- China

- /

- Metals and Mining

- /

- SZSE:002445

The 10% return this week takes Jiangyin Zhongnan Heavy IndustriesLtd's (SZSE:002445) shareholders five-year gains to 31%

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Jiangyin Zhongnan Heavy IndustriesLtd share price has climbed 31% in five years, easily topping the market decline of 1.3% (ignoring dividends).

Since the stock has added CN¥407m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Jiangyin Zhongnan Heavy IndustriesLtd

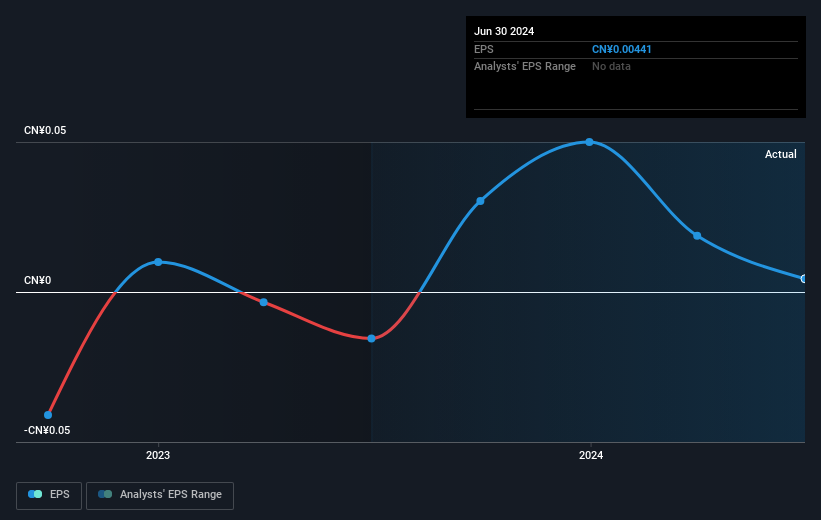

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Jiangyin Zhongnan Heavy IndustriesLtd became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Jiangyin Zhongnan Heavy IndustriesLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 14% in the twelve months, Jiangyin Zhongnan Heavy IndustriesLtd shareholders did even worse, losing 20%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Jiangyin Zhongnan Heavy IndustriesLtd , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002445

Jiangyin Zhongnan Heavy IndustriesLtd

Engages in the production and sale of metal pipe fittings, flanges, piping systems, and pressure vessels primarily in China.

Flawless balance sheet and slightly overvalued.