As Asian markets navigate a landscape marked by cautious optimism and economic challenges, investors are turning their attention to growth companies with robust insider ownership as potential opportunities. In this environment, high insider ownership can be a positive indicator of confidence in the company's future prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Tongguan Gold Group (SEHK:340) | 30.1% | 29.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.2% | 27.6% |

| Seers Technology (KOSDAQ:A458870) | 34.1% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.3% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.9% | 91.9% |

Let's uncover some gems from our specialized screener.

APT Medical (SHSE:688617)

Simply Wall St Growth Rating: ★★★★★★

Overview: APT Medical Inc. focuses on the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China, with a market cap of CN¥44.74 billion.

Operations: The company generates revenue of CN¥2.28 billion from its medical products segment.

Insider Ownership: 22%

APT Medical has demonstrated solid growth, with recent earnings showing a net income of CNY 425.16 million, up from CNY 342.56 million the previous year. The company's revenue is projected to grow at 26.8% annually, outpacing the Chinese market's average growth rate of 13.8%. Earnings are expected to increase significantly over the next three years, with a forecasted annual profit growth of 27.8%, indicating robust potential for sustained expansion in Asia's medical sector.

- Click here and access our complete growth analysis report to understand the dynamics of APT Medical.

- Our expertly prepared valuation report APT Medical implies its share price may be too high.

Ganfeng Lithium Group (SZSE:002460)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ganfeng Lithium Group Co., Ltd. is engaged in the manufacturing and sale of lithium products, with a market capitalization of approximately CN¥92.81 billion.

Operations: Ganfeng Lithium Group Co., Ltd. generates its revenue through the production and sale of lithium products.

Insider Ownership: 27.3%

Ganfeng Lithium Group is experiencing a challenging phase with a reported net loss of CNY 531.24 million for the first half of 2025, despite strategic initiatives like a joint venture with Lithium Argentina AG. The company completed an HKD 1.17 billion equity offering to bolster its financial position. While revenue is forecasted to grow at 20.2% annually, surpassing the market average, profitability remains elusive in the near term due to falling lithium prices and asset impairments.

- Delve into the full analysis future growth report here for a deeper understanding of Ganfeng Lithium Group.

- The analysis detailed in our Ganfeng Lithium Group valuation report hints at an inflated share price compared to its estimated value.

PeptiDream (TSE:4587)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on discovering and developing constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market cap of approximately ¥221.60 billion.

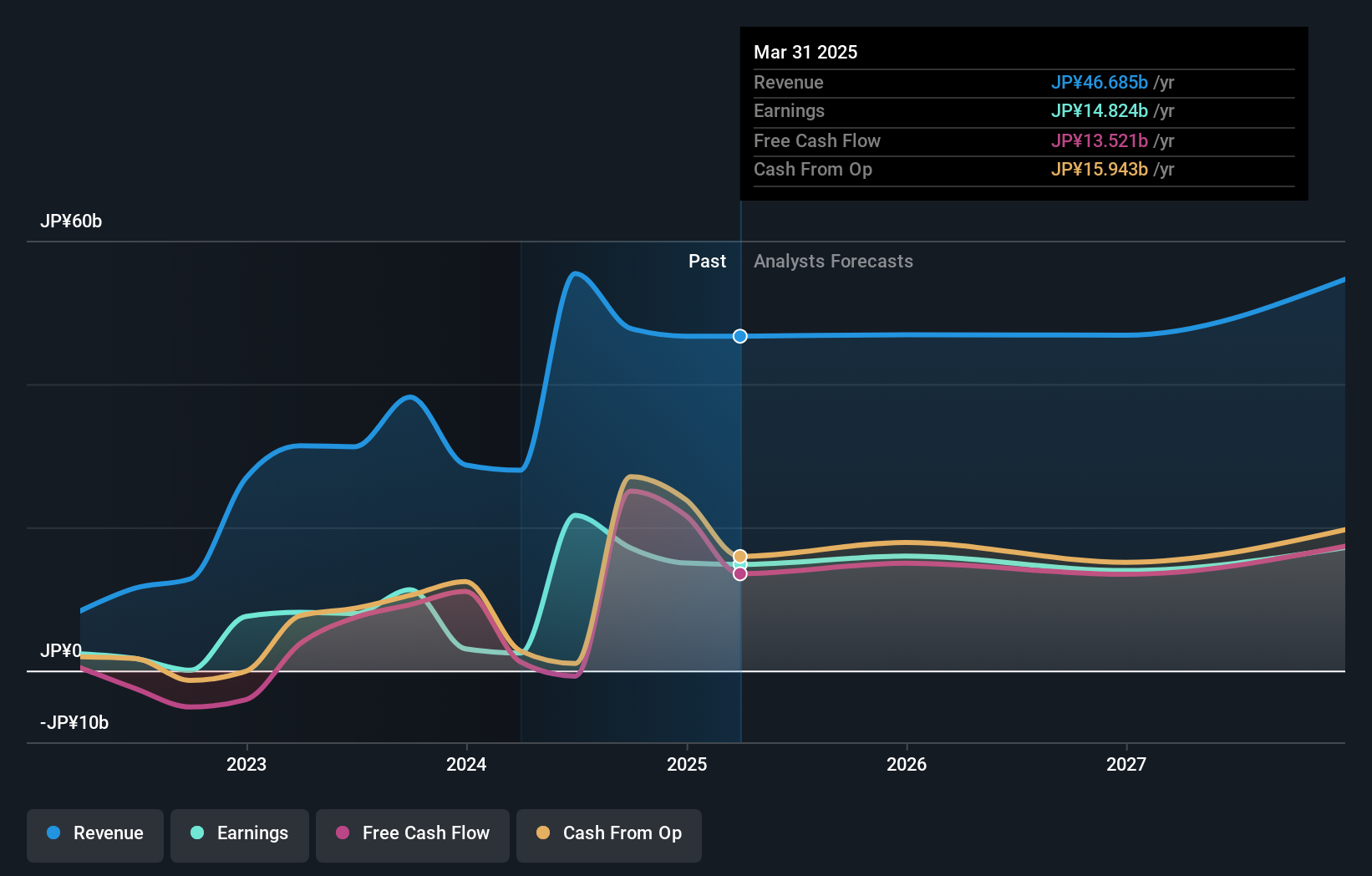

Operations: PeptiDream generates revenue primarily from its Radioactive Pharmaceutical Business, which accounts for ¥16.51 billion, and its Drug Discovery and Development Business, contributing ¥3.59 billion.

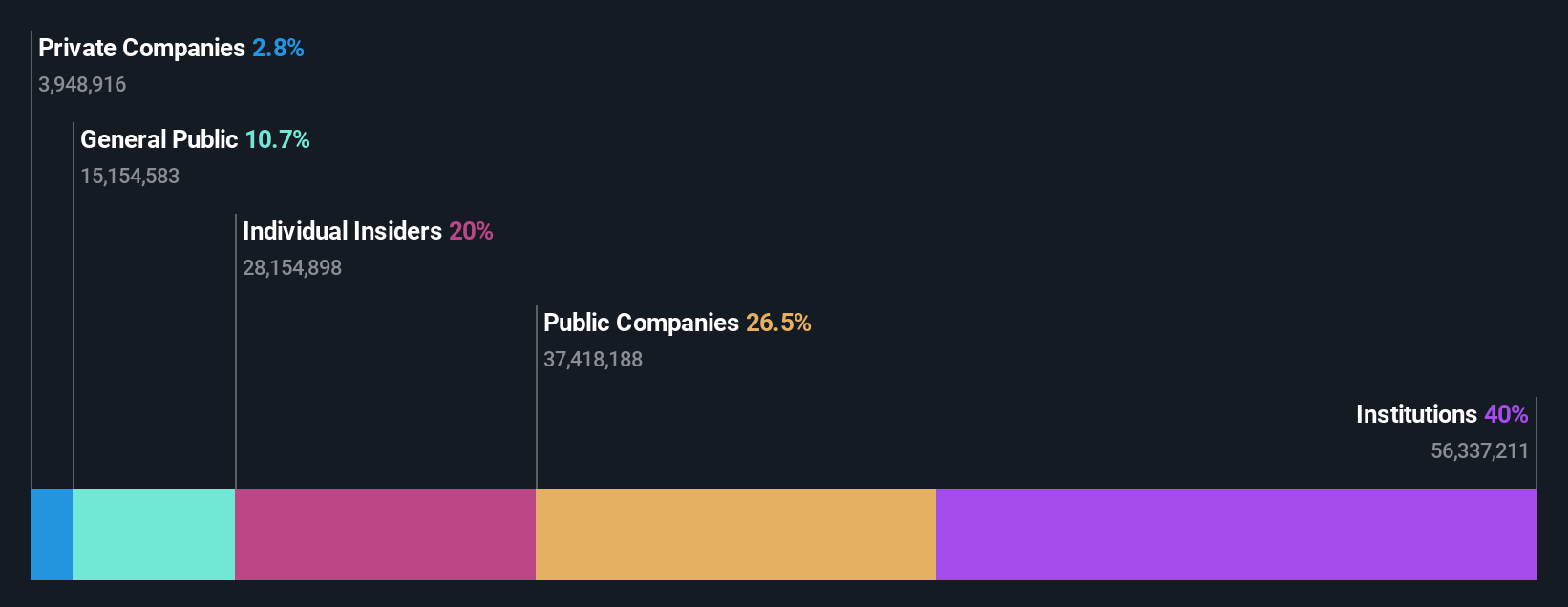

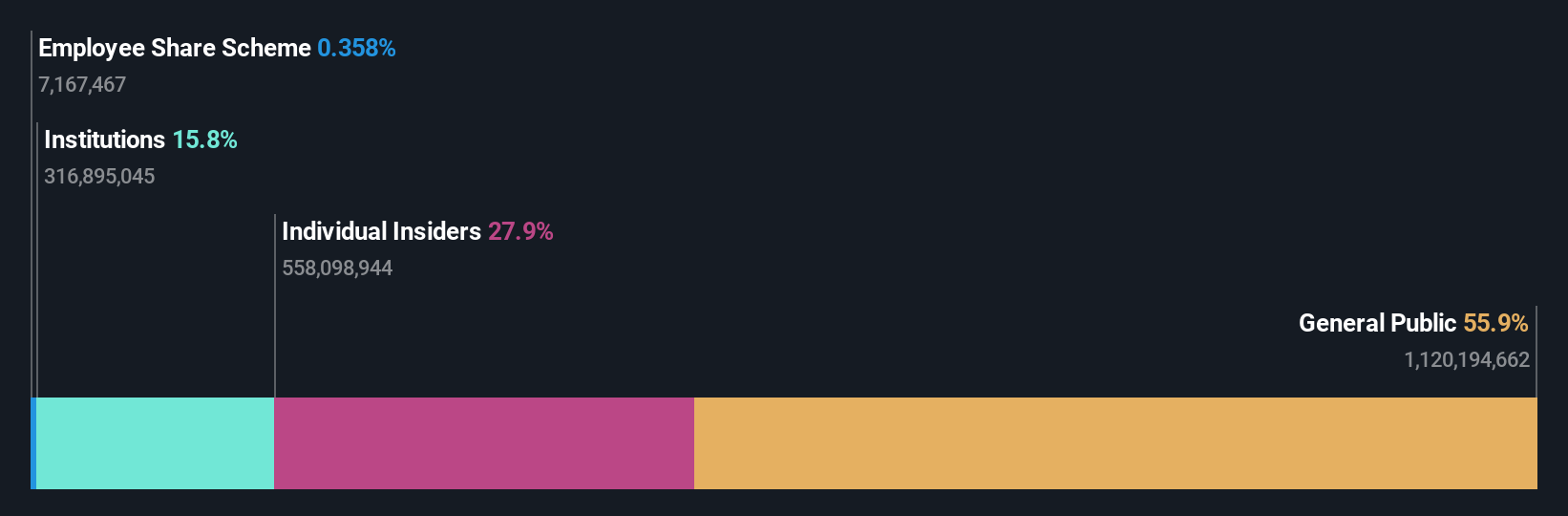

Insider Ownership: 25.7%

PeptiDream is poised for significant growth, with earnings expected to increase by 30.96% annually and revenue projected to rise at 17.6% per year, outpacing the Japanese market average. Despite this strong growth trajectory, the company's share price has been highly volatile recently. PeptiDream trades at a substantial discount to its estimated fair value and aims for profitability within three years, although its forecasted return on equity remains modest at 17.6%.

- Navigate through the intricacies of PeptiDream with our comprehensive analyst estimates report here.

- Our valuation report here indicates PeptiDream may be undervalued.

Summing It All Up

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 614 companies by clicking here.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4587

PeptiDream

A biopharmaceutical company, engages in the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives