- China

- /

- Metals and Mining

- /

- SZSE:002428

Yunnan Lincang Xinyuan Germanium IndustryLTD (SZSE:002428) shareholder returns have been splendid, earning 189% in 5 years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. Long term Yunnan Lincang Xinyuan Germanium Industry Co.,LTD (SZSE:002428) shareholders would be well aware of this, since the stock is up 189% in five years. Also pleasing for shareholders was the 60% gain in the last three months.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Yunnan Lincang Xinyuan Germanium IndustryLTD

While Yunnan Lincang Xinyuan Germanium IndustryLTD made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Yunnan Lincang Xinyuan Germanium IndustryLTD saw its revenue grow at 5.8% per year. That's not a very high growth rate considering the bottom line. So we wouldn't have expected to see the share price to have lifted 24% for each year during that time, but that's what happened. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. Some might suggest that the sentiment around the stock is rather positive.

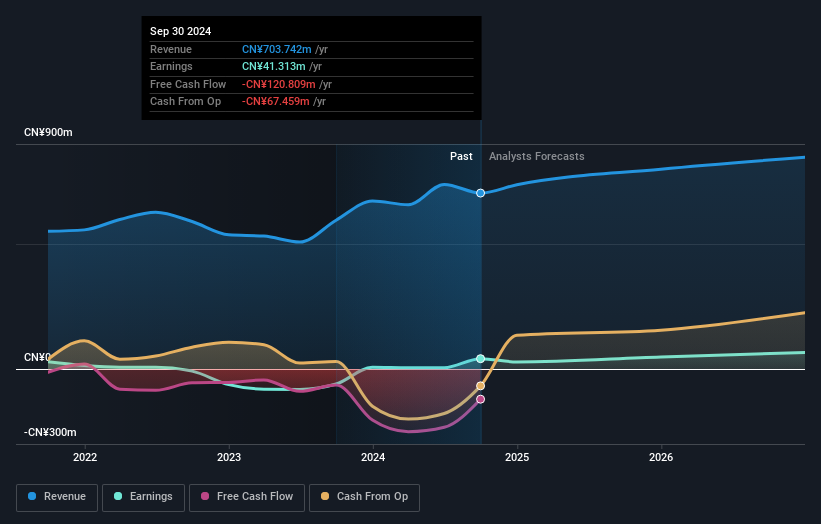

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Yunnan Lincang Xinyuan Germanium IndustryLTD stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that Yunnan Lincang Xinyuan Germanium IndustryLTD has rewarded shareholders with a total shareholder return of 71% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 24% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Yunnan Lincang Xinyuan Germanium IndustryLTD that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002428

Yunnan Lincang Xinyuan Germanium IndustryLTD

Engages in the research and development, deep processing, and germanium mining in China.

Moderate growth potential with mediocre balance sheet.