- China

- /

- Electronic Equipment and Components

- /

- SHSE:688025

Exploring CSSC Hong Kong Shipping And 2 Other Promising Small Caps In Asia

Reviewed by Simply Wall St

As the global markets experience a mix of economic signals, with small-cap stocks in the U.S. showing resilience and leading gains, Asian markets are navigating through their own unique challenges and opportunities. Amidst these dynamics, investors often seek out smaller companies that demonstrate robust fundamentals and potential for growth, making them compelling candidates for further exploration in the diverse landscape of Asia's market.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Advancetek EnterpriseLtd | 43.92% | 38.91% | 59.75% | ★★★★★★ |

| Shandong Sinoglory Health Food | 1.80% | 2.21% | 5.77% | ★★★★★★ |

| Xiangyang Changyuandonggu Industry | 35.39% | 2.07% | -13.74% | ★★★★★★ |

| Tohoku Steel | NA | 5.34% | -2.26% | ★★★★★★ |

| Shenzhen Chengtian Weiye Technology | NA | 0.96% | -23.07% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Chongqing Machinery & Electric | 25.60% | 7.97% | 18.73% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Sinomag Technology | 68.80% | 16.08% | 3.66% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

CSSC (Hong Kong) Shipping (SEHK:3877)

Simply Wall St Value Rating: ★★★★☆☆

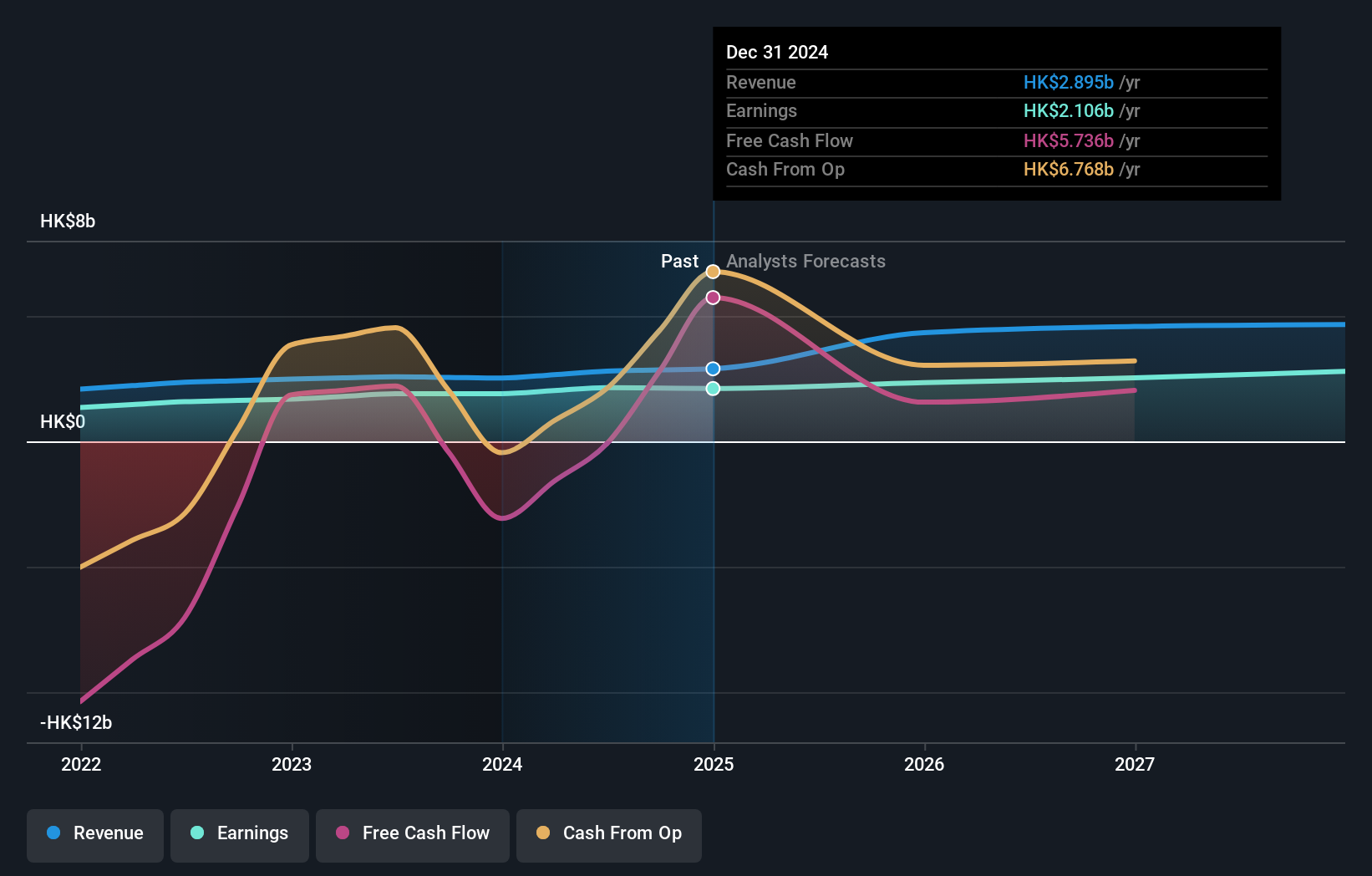

Overview: CSSC (Hong Kong) Shipping Company Limited functions as a shipyard-affiliated leasing company with operations across the People’s Republic of China, Asia, the United States, and Europe, and has a market capitalization of approximately HK$12.76 billion.

Operations: The company's primary revenue streams include operating lease services at HK$2.24 billion and finance lease services at HK$1.22 billion, supplemented by loan borrowings and shipbroking services. Operating leases contribute significantly to the overall revenue structure.

CSSC Shipping, a relatively smaller player in the shipping industry, has shown promising growth with earnings rising 10.7% last year, outpacing the broader Diversified Financial sector's 1.2%. The company's debt to equity ratio improved from 220% to 195.2% over five years, yet it still carries a high net debt to equity ratio of 176.8%. Trading at an attractive value—18.2% below estimated fair value—it also reported net income of HK$2.11 billion for 2024 compared to HK$1.90 billion previously, reflecting strong financial performance and potential for future growth despite its high leverage position.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Value Rating: ★★★★★★

