Zhejiang Great SoutheastLtd (SZSE:002263) shareholders have lost 37% over 3 years, earnings decline likely the culprit

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Zhejiang Great Southeast Corp.Ltd (SZSE:002263) shareholders, since the share price is down 37% in the last three years, falling well short of the market decline of around 19%. Unfortunately the share price momentum is still quite negative, with prices down 21% in thirty days.

After losing 8.2% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Zhejiang Great SoutheastLtd

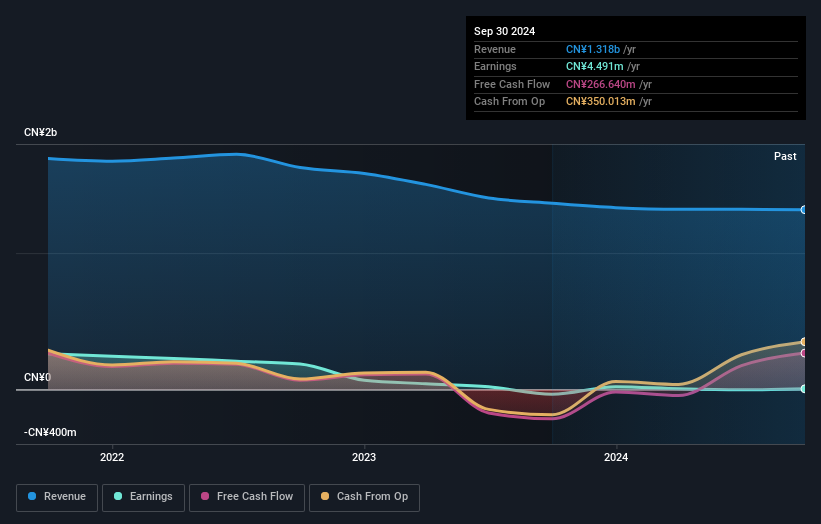

Given that Zhejiang Great SoutheastLtd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years Zhejiang Great SoutheastLtd saw its revenue shrink by 11% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 11%, annualized. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Zhejiang Great SoutheastLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 6.1% in the last year, Zhejiang Great SoutheastLtd shareholders lost 5.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 1.8%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Zhejiang Great SoutheastLtd that you should be aware of before investing here.

Of course Zhejiang Great SoutheastLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Great SoutheastLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002263

Zhejiang Great SoutheastLtd

Engages in the plastic product business in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives