- China

- /

- Basic Materials

- /

- SZSE:002398

Investors Aren't Buying Lets Holdings Group Co., Ltd.'s (SZSE:002398) Earnings

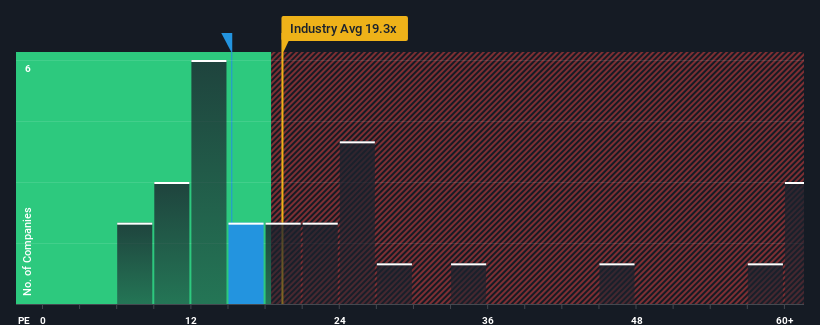

Lets Holdings Group Co., Ltd.'s (SZSE:002398) price-to-earnings (or "P/E") ratio of 15.2x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 50x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Lets Holdings Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Lets Holdings Group

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Lets Holdings Group's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. As a result, earnings from three years ago have also fallen 56% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 12% each year over the next three years. With the market predicted to deliver 21% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Lets Holdings Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Lets Holdings Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Lets Holdings Group, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Lets Holdings Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002398

Lets Holdings Group

Engages in the research and development, production, and sale of construction materials in China and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives