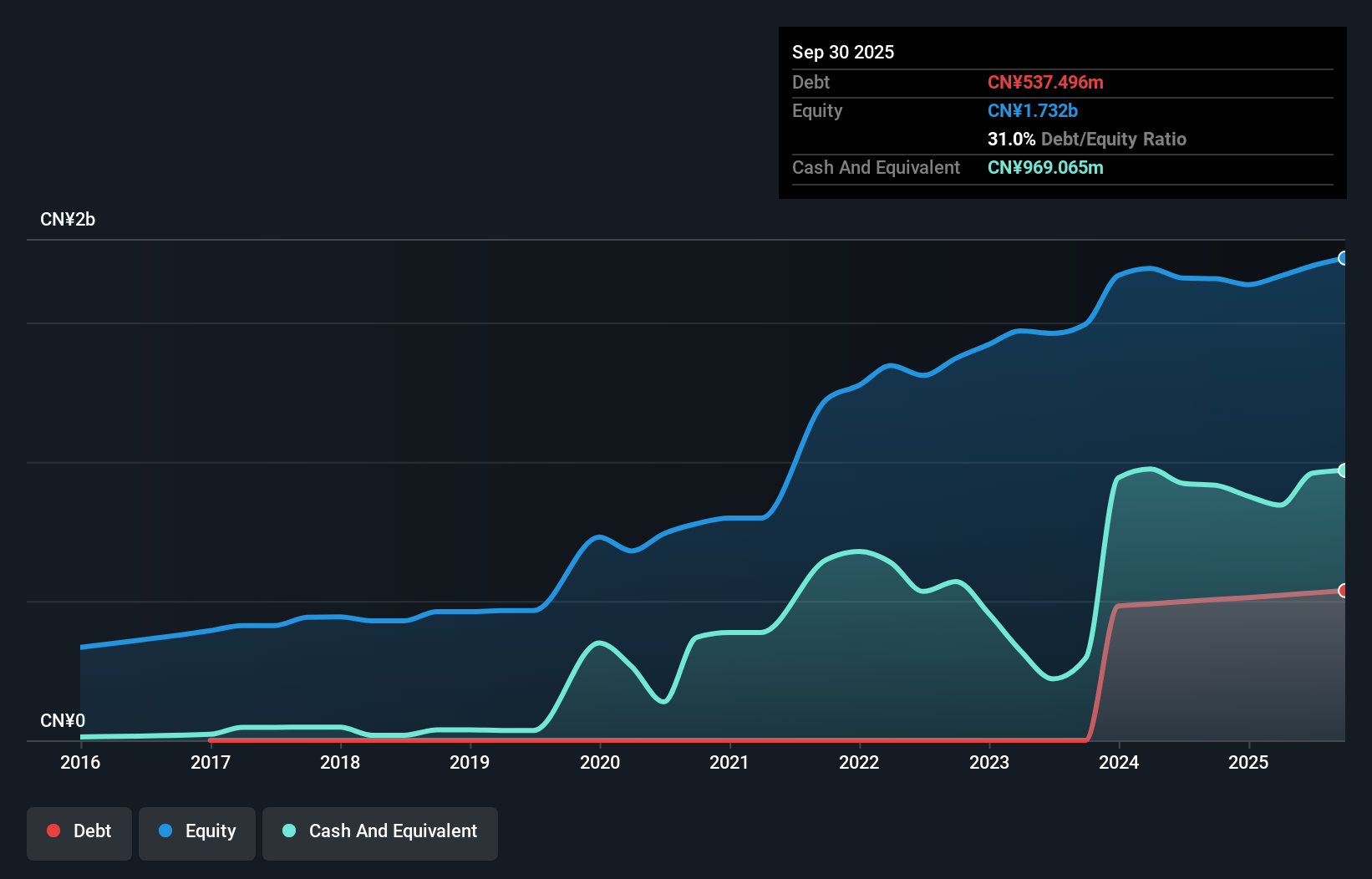

Shandong Kaisheng New Materials, a relatively small player in the chemicals sector, has showcased impressive earnings growth of 56% over the past year, outpacing the industry's 1.9%. Despite a rise in debt to equity from 0% to 31% over five years, it holds more cash than total debt. The company reported CNY 774.1 million in sales for nine months ending September 2025, up from CNY 696 million last year, with net income jumping to CNY 115.76 million from CNY 52.24 million. Earnings per share increased significantly to CNY 0.2752 compared to last year's CNY 0.1242.

Make It Happen

- Dive into all 2386 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002748

Jiangxi Selon Industrial

Research, develops, produces, markets, and sells fine chemical products in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives