Undiscovered Asian Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets respond to evolving economic data and interest rate speculations, small-cap stocks have shown resilience, with the Russell 2000 Index recently outperforming larger indices. In this dynamic environment, identifying promising stocks often involves looking for companies with solid fundamentals and growth potential that can navigate both local and international challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Ascentech K.K | NA | 133.18% | 172.84% | ★★★★★★ |

| Center International GroupLtd | 18.20% | 0.69% | -31.63% | ★★★★★★ |

| Zhejiang JW Precision MachineryLtd | 14.74% | 4.97% | -20.59% | ★★★★★★ |

| Torigoe | 8.59% | 4.69% | 9.28% | ★★★★★☆ |

| Hangzhou Zhengqiang | 26.03% | 2.95% | 16.75% | ★★★★★☆ |

| Praise Victor Industrial | 85.87% | 1.77% | 44.52% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Techno Smart | 24.76% | 15.56% | 25.47% | ★★★★☆☆ |

| Sichuan Haite High-techLtd | 42.33% | 7.82% | -23.34% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dah Sing Financial Holdings Limited is an investment holding company offering banking, insurance, and financial services across Hong Kong, Macau, and the People's Republic of China with a market cap of HK$11.09 billion.

Operations: Dah Sing Financial Holdings generates revenue primarily from its banking and insurance operations in Hong Kong, Macau, and the People's Republic of China. The company's net profit margin has shown variability over recent periods.

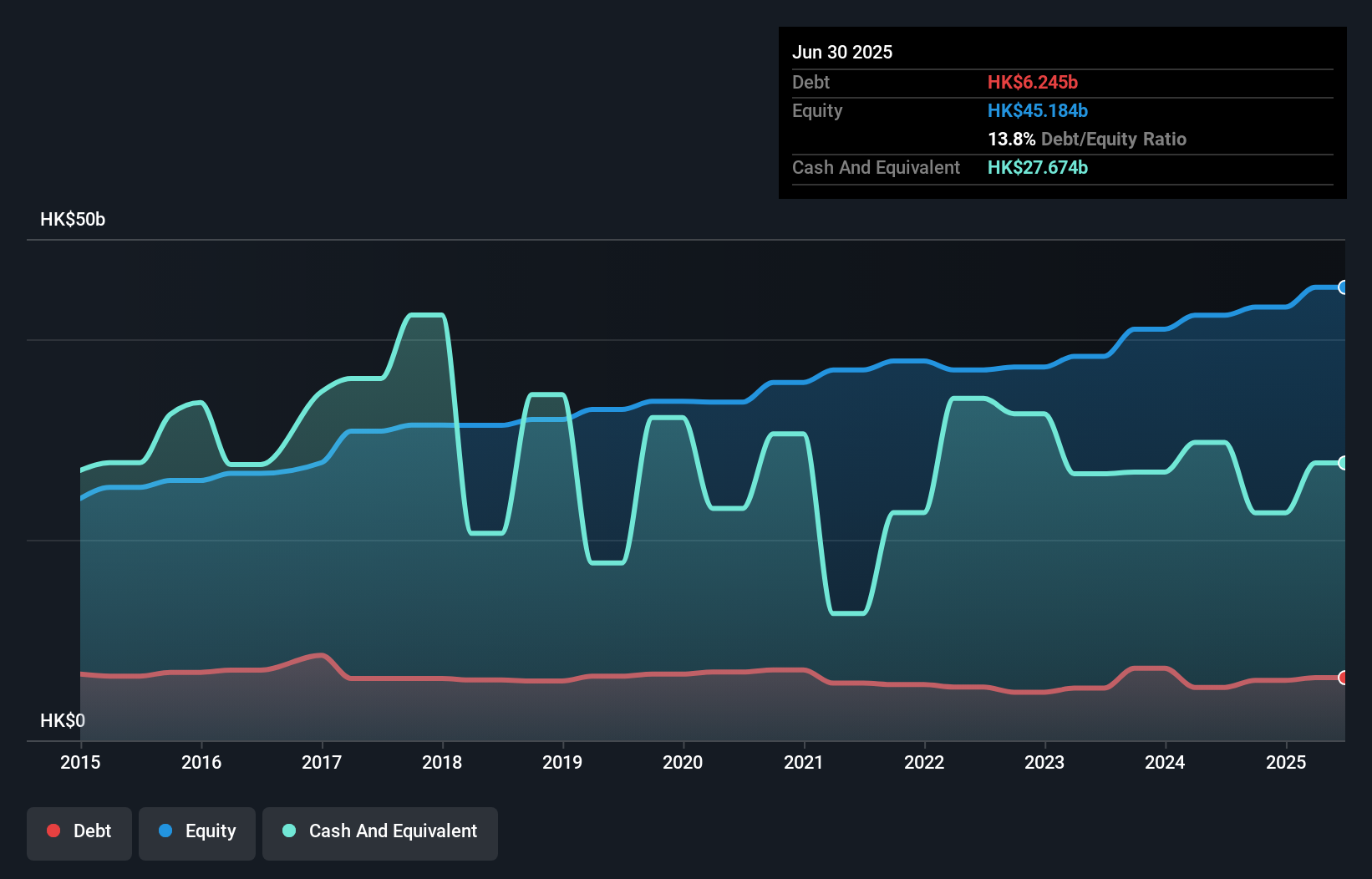

Dah Sing Financial Holdings, a relatively small player in the Asian banking sector, appears undervalued by 39.3% compared to its estimated fair value. The company boasts total assets of HK$271.8 billion and equity amounting to HK$45.2 billion, with deposits reaching HK$207.3 billion against loans of HK$140.1 billion. Despite a high non-performing loan ratio at 3.1%, it has seen earnings grow by 10.3% over the past year, outpacing the industry average of 2.9%. With low-risk funding comprising 91% of liabilities, Dah Sing presents a mix of challenges and opportunities for potential investors seeking hidden gems in Asia's financial landscape.

Chongyi Zhangyuan Tungsten (SZSE:002378)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chongyi Zhangyuan Tungsten Co., Ltd. operates in the mining sector, focusing on tungsten concentrate and other metal mineral products both within China and globally, with a market capitalization of CN¥13.28 billion.

Operations: Chongyi Zhangyuan Tungsten generates revenue primarily from the mining and sale of tungsten concentrate and other metal mineral products. The company reports a gross profit margin that reflects its cost efficiency in production.

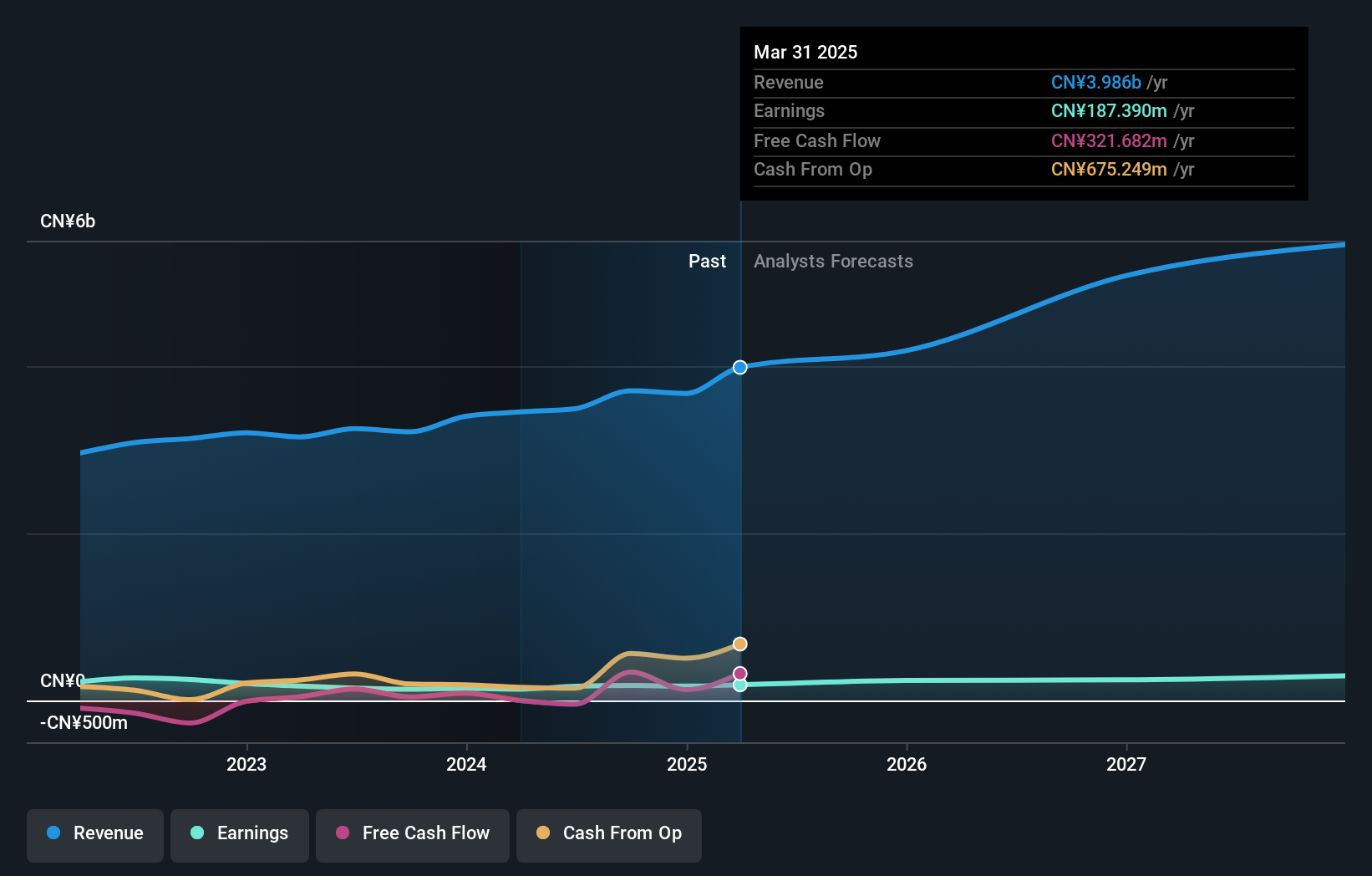

Chongyi Zhangyuan Tungsten, a smaller player in the metals and mining sector, has shown resilience with earnings growth of 3% over the past year, outpacing the industry average of -4%. Despite a high net debt to equity ratio at 75.4%, interest payments are well-covered by EBIT at 4.1x. The company is free cash flow positive, posting A$339.92 million in levered free cash flow as of September 2024. Amendments to its articles were approved recently, indicating potential strategic shifts ahead. Earnings are projected to grow by 17.8% annually, suggesting promising future prospects amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Chongyi Zhangyuan Tungsten's health report.

Guangdong Rifeng Electric Cable (SZSE:002953)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangdong Rifeng Electric Cable Co., Ltd. operates in the electric cable industry and has a market capitalization of CN¥6.33 billion.

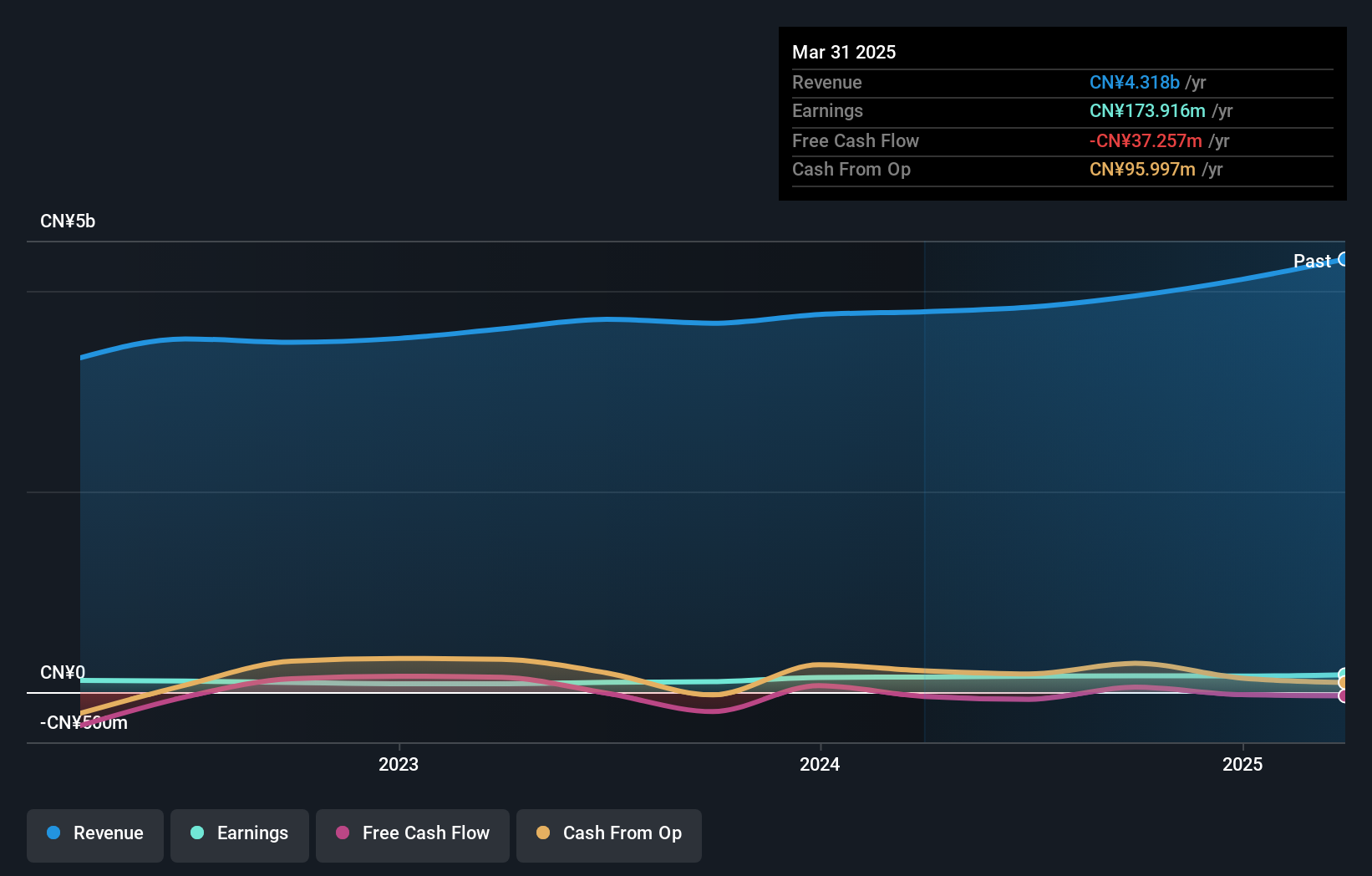

Operations: Rifeng Electric Cable's primary revenue stream comes from its Wire & Cable Products segment, generating CN¥4.32 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Guangdong Rifeng Electric Cable, a promising player in the electrical industry, showcases a solid financial footing with high-quality earnings and an impressive EBIT covering interest payments 12 times over. Over the past year, its earnings surged by 15.5%, outpacing the industry's -0.8% growth rate, indicating robust market positioning. Despite a rise in debt to equity ratio from 3.1% to 32.4% over five years, it remains satisfactory at 20.4%. The company's P/E ratio of 36.4x is attractive compared to the broader CN market's 45x, suggesting potential undervaluation for investors seeking value opportunities in Asia's emerging markets.

Next Steps

- Unlock our comprehensive list of 2412 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:440

Dah Sing Financial Holdings

An investment holding company, provides banking, insurance, financial, and other related services in Hong Kong, Macau, and the People’s Republic of China.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives