- Hong Kong

- /

- Real Estate

- /

- SEHK:202

3 Promising Penny Stocks With Market Caps Under US$1B

Reviewed by Simply Wall St

As global markets react to rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge. Amidst these conditions, investors often seek opportunities in lesser-known areas of the market that offer potential for both value and growth. Penny stocks, though an older term, remain relevant as they represent smaller or newer companies that can present unique investment opportunities when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.66B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$45.35B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.61M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.835 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$142.2M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.38 | £336.16M | ★★★★☆☆ |

Click here to see the full list of 5,672 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

EverChina Int'l Holdings (SEHK:202)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EverChina Int'l Holdings Company Limited is an investment holding company focused on property investment and hotel operations in China and Bolivia, with a market cap of HK$758.61 million.

Operations: The company's revenue is primarily derived from its agricultural operation, generating HK$74.58 million, and its property investment operation, contributing HK$29.43 million.

Market Cap: HK$758.61M

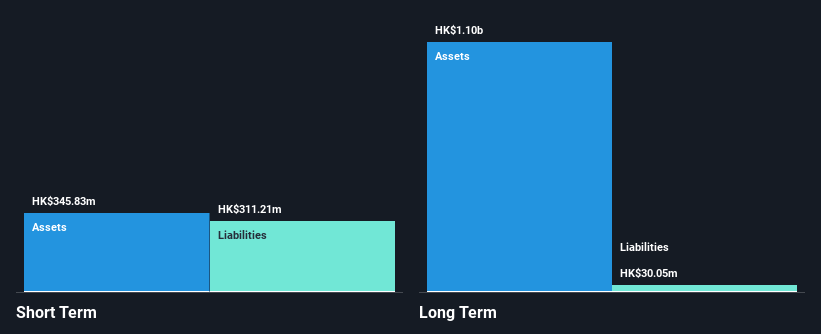

EverChina Int'l Holdings, with a market cap of HK$758.61 million, primarily generates revenue from agricultural operations and property investments. Despite being unprofitable, the company has reduced its losses over the past five years by 10% annually. Recent earnings showed a net loss of HK$67.73 million but improved from a larger deficit last year. The company's short-term assets exceed both its short- and long-term liabilities, indicating sound liquidity management. However, it faces challenges with less than one year of cash runway if current free cash flow trends persist. A recent board change may influence future strategic directions.

- Click here and access our complete financial health analysis report to understand the dynamics of EverChina Int'l Holdings.

- Learn about EverChina Int'l Holdings' historical performance here.

Zhejiang Jihua Group (SHSE:603980)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Jihua Group Co., Ltd. operates in the dyestuff industry and has a market cap of CN¥3.09 billion.

Operations: Zhejiang Jihua Group Co., Ltd. does not report specific revenue segments, focusing its operations in the dyestuff industry.

Market Cap: CN¥3.09B

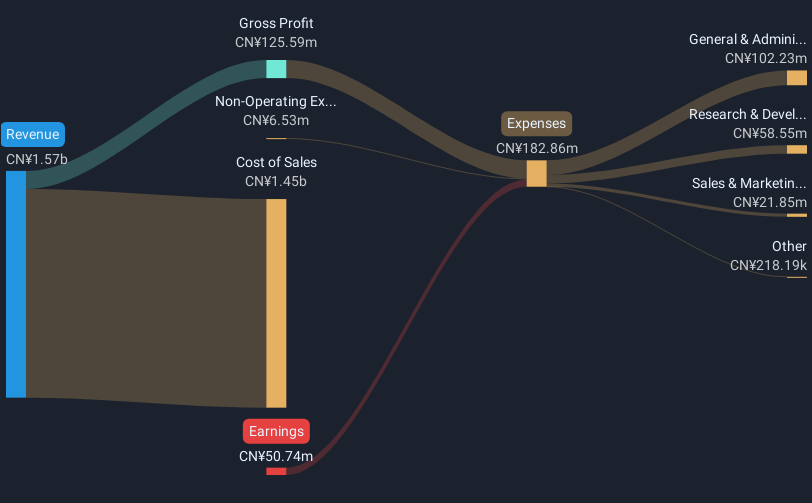

Zhejiang Jihua Group, with a market cap of CN¥3.09 billion, operates in the dyestuff industry and currently faces profitability challenges. The company's short-term assets of CN¥3 billion comfortably cover both its short- and long-term liabilities, suggesting robust liquidity. However, it remains unprofitable with earnings declining significantly over the past five years by 66.2% annually. Despite this, its debt is modestly covered by operating cash flow at 47.5%, and shareholders have not faced significant dilution recently. A Special Shareholders Meeting scheduled for January 22 may address strategic or operational adjustments moving forward.

- Click to explore a detailed breakdown of our findings in Zhejiang Jihua Group's financial health report.

- Explore historical data to track Zhejiang Jihua Group's performance over time in our past results report.

Beijing Kingee Culture Development (SZSE:002721)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Kingee Culture Development Co., Ltd. operates in the cultural and creative industries, focusing on design and production services, with a market cap of CN¥6.73 billion.

Operations: Beijing Kingee Culture Development Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥6.73B

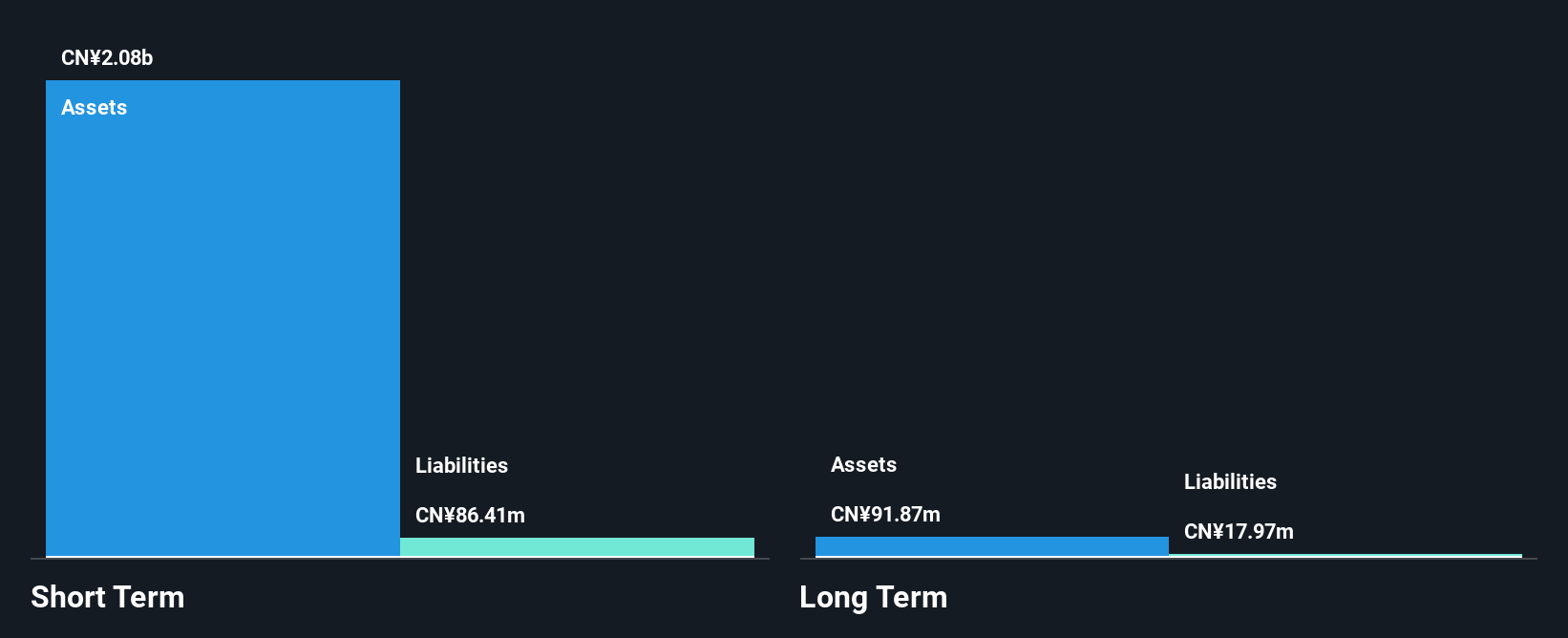

Beijing Kingee Culture Development, with a market cap of CN¥6.73 billion, has recently turned profitable and exhibits strong financial health. Its short-term assets of CN¥2.1 billion far exceed both its short- and long-term liabilities, while the company remains debt-free, eliminating concerns over interest coverage or cash flow issues related to debt repayment. The Return on Equity is outstanding at 57.8%, reflecting efficient use of equity capital. Additionally, the Price-To-Earnings ratio of 5.8x suggests potential undervaluation compared to the broader Chinese market average of 36.6x. An upcoming shareholders meeting may discuss strategic capital adjustments affecting future growth prospects.

- Get an in-depth perspective on Beijing Kingee Culture Development's performance by reading our balance sheet health report here.

- Gain insights into Beijing Kingee Culture Development's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Dive into all 5,672 of the Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EverChina Int'l Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:202

EverChina Int'l Holdings

An investment holding company, primarily engages in the property investment and hotel operations in the People’s Republic of China and Bolivia.

Mediocre balance sheet minimal.

Market Insights

Community Narratives