Stock Analysis

Top 3 Chinese Stocks Estimated To Be Trading Below Their Value In July 2024

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, China's economy has shown resilience with strong export figures in June 2024, suggesting potential undercurrents of strength despite broader concerns about deflationary pressures. This context sets an intriguing stage for investors to consider Chinese stocks that may be trading below their intrinsic values. In assessing what makes a stock particularly appealing in the current environment, factors such as robust export performance and relative market undervaluation come to the forefront. These elements can highlight opportunities for discerning investors looking to capitalize on discrepancies between market price and underlying economic fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥166.20 | CN¥320.90 | 48.2% |

| Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥18.22 | CN¥33.39 | 45.4% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥15.95 | CN¥29.86 | 46.6% |

| Eyebright Medical Technology (Beijing) (SHSE:688050) | CN¥65.69 | CN¥121.92 | 46.1% |

| Shanghai Milkground Food Tech (SHSE:600882) | CN¥13.50 | CN¥26.97 | 49.9% |

| INKON Life Technology (SZSE:300143) | CN¥7.42 | CN¥14.64 | 49.3% |

| China Film (SHSE:600977) | CN¥10.46 | CN¥20.25 | 48.3% |

| Seres GroupLtd (SHSE:601127) | CN¥77.70 | CN¥149.41 | 48% |

| Quectel Wireless Solutions (SHSE:603236) | CN¥53.17 | CN¥96.99 | 45.2% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.80 | CN¥18.84 | 48% |

Here we highlight a subset of our preferred stocks from the screener.

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. is a company that specializes in electronic technology, with a market capitalization of approximately CN¥8.27 billion.

Operations: The revenue segments for the company are not detailed in the provided text.

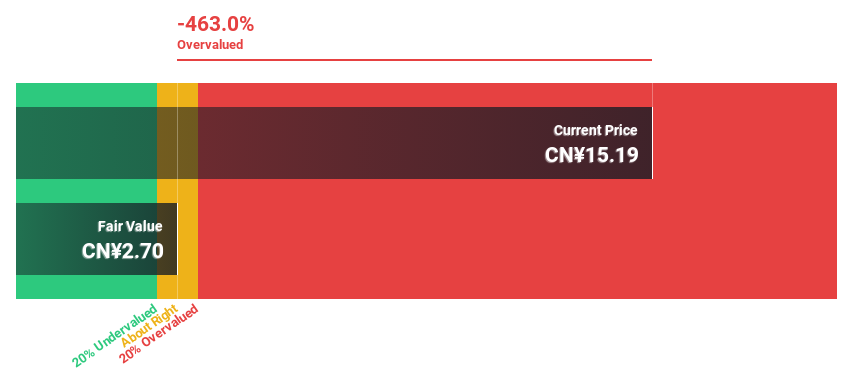

Estimated Discount To Fair Value: 37.7%

Beijing Yuanliu Hongyuan Electronic Technology is trading at CN¥35.86, significantly below the estimated fair value of CN¥57.58, indicating a potential undervaluation based on discounted cash flows. Despite a recent dip in net income and EPS as reported in Q1 2024 results, the company's revenue growth is expected to outpace the Chinese market average significantly at 21.8% annually. However, its profit margins have decreased from last year, and its forecasted return on equity in three years is relatively low at 10.9%.

- The analysis detailed in our Beijing Yuanliu Hongyuan Electronic Technology growth report hints at robust future financial performance.

- Get an in-depth perspective on Beijing Yuanliu Hongyuan Electronic Technology's balance sheet by reading our health report here.

Ganfeng Lithium Group (SZSE:002460)

Overview: Ganfeng Lithium Group Co., Ltd. is a global company based in Mainland China that manufactures and sells lithium products across Asia, the European Union, North America, and other international markets, with a market capitalization of approximately CN¥52.74 billion.

Operations: The company generates its revenue by manufacturing and selling lithium products across various regions including Mainland China, the rest of Asia, the European Union, and North America.

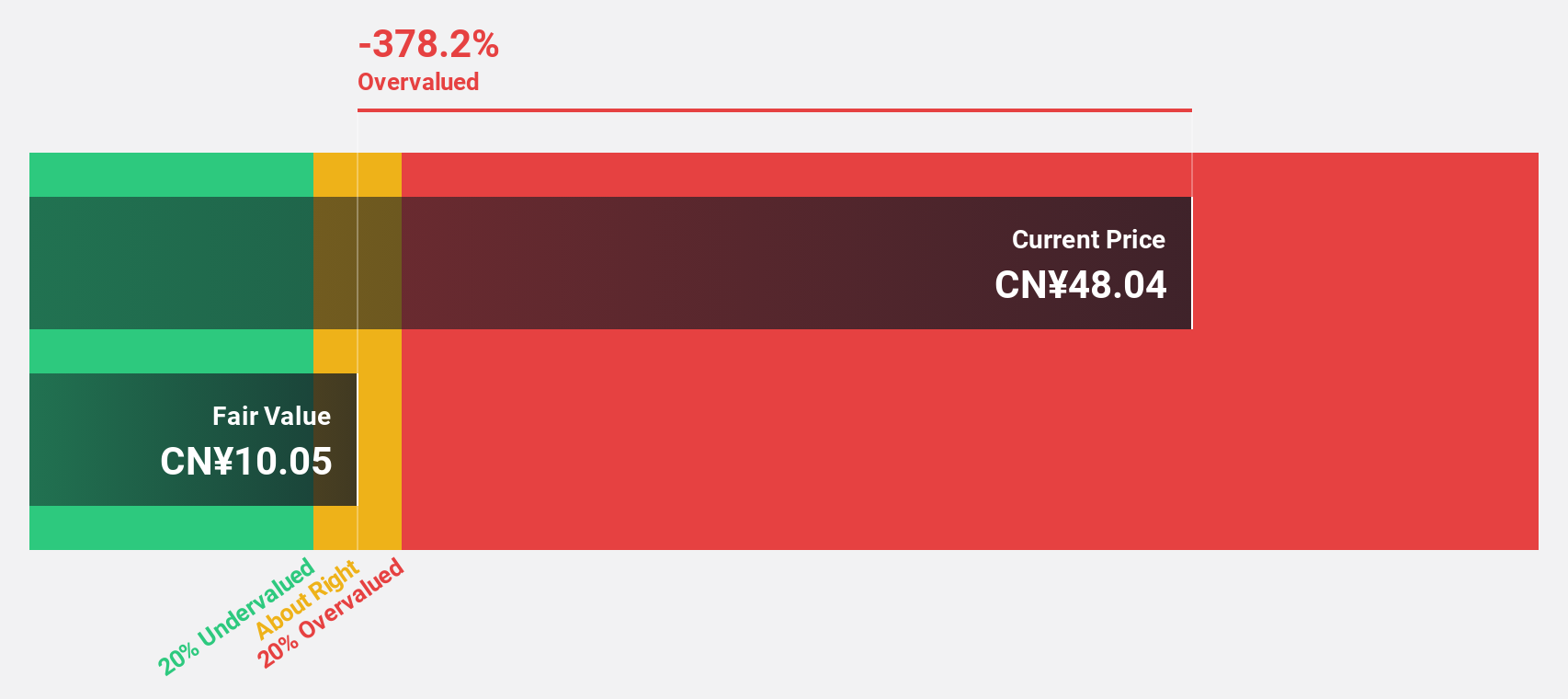

Estimated Discount To Fair Value: 41.7%

Ganfeng Lithium Group, priced at CN¥28.8, is valued well below its fair value of CN¥49.42, suggesting a significant undervaluation based on cash flows. Despite a challenging financial period with recent substantial losses and lowered dividends, the company's earnings are expected to grow by 29.6% annually over the next three years, outpacing the Chinese market forecast of 22.1%. However, concerns arise from recent executive resignations and unimpressive profit margins at 7.4%, compared to last year’s 42.2%.

- Our growth report here indicates Ganfeng Lithium Group may be poised for an improving outlook.

- Dive into the specifics of Ganfeng Lithium Group here with our thorough financial health report.

Shandong Sinocera Functional Material (SZSE:300285)

Overview: Shandong Sinocera Functional Material Co., Ltd. is a company engaged in the research, development, production, and sale of functional ceramic materials with a market capitalization of approximately CN¥17.53 billion.

Operations: The revenue segments for the company are not detailed in the provided text.

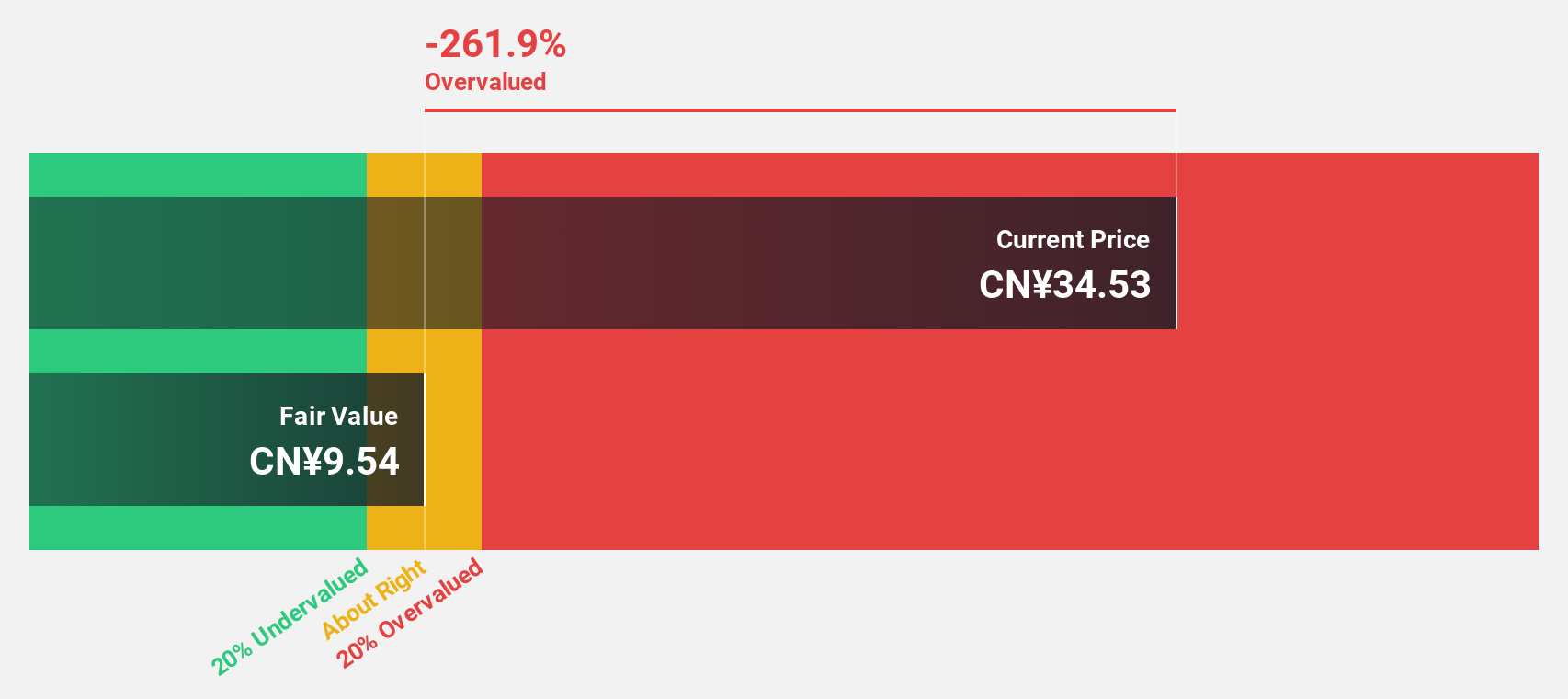

Estimated Discount To Fair Value: 31.2%

Shandong Sinocera Functional Material is trading at CN¥17.58, substantially below its calculated fair value of CN¥25.55, indicating a potential undervaluation based on cash flows. The company's earnings and revenue are both forecasted to grow at 25% and 17.7% per year respectively, outstripping broader market expectations. However, its Return on Equity is expected to be modest at 12.9%. Recent activities include a share buyback for CN¥10.45 million and consistent dividend payments, reflecting a stable financial strategy amidst growth.

- The growth report we've compiled suggests that Shandong Sinocera Functional Material's future prospects could be on the up.

- Navigate through the intricacies of Shandong Sinocera Functional Material with our comprehensive financial health report here.

Summing It All Up

- Investigate our full lineup of 98 Undervalued Chinese Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Ganfeng Lithium Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002460

Ganfeng Lithium Group

Manufactures and sells lithium products in Mainland China, rest of Asia, the European Union, North America, and internationally.

Good value with reasonable growth potential and pays a dividend.