- China

- /

- Metals and Mining

- /

- SZSE:002547

Suzhou Chunxing Precision Mechanical Co., Ltd.'s (SZSE:002547) 29% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Unfortunately for some shareholders, the Suzhou Chunxing Precision Mechanical Co., Ltd. (SZSE:002547) share price has dived 29% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

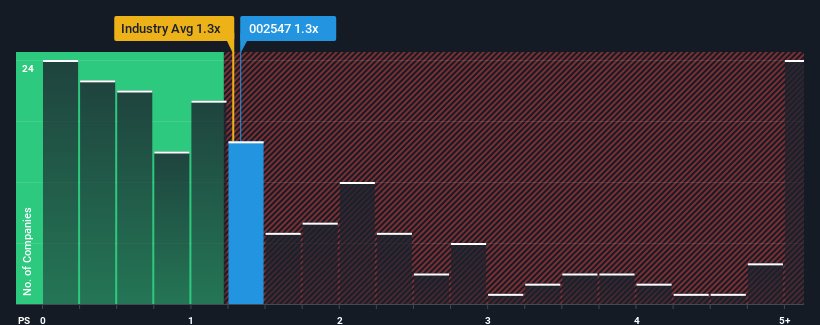

Even after such a large drop in price, there still wouldn't be many who think Suzhou Chunxing Precision Mechanical's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when it essentially matches the median P/S in China's Metals and Mining industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Suzhou Chunxing Precision Mechanical

How Has Suzhou Chunxing Precision Mechanical Performed Recently?

For example, consider that Suzhou Chunxing Precision Mechanical's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Suzhou Chunxing Precision Mechanical's earnings, revenue and cash flow.How Is Suzhou Chunxing Precision Mechanical's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Suzhou Chunxing Precision Mechanical's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 51% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 15% shows it's an unpleasant look.

With this information, we find it concerning that Suzhou Chunxing Precision Mechanical is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Following Suzhou Chunxing Precision Mechanical's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We find it unexpected that Suzhou Chunxing Precision Mechanical trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you take the next step, you should know about the 1 warning sign for Suzhou Chunxing Precision Mechanical that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002547

Suzhou Chunxing Precision Mechanical

Suzhou Chunxing Precision Mechanical Co., Ltd.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success