Market Cool On Shanghai Pret Composites Co., Ltd.'s (SZSE:002324) Earnings Pushing Shares 25% Lower

Shanghai Pret Composites Co., Ltd. (SZSE:002324) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

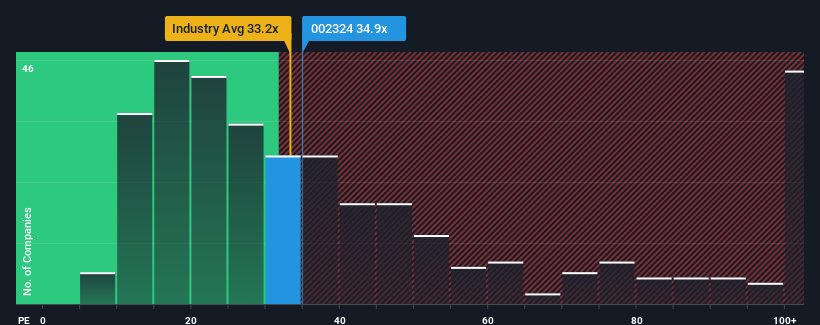

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Shanghai Pret Composites' P/E ratio of 34.9x, since the median price-to-earnings (or "P/E") ratio in China is also close to 33x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Shanghai Pret Composites has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Shanghai Pret Composites

Is There Some Growth For Shanghai Pret Composites?

In order to justify its P/E ratio, Shanghai Pret Composites would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 42%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 123% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 48% during the coming year according to the two analysts following the company. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's curious that Shanghai Pret Composites' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Shanghai Pret Composites' plummeting stock price has brought its P/E right back to the rest of the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shanghai Pret Composites currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Shanghai Pret Composites (1 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Shanghai Pret Composites' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002324

Shanghai Pret Composites

Engages in the research and development, production, sale, and service of polymer and composite materials in China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives