- United Arab Emirates

- /

- Real Estate

- /

- ADX:KICO

Spotlight On Al Khaleej Investment P.J.S.C And Two Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating, while small-cap stocks showed resilience amidst mixed economic signals. In such fluctuating conditions, investors often look beyond established giants to explore opportunities in lesser-known areas of the market. Penny stocks, though an older term, still capture the essence of investing in smaller or newer companies that may offer affordability and growth potential. This article will spotlight three penny stocks that stand out for their financial strength and potential for stability amidst current market dynamics.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.795 | MYR137.71M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.85 | £467.47M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.415 | £347M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.00 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.9644 | £394.28M | ★★★★☆☆ |

Click here to see the full list of 5,802 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Al Khaleej Investment P.J.S.C (ADX:KICO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Khaleej Investment P.J.S.C. is a real estate and investment company based in the United Arab Emirates with a market cap of AED472.50 million.

Operations: The company generates revenue primarily from its real estate segment, totaling AED17.08 million.

Market Cap: AED472.5M

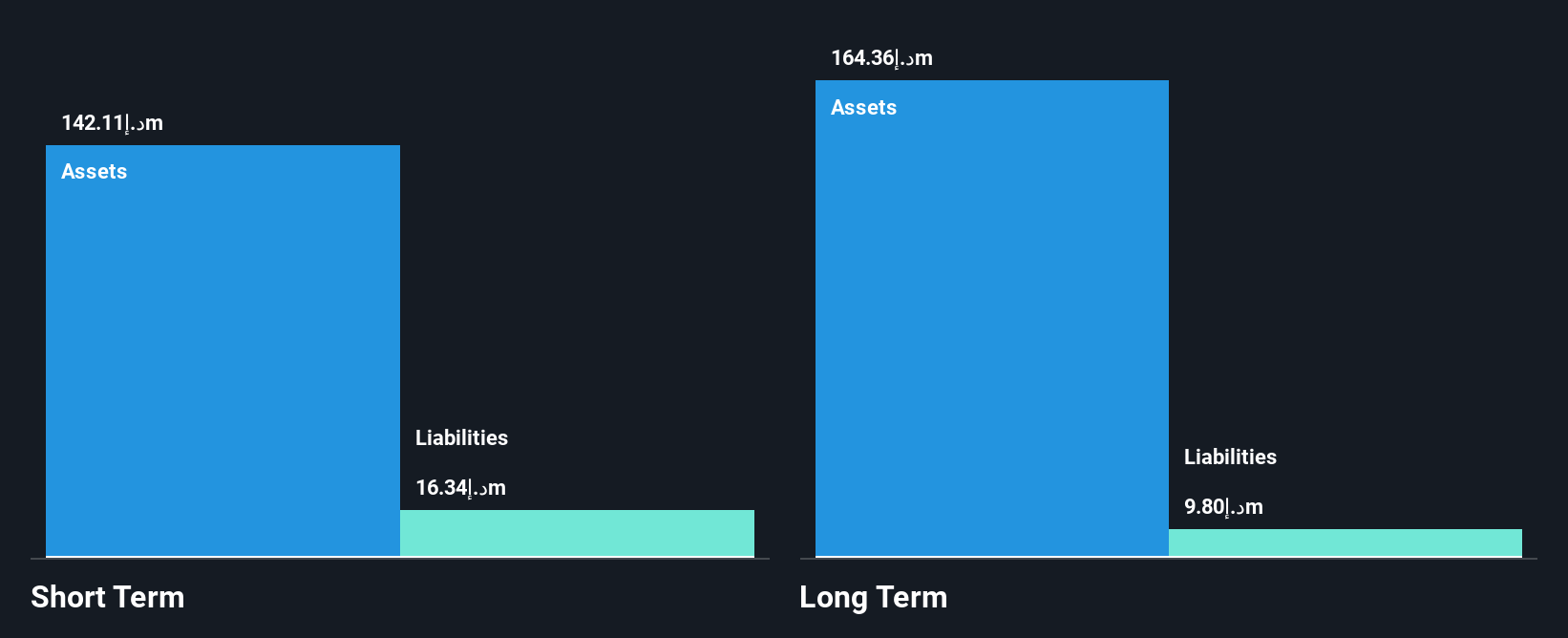

Al Khaleej Investment P.J.S.C., a real estate and investment firm, reported earnings for the second quarter of 2024 with sales of AED 4.39 million and net income of AED 1.07 million, showing slight growth from last year. Despite having no debt and short-term assets exceeding liabilities, the company faces challenges with low return on equity at 2.9% and negative earnings growth over the past year. The company has experienced significant profit growth over five years but is impacted by large one-off items affecting recent financial results, contributing to its volatile share price in recent months.

- Click here and access our complete financial health analysis report to understand the dynamics of Al Khaleej Investment P.J.S.C.

- Explore historical data to track Al Khaleej Investment P.J.S.C's performance over time in our past results report.

Karrie International Holdings (SEHK:1050)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Karrie International Holdings Limited is an investment holding company that manufactures and sells metal, plastic, and electronic products across Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe with a market cap of approximately HK$1.78 billion.

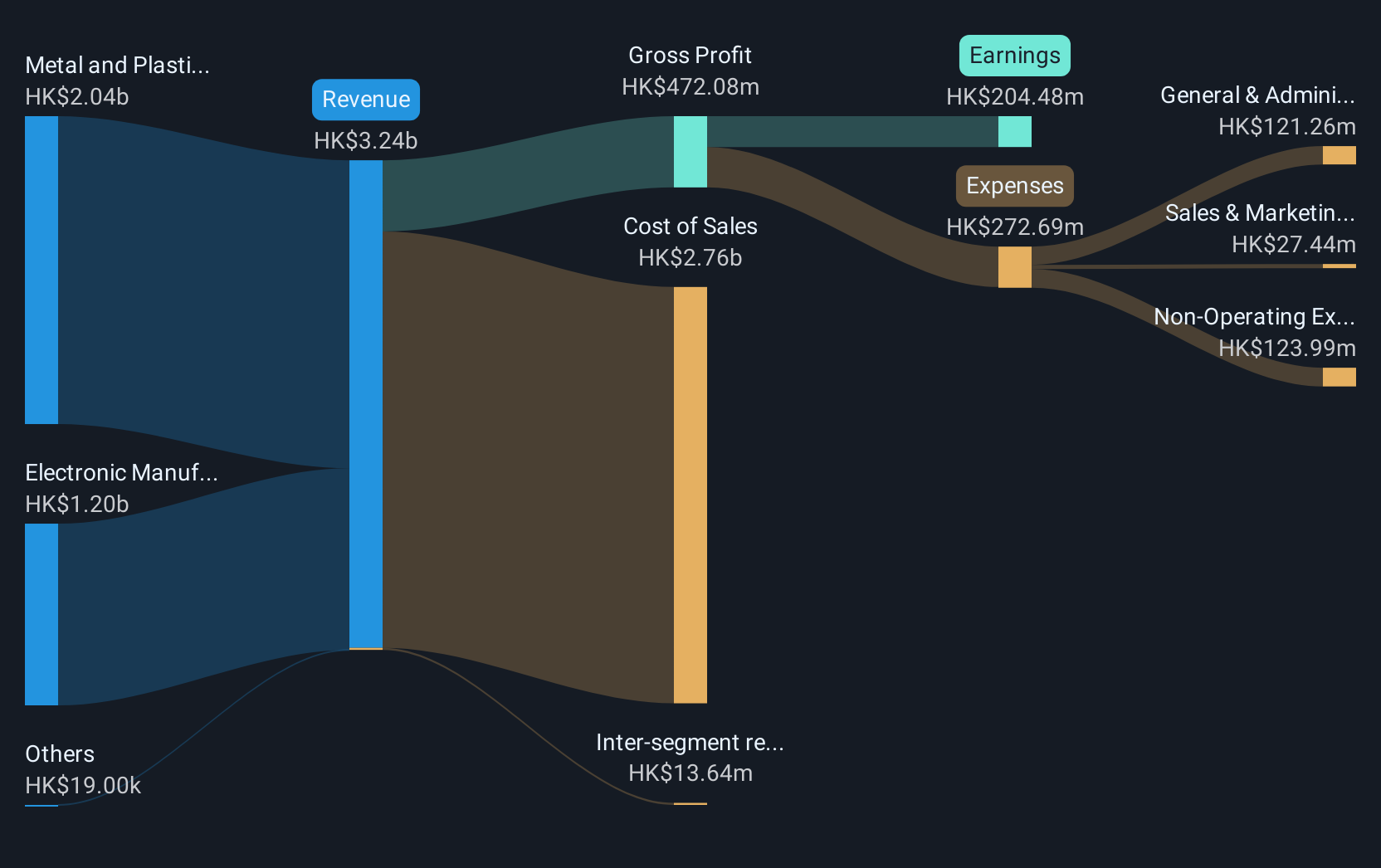

Operations: The company generates revenue primarily from its Metal and Plastic Business, which accounts for HK$1.75 billion, and its Electronic Manufacturing Services Business, contributing HK$1.19 billion.

Market Cap: HK$1.78B

Karrie International Holdings, with a market cap of HK$1.78 billion, has shown resilience in its financials despite some challenges. The company anticipates at least a 30% increase in profit for the six months ending September 2024, driven by strong demand for AI server components. Its metal and plastic business is a key revenue driver, contributing significantly to total income. While earnings have declined by 8.5% annually over five years and recent profit margins slightly decreased, the company's debt is well-managed with satisfactory coverage ratios and experienced management supports stability amidst industry volatility.

- Unlock comprehensive insights into our analysis of Karrie International Holdings stock in this financial health report.

- Understand Karrie International Holdings' track record by examining our performance history report.

Beijing Lier High-temperature MaterialsLtd (SZSE:002392)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beijing Lier High-temperature Materials Co., Ltd. specializes in the production of high-temperature resistant materials, with a market cap of CN¥4.64 billion.

Operations: Beijing Lier High-temperature Materials Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.64B

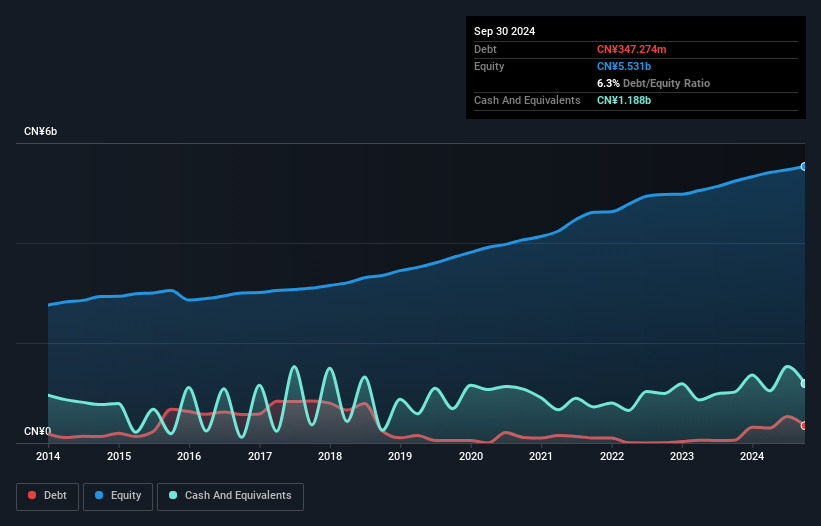

Beijing Lier High-temperature Materials Co., Ltd. has demonstrated solid financial performance with sales of CN¥4.99 billion and net income of CN¥309.81 million for the nine months ending September 2024, reflecting growth from the previous year. The company has initiated a share repurchase program worth up to CN¥200 million, indicating confidence in its valuation and future prospects. Despite negative operating cash flow, debt is well-managed with interest payments comfortably covered by EBIT at 133 times coverage. Although earnings have declined over five years, recent profit growth of 51.5% suggests a positive trajectory supported by strong asset coverage of liabilities and good relative value compared to peers.

- Get an in-depth perspective on Beijing Lier High-temperature MaterialsLtd's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Beijing Lier High-temperature MaterialsLtd's future.

Where To Now?

- Reveal the 5,802 hidden gems among our Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:KICO

Al Khaleej Investment P.J.S.C

Operates as a real estate and investment company in the United Arab Emirates.

Flawless balance sheet low.