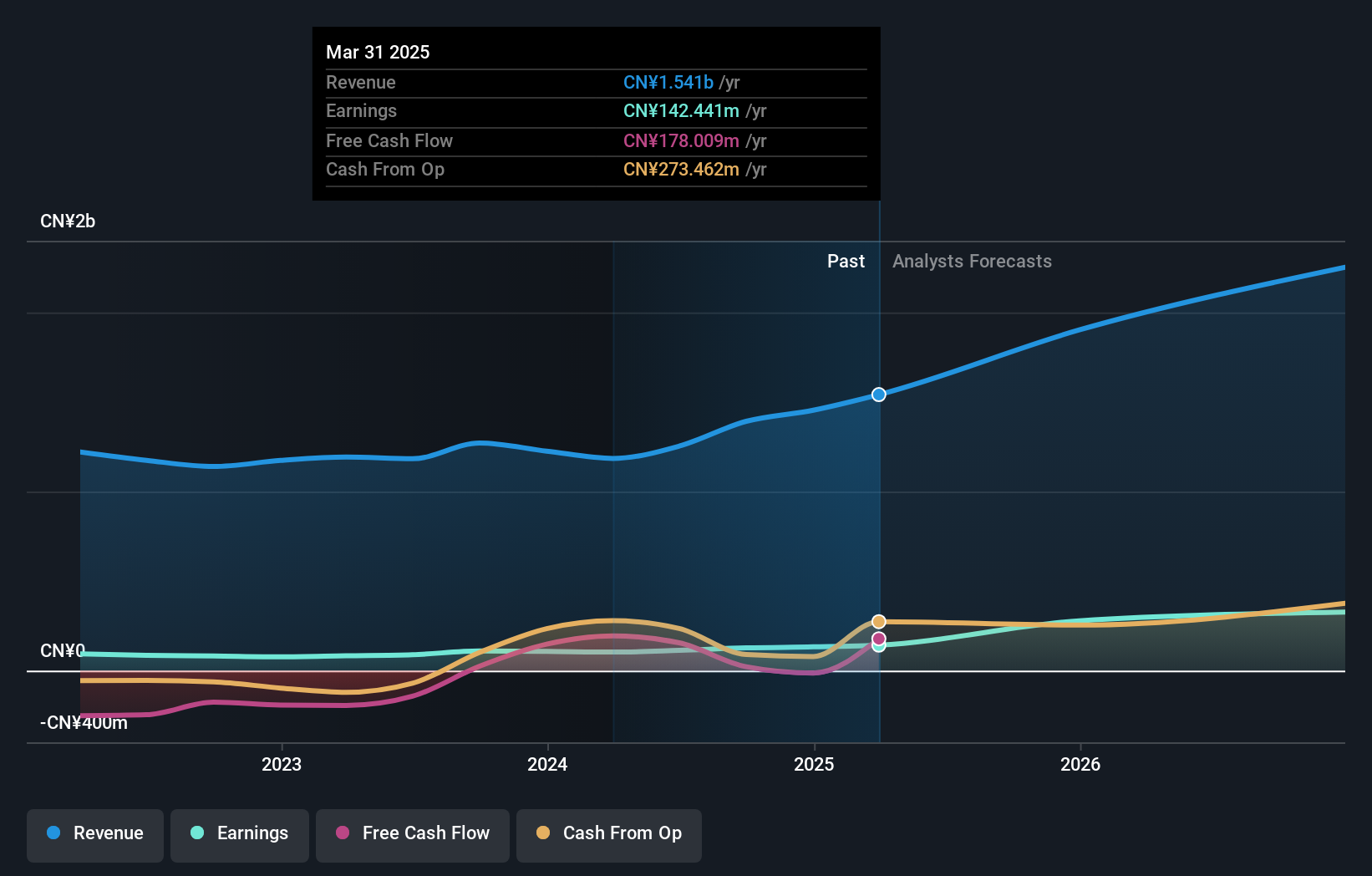

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the R&D, production, sale, and technical services of laser and optical devices with a market cap of CN¥5.53 billion.

Operations: JPT Opto-Electronics generates revenue primarily from its Computer Communications and Other Electronic Equipment segment, amounting to CN¥1.54 billion.

Shenzhen JPT Opto-Electronics, a dynamic player in the electronics sector, has been making waves with its impressive earnings growth of 37.7% over the past year, outpacing the industry average of 2.7%. The company reported Q1 2025 revenue at CNY 342.86 million, up from CNY 255.73 million a year prior, while net income rose to CNY 36.05 million from CNY 26.29 million. With a price-to-earnings ratio of 38.9x below the industry norm and a robust debt-to-equity reduction from 8.3% to just under one over five years, it presents an intriguing investment case amidst market volatility.

Anhui Huilong Agricultural Means of ProductionLtd (SZSE:002556)

Simply Wall St Value Rating: ★★★★☆☆

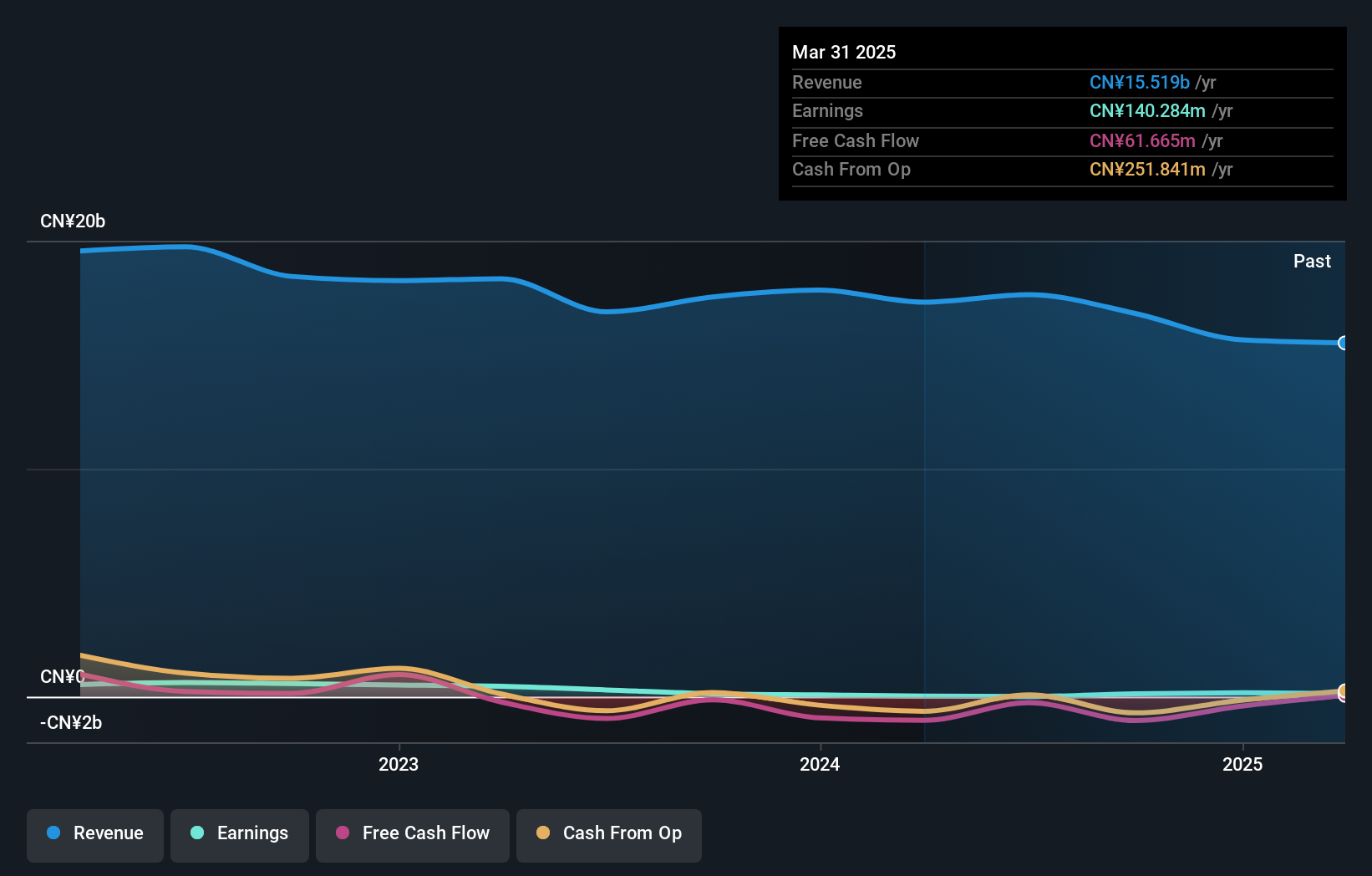

Overview: Anhui Huilong Agricultural Means of Production Co., Ltd. operates in the agricultural sector, focusing on the distribution and sale of agricultural materials, with a market cap of CN¥6.24 billion.

Operations: Anhui Huilong generates its revenue primarily through the distribution and sale of agricultural materials. The company's net profit margin reflects its efficiency in managing costs relative to its revenue, offering insight into profitability trends.

Anhui Huilong, a relatively small player in its sector, has shown a mixed financial picture recently. Earnings surged by 372% over the past year, outpacing the industry's growth. However, this was partly due to a one-off gain of ¥55.7M impacting recent results. The company reported first-quarter sales of ¥3.66 billion compared to last year's ¥3.80 billion and net income at ¥81.86 million versus ¥110.5 million previously, reflecting some challenges in maintaining consistent revenue streams amid declining earnings over five years by 16% annually. Despite these fluctuations, it remains free cash flow positive with interest payments well covered at 14 times EBIT.

Make It Happen

- Delve into our full catalog of 2614 Asian Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688025

Shenzhen JPT Opto-Electronics

Engages in the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion