As global markets navigate a whirlwind of earnings reports and economic data, major indices have experienced volatility, with growth stocks lagging behind their value counterparts. Amidst this backdrop of cautious optimism and fluctuating market dynamics, dividend stocks present a compelling option for investors seeking steady income streams. A good dividend stock typically offers a reliable payout history and resilience in uncertain economic climates, making them an attractive consideration in the current environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Globeride (TSE:7990) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

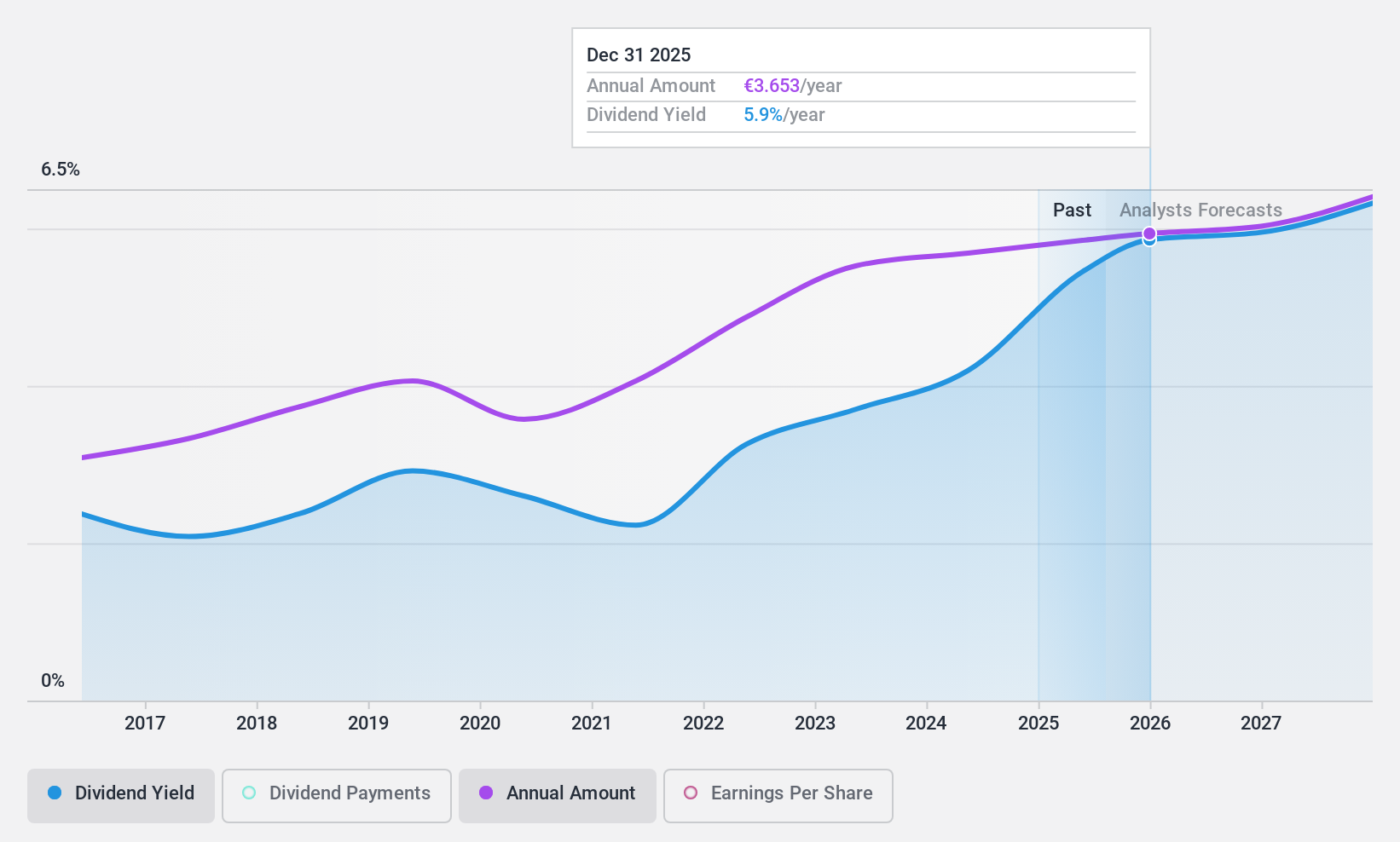

Arkema (ENXTPA:AKE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arkema S.A. is a global manufacturer and seller of specialty chemicals and advanced materials, with a market cap of €6.19 billion.

Operations: Arkema S.A.'s revenue is primarily derived from its Advanced Materials segment (€3.51 billion), followed by Adhesive Solutions (€2.71 billion), Coating Solutions (€2.39 billion), and Intermediates (€779 million).

Dividend Yield: 4.2%

Arkema's dividend payments have been reliable and stable over the past decade, with a payout ratio of 76.4% indicating coverage by earnings, and a cash payout ratio of 47% showing strong cash flow support. The current yield is 4.22%, below the top quartile in France. Recent Q3 results showed slight increases in sales (€2.39 billion) and net income (€118 million), reinforcing its capacity to maintain dividends amidst strategic shifts towards sustainability initiatives like bio-based ethyl acrylate production.

- Take a closer look at Arkema's potential here in our dividend report.

- Our expertly prepared valuation report Arkema implies its share price may be lower than expected.

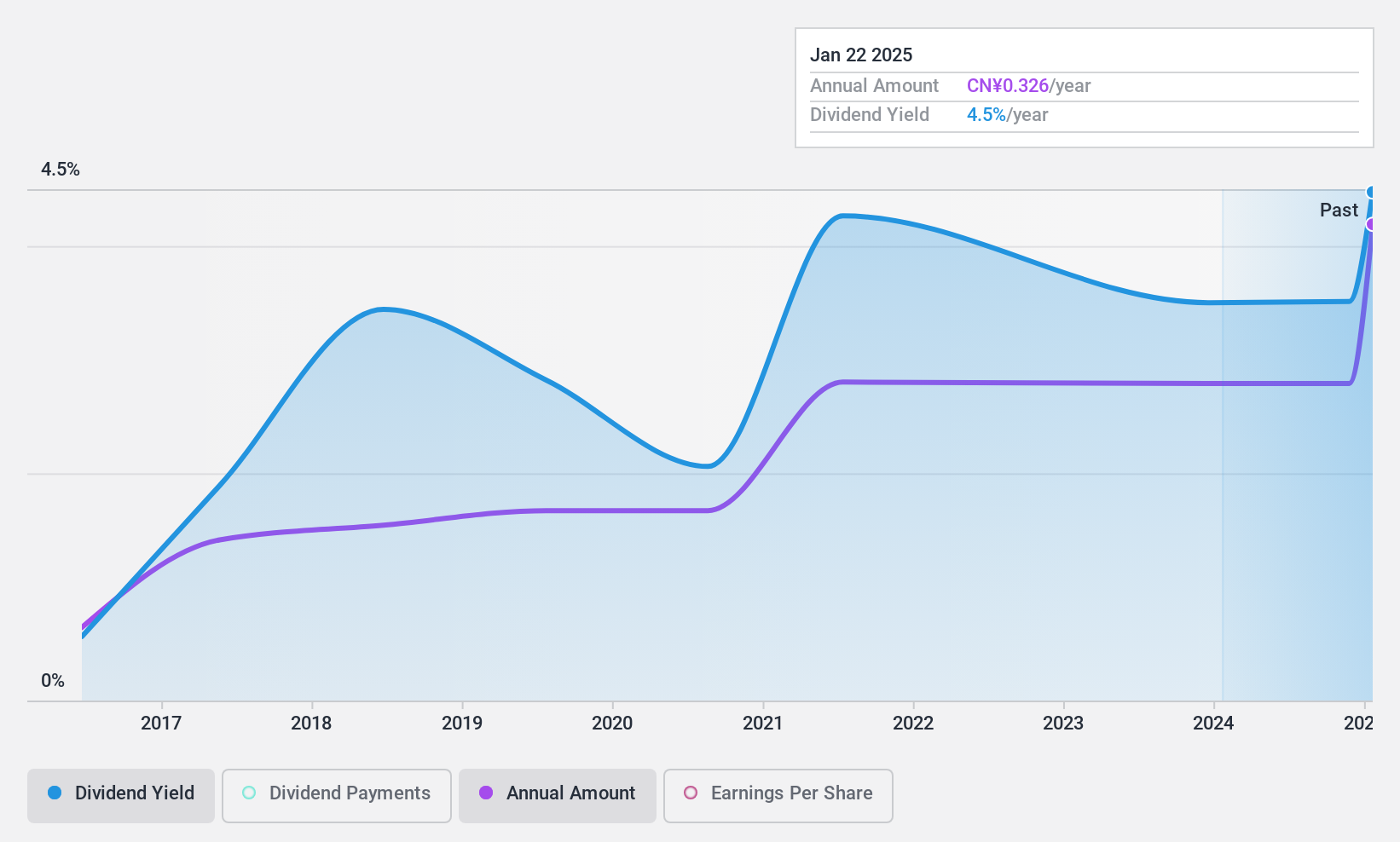

Jiangnan Mould & Plastic Technology (SZSE:000700)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. operates in the mould and plastic industry with a market cap of CN¥6.63 billion.

Operations: I'm sorry, but it seems that the revenue segment data is missing from the provided text. If you can provide the specific details or numbers for each revenue segment, I'd be happy to help summarize them for you.

Dividend Yield: 3%

Jiangnan Mould & Plastic Technology's dividend yield of 3.02% ranks in the top 25% within China's market, yet its reliability is questionable due to volatility over the past decade. Despite this, dividends are well-covered by cash flows with a low cash payout ratio of 19.8%. The company reported a net income increase to CNY 539.12 million for nine months ending September 2024, although sales decreased compared to last year, potentially impacting future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Jiangnan Mould & Plastic Technology.

- Upon reviewing our latest valuation report, Jiangnan Mould & Plastic Technology's share price might be too pessimistic.

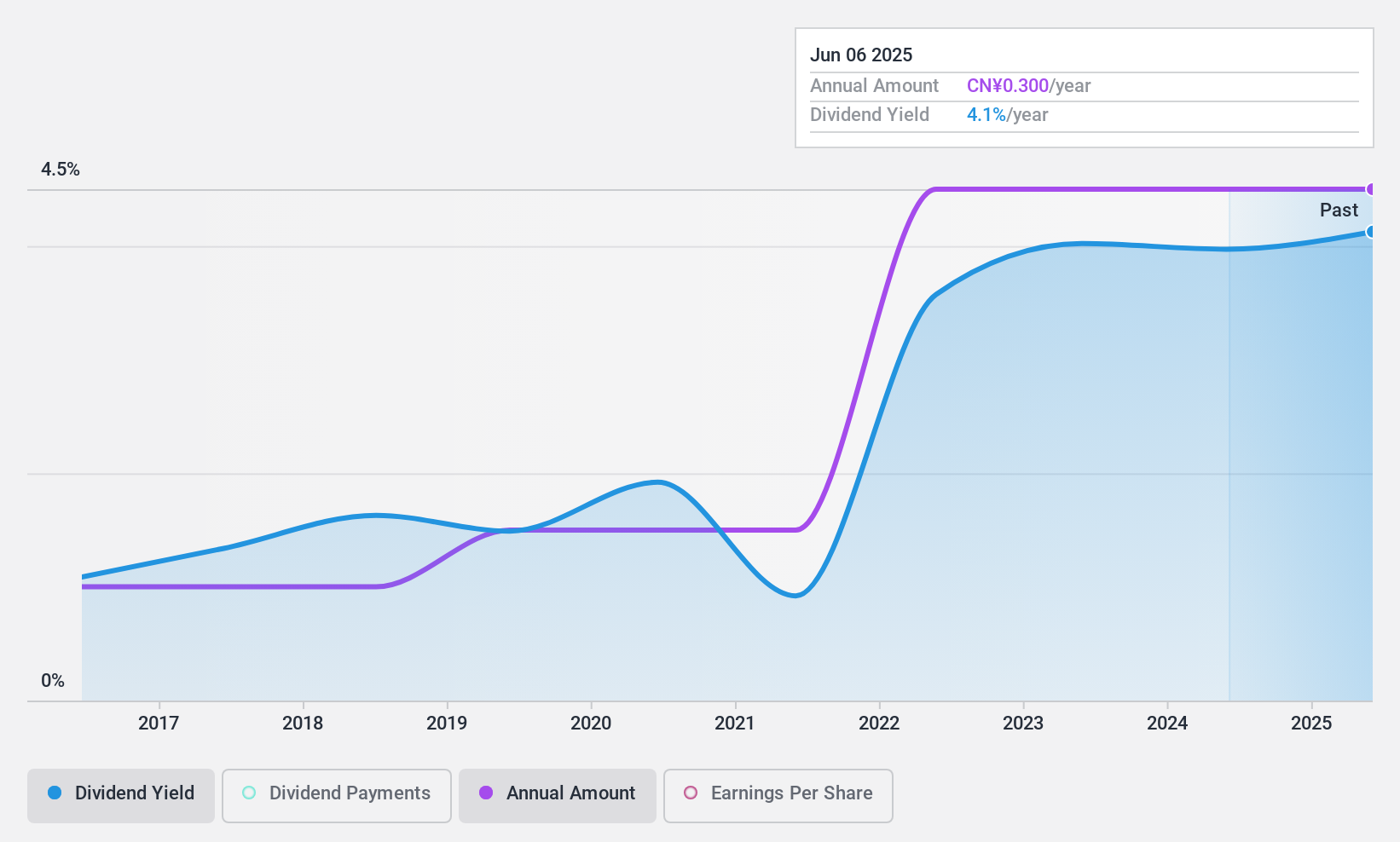

Jiangsu Huachang Chemical (SZSE:002274)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Huachang Chemical Co., Ltd operates in China, manufacturing and selling agrochemicals, basic chemicals, fine chemicals, and biochemical products with a market cap of CN¥7.59 billion.

Operations: Jiangsu Huachang Chemical Co., Ltd generates its revenue from the production and sale of agrochemicals, basic chemicals, fine chemicals, and biochemical products in China.

Dividend Yield: 3.8%

Jiangsu Huachang Chemical offers a dividend yield of 3.76%, placing it in the top 25% of China's market. Its dividends are well-covered by earnings, with a payout ratio of 36.2%, and cash flows, with a cash payout ratio of 71.3%. Despite having only an eight-year dividend history, payments have been stable and growing. Recent earnings for nine months ending September 2024 showed net income rising to CNY 529.99 million from CNY 469.43 million the previous year, supporting its dividend sustainability.

- Click to explore a detailed breakdown of our findings in Jiangsu Huachang Chemical's dividend report.

- In light of our recent valuation report, it seems possible that Jiangsu Huachang Chemical is trading beyond its estimated value.

Where To Now?

- Reveal the 1960 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AKE

Arkema

Manufactures and sells specialty materials in Europe, the United States, Canada, Mexico, China, Hong Kong, Taiwan, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives