Further Upside For Jiangsu Baichuan High-Tech New Materials Co., Ltd (SZSE:002455) Shares Could Introduce Price Risks After 43% Bounce

Jiangsu Baichuan High-Tech New Materials Co., Ltd (SZSE:002455) shareholders would be excited to see that the share price has had a great month, posting a 43% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.1% over the last year.

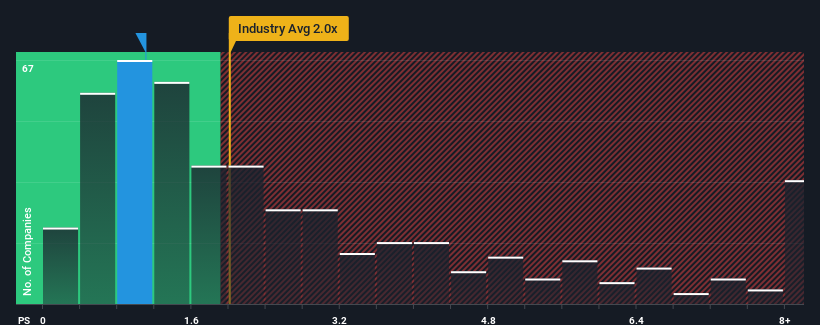

Even after such a large jump in price, Jiangsu Baichuan High-Tech New Materials may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.1x, since almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Jiangsu Baichuan High-Tech New Materials

What Does Jiangsu Baichuan High-Tech New Materials' P/S Mean For Shareholders?

It looks like revenue growth has deserted Jiangsu Baichuan High-Tech New Materials recently, which is not something to boast about. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangsu Baichuan High-Tech New Materials will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Jiangsu Baichuan High-Tech New Materials would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 92% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 21% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Jiangsu Baichuan High-Tech New Materials' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Jiangsu Baichuan High-Tech New Materials' P/S Mean For Investors?

Jiangsu Baichuan High-Tech New Materials' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Jiangsu Baichuan High-Tech New Materials currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Jiangsu Baichuan High-Tech New Materials (1 is a bit concerning!) that you need to be mindful of.

If you're unsure about the strength of Jiangsu Baichuan High-Tech New Materials' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002455

Jiangsu Baichuan High-Tech New Materials

Jiangsu Baichuan High-Tech New Materials Co., Ltd.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives