There's No Escaping Kingenta Ecological Engineering Group Co., Ltd.'s (SZSE:002470) Muted Revenues Despite A 32% Share Price Rise

Despite an already strong run, Kingenta Ecological Engineering Group Co., Ltd. (SZSE:002470) shares have been powering on, with a gain of 32% in the last thirty days. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

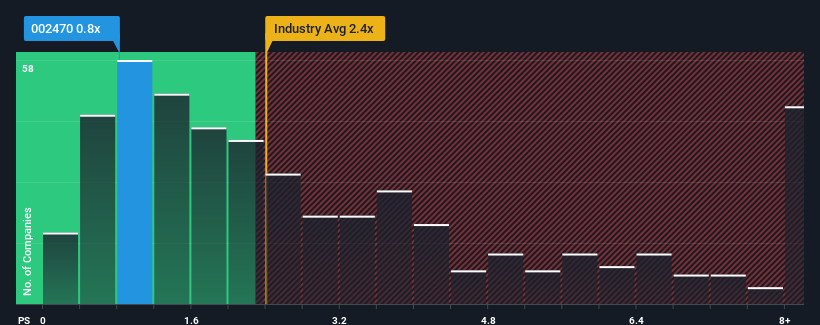

Although its price has surged higher, Kingenta Ecological Engineering Group's price-to-sales (or "P/S") ratio of 0.8x might still make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 2.4x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Kingenta Ecological Engineering Group

How Kingenta Ecological Engineering Group Has Been Performing

For example, consider that Kingenta Ecological Engineering Group's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kingenta Ecological Engineering Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Kingenta Ecological Engineering Group?

The only time you'd be truly comfortable seeing a P/S as low as Kingenta Ecological Engineering Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.7%. As a result, revenue from three years ago have also fallen 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Kingenta Ecological Engineering Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Kingenta Ecological Engineering Group's P/S

The latest share price surge wasn't enough to lift Kingenta Ecological Engineering Group's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Kingenta Ecological Engineering Group maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Kingenta Ecological Engineering Group with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kingenta Ecological Engineering Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002470

Kingenta Ecological Engineering Group

Research, develops, produces, and sells agricultural fertilizers and raw materials in China.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives