Puyang Refractories Group Co., Ltd.'s (SZSE:002225) 26% Dip In Price Shows Sentiment Is Matching Earnings

Puyang Refractories Group Co., Ltd. (SZSE:002225) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

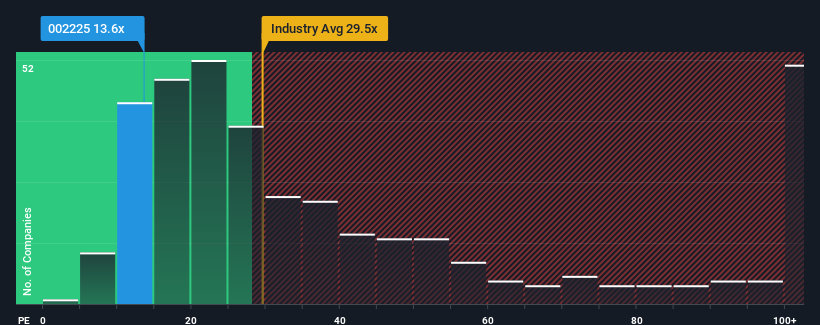

Since its price has dipped substantially, Puyang Refractories Group may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.6x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Puyang Refractories Group has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Puyang Refractories Group

How Is Puyang Refractories Group's Growth Trending?

Puyang Refractories Group's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 38% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 9.8% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the two analysts watching the company. With the market predicted to deliver 25% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Puyang Refractories Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Puyang Refractories Group's P/E looks about as weak as its stock price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Puyang Refractories Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Puyang Refractories Group has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002225

Puyang Refractories Group

Engages in the research, development, production, and sales of shaped, unshaped, and functional refractory products in China and internationally.

Slight risk with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026