- China

- /

- Metals and Mining

- /

- SZSE:002738

Sinomine Resource Group Co., Ltd.'s (SZSE:002738) Stock Is Going Strong: Have Financials A Role To Play?

Sinomine Resource Group (SZSE:002738) has had a great run on the share market with its stock up by a significant 13% over the last three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Particularly, we will be paying attention to Sinomine Resource Group's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Sinomine Resource Group

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Sinomine Resource Group is:

5.5% = CN¥676m ÷ CN¥12b (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.06.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Sinomine Resource Group's Earnings Growth And 5.5% ROE

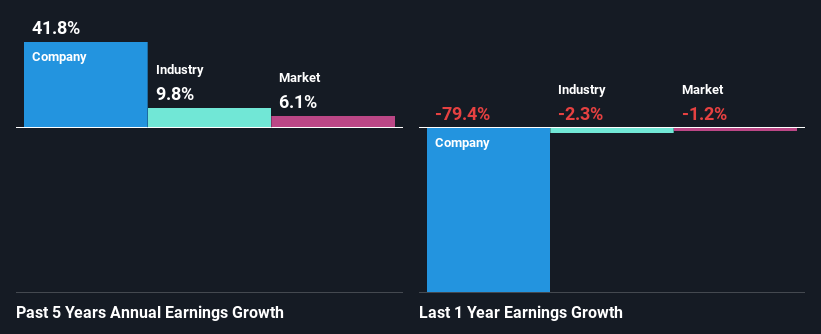

When you first look at it, Sinomine Resource Group's ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 7.5% either. Despite this, surprisingly, Sinomine Resource Group saw an exceptional 42% net income growth over the past five years. Therefore, there could be other reasons behind this growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that Sinomine Resource Group's growth is quite high when compared to the industry average growth of 9.8% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Sinomine Resource Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Sinomine Resource Group Using Its Retained Earnings Effectively?

Sinomine Resource Group's three-year median payout ratio to shareholders is 14%, which is quite low. This implies that the company is retaining 86% of its profits. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

Additionally, Sinomine Resource Group has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 37% over the next three years. However, Sinomine Resource Group's future ROE is expected to rise to 9.9% despite the expected increase in the company's payout ratio. We infer that there could be other factors that could be driving the anticipated growth in the company's ROE.

Conclusion

On the whole, we do feel that Sinomine Resource Group has some positive attributes. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002738

Sinomine Resource Group

Operates as a geological exploration technology services company.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives