As global markets navigate through geopolitical tensions and consumer spending concerns, small-cap stocks have been particularly impacted, with indices like the S&P 600 reflecting broader economic uncertainties. Despite these challenges, the search for undiscovered gems remains compelling as investors look for companies that can demonstrate resilience and innovation in a fluctuating environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.92% | 8.23% | 18.26% | ★★★★★★ |

| Intelligent Wave | NA | 7.78% | 15.50% | ★★★★★★ |

| Kyoritsu Electric | 7.58% | 3.45% | 12.53% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yashima Denki | 2.71% | -1.00% | 18.12% | ★★★★★★ |

| Toyo Kanetsu K.K | 33.97% | 3.33% | 18.20% | ★★★★★☆ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Loadstar Capital K.K | 244.76% | 17.29% | 21.16% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

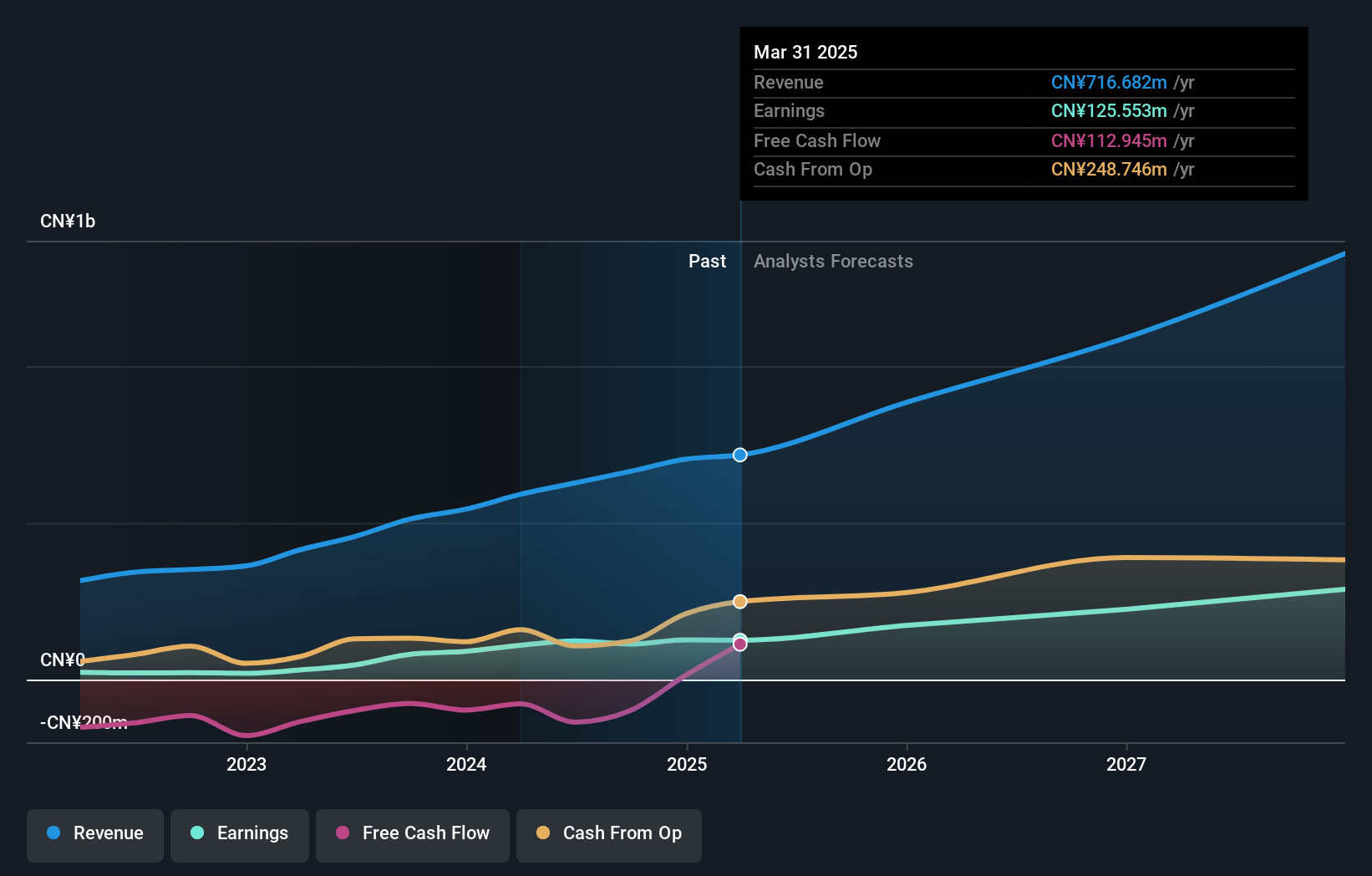

Wuxi HyatechLtd (SHSE:688510)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Hyatech Co., Ltd. is engaged in the research, development, manufacturing, and sale of aero-engine parts and forged medical orthopedic implants both in China and internationally, with a market capitalization of CN¥4.63 billion.

Operations: Wuxi Hyatech generates revenue primarily from the sale of aero-engine parts and forged medical orthopedic implants. The company's financial performance is highlighted by a net profit margin of 12.5%, indicating its profitability relative to total revenue.

Wuxi Hyatech, a player in the Aerospace & Defense sector, recently reported sales of CNY 703.24 million for 2024, up from CNY 543.51 million the previous year. Net income rose to CNY 126.62 million from CNY 90.2 million, with basic earnings per share climbing to CNY 0.49 from CNY 0.35. The company's price-to-earnings ratio of 36.6x is slightly below the CN market average of 38.1x, suggesting potential value appeal despite its increased debt-to-equity ratio over five years from 14% to about 20%. Earnings growth outpaced industry averages significantly at over -13%.

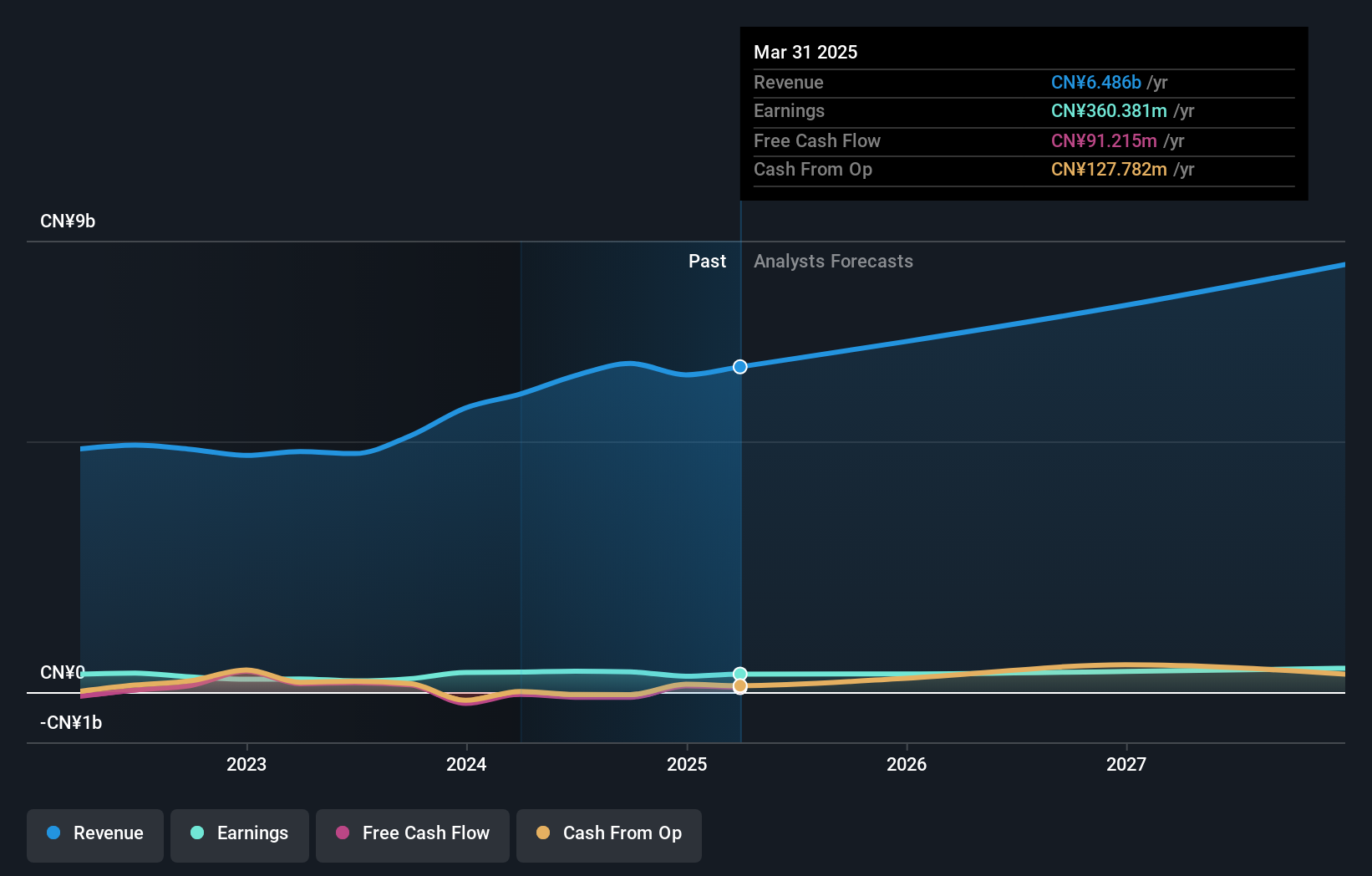

Beijing Lier High-temperature MaterialsLtd (SZSE:002392)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Lier High-temperature Materials Co., Ltd. specializes in the production and sale of high-temperature resistant materials, with a market cap of CN¥5.60 billion.

Operations: The company generates revenue primarily from the production and sale of high-temperature resistant materials. It has a market capitalization of CN¥5.60 billion, reflecting its scale in the industry.

Beijing Lier High-temperature Materials Ltd. offers compelling value with a price-to-earnings ratio of 14x, notably below the CN market average of 38.1x. Its debt to equity ratio has increased from 1.3% to 6.3% over five years, yet it maintains more cash than total debt, ensuring financial stability. The company's earnings growth of 48.5% last year outpaced the Metals and Mining industry’s -1.3%, highlighting robust performance despite challenges in free cash flow positivity and recent share repurchases totaling CNY 93.91 million for about 1.94% of shares outstanding suggest confidence in its future prospects.

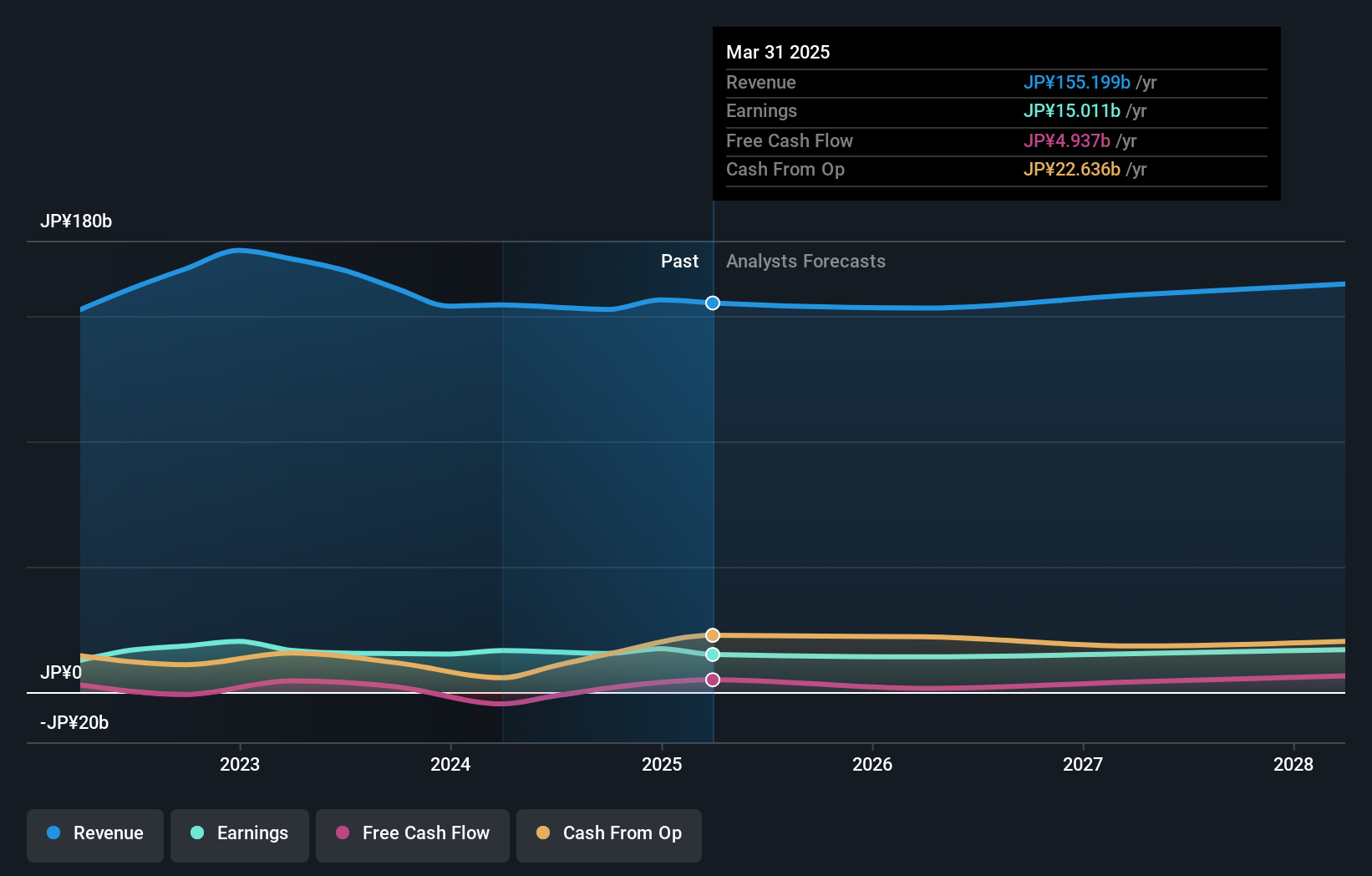

Nippon Soda (TSE:4041)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nippon Soda Co., Ltd. operates in the development, production, and distribution of chemicals and agrochemicals both domestically and internationally, with a market capitalization of approximately ¥160.95 billion.

Operations: Nippon Soda generates revenue primarily from its Chemicals Business and Trading Company Business, contributing ¥51.08 billion and ¥51.21 billion respectively. The Agriculture Chemicals Business also plays a significant role with revenue of ¥53.77 billion.

Nippon Soda, a player in the chemicals sector, offers an intriguing proposition with its net debt to equity ratio at 14%, deemed satisfactory. Over the past five years, its debt to equity ratio has risen from 19.4% to 26.7%, yet it remains profitable with no cash runway concerns. The company trades at a favorable price-to-earnings ratio of 9.3x compared to Japan's market average of 13.1x and has seen earnings grow by an impressive 20.8% annually over five years, although recent growth of 14.2% lagged behind the industry’s pace of 17%.

- Navigate through the intricacies of Nippon Soda with our comprehensive health report here.

Review our historical performance report to gain insights into Nippon Soda's's past performance.

Summing It All Up

- Reveal the 4752 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Soda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4041

Nippon Soda

Provides agri-business, pharmaceuticals, specialty chemicals, eco chemicals, and chlor-alkali products in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives