- China

- /

- Medical Equipment

- /

- SHSE:688576

Undiscovered Gems with Promising Potential In February 2025

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions, consumer spending concerns, and tariff uncertainties, small-cap stocks have faced challenges amid declining indices such as the S&P MidCap 400 and Russell 2000. Despite these headwinds, the search for undiscovered gems continues to be a priority for investors looking to navigate this complex landscape; identifying stocks with strong fundamentals and growth potential can offer promising opportunities even in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Chongqing Xishan Science & Technology (SHSE:688576)

Simply Wall St Value Rating: ★★★★★★

Overview: Chongqing Xishan Science & Technology Co., Ltd. operates as a company involved in scientific and technological advancements, with a market capitalization of CN¥2.94 billion.

Operations: With a market capitalization of CN¥2.94 billion, Chongqing Xishan Science & Technology generates revenue primarily through its involvement in scientific and technological advancements. The company's financial performance is characterized by its focus on optimizing cost structures to enhance profitability.

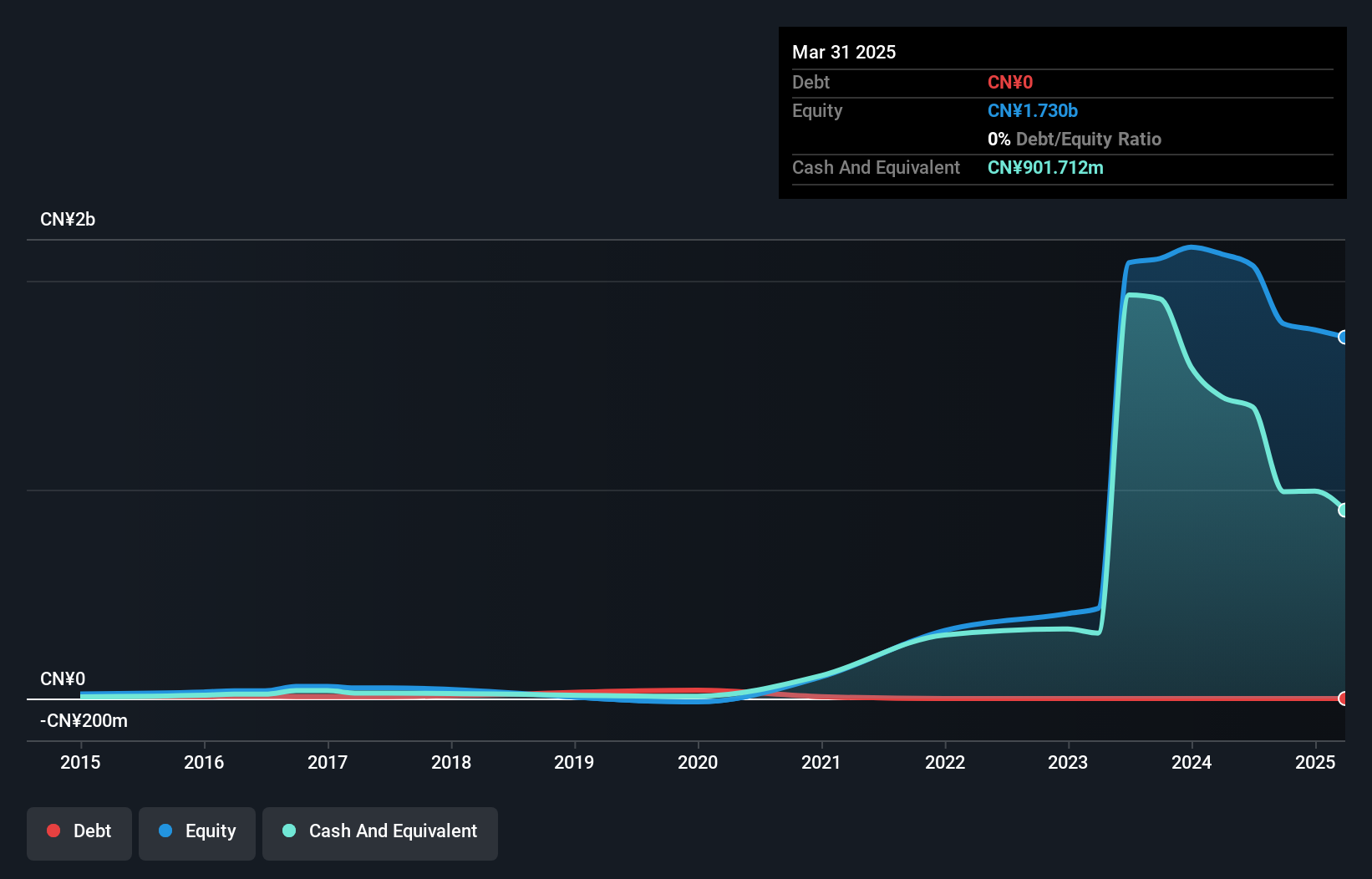

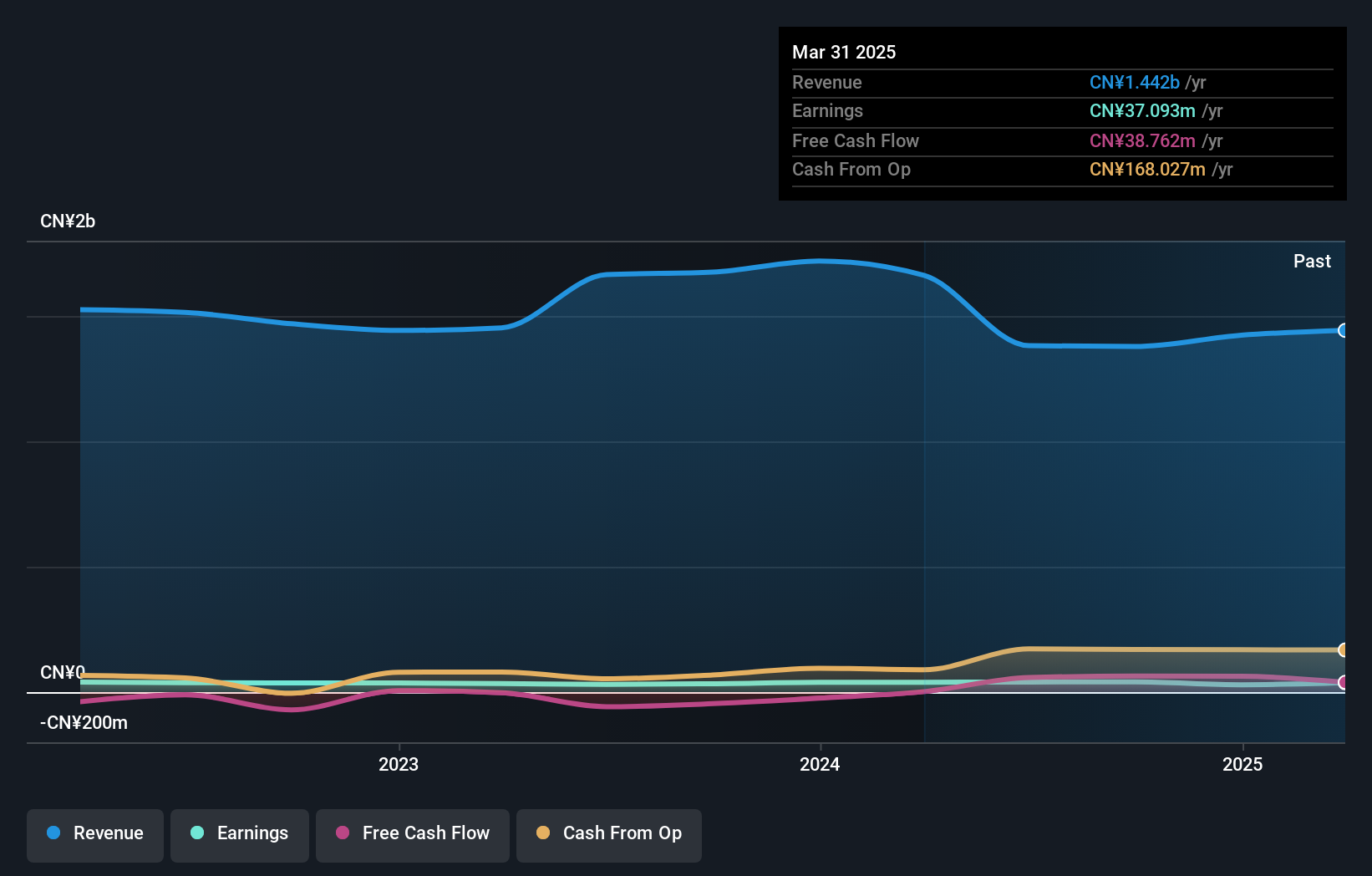

Chongqing Xishan Science & Technology showcases a compelling profile with its debt-free status, eliminating concerns over interest payments. The company has exhibited robust earnings growth of 22.4% in the past year, outpacing the Medical Equipment industry's -8.9%. Its price-to-earnings ratio stands at 24.8x, offering a better value compared to the CN market's 38.1x. Despite not being free cash flow positive recently, it seems committed to enhancing shareholder value through share repurchases, buying back approximately 4.73% of shares for CNY 150 million by December 2024. Earnings are projected to grow by an impressive 28% annually moving forward.

- Delve into the full analysis health report here for a deeper understanding of Chongqing Xishan Science & Technology.

Understand Chongqing Xishan Science & Technology's track record by examining our Past report.

Jiangsu Jiuding New Material (SZSE:002201)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Jiuding New Material Co., Ltd. is engaged in the production and sale of glass fiber yarn, fabrics, and FRP products in China with a market capitalization of CN¥3.59 billion.

Operations: Jiangsu Jiuding generates revenue primarily from the sale of glass fiber yarn, fabrics, and FRP products. The company has a market capitalization of CN¥3.59 billion.

Jiangsu Jiuding New Material, a nimble player in the chemicals sector, has seen its debt to equity ratio improve significantly from 91.2% to 49.1% over five years, indicating a stronger financial footing. Despite this progress, the company's EBIT covers interest payments only 2.4 times, which is below optimal levels. Earnings growth has been challenging with a -16.1% change compared to the industry average of -5.4%. Recent news highlights include a completed acquisition of a 2.06% stake for CNY 65 million and net income of CNY 32 million for the year ending December 2024, reflecting slight pressure on profitability amidst industry headwinds.

Anhui Anli Material Technology (SZSE:300218)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Anli Material Technology Co., Ltd. focuses on the research, development, production, sale, and servicing of ecological functional polyurethane synthetic leather products and other polymer composite materials in China, with a market cap of CN¥3.62 billion.

Operations: Anli generates its revenue primarily from the artificial leather synthetic leather industry, contributing CN¥2.37 billion. The company's financial performance can be evaluated by looking at its gross profit margin, which provides insight into profitability trends over time.

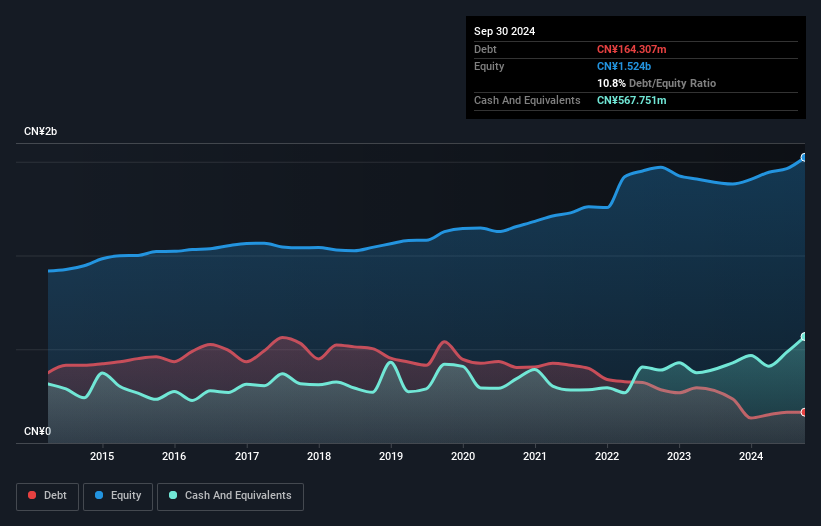

Anhui Anli Material Technology is making waves with a staggering 7974.9% earnings growth over the past year, far outpacing the Luxury industry's 1.9%. The company appears to be trading at a good value, sitting 20.3% below its estimated fair value, and boasts high-quality earnings alongside a solid debt-to-equity ratio improvement from 47.9% to just 10.8% over five years. With interest payments well covered by EBIT at an impressive 28 times coverage, it seems poised for continued financial health and profitability without concerns about cash runway or excessive debt levels impacting its operations negatively in the near term.

Taking Advantage

- Click here to access our complete index of 4750 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688576

Chongqing Xishan Science & Technology

Chongqing Xishan Science & Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion