- China

- /

- Auto Components

- /

- SHSE:600698

Discovering Undiscovered Gems in Global Stocks June 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed U.S. stock index performances and steady interest rates from the Federal Reserve, small-cap stocks have shown resilience amid broader economic uncertainties. In this climate, identifying promising small-cap companies—those with strong fundamentals and growth potential—can be particularly rewarding for investors seeking undiscovered gems in the global market.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Hunan Tyen MachineryLtd (SHSE:600698)

Simply Wall St Value Rating: ★★★★★★

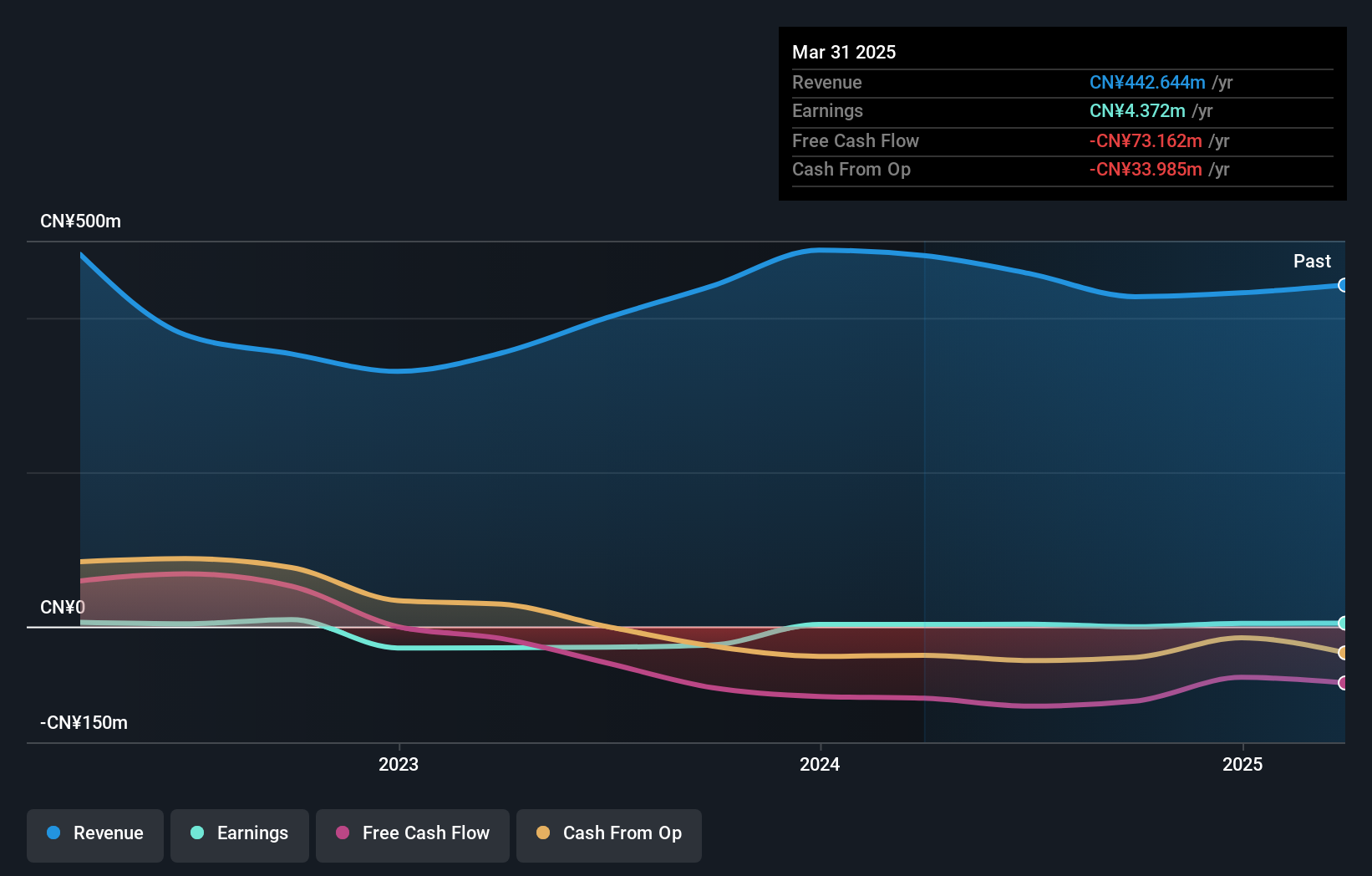

Overview: Hunan Tyen Machinery Co., Ltd specializes in the development, design, production, and sales of engine parts in China and has a market capitalization of CN¥6.99 billion.

Operations: Tyen Machinery generates revenue primarily from its auto parts segment, amounting to CN¥442.64 million. The company's market capitalization stands at approximately CN¥6.99 billion.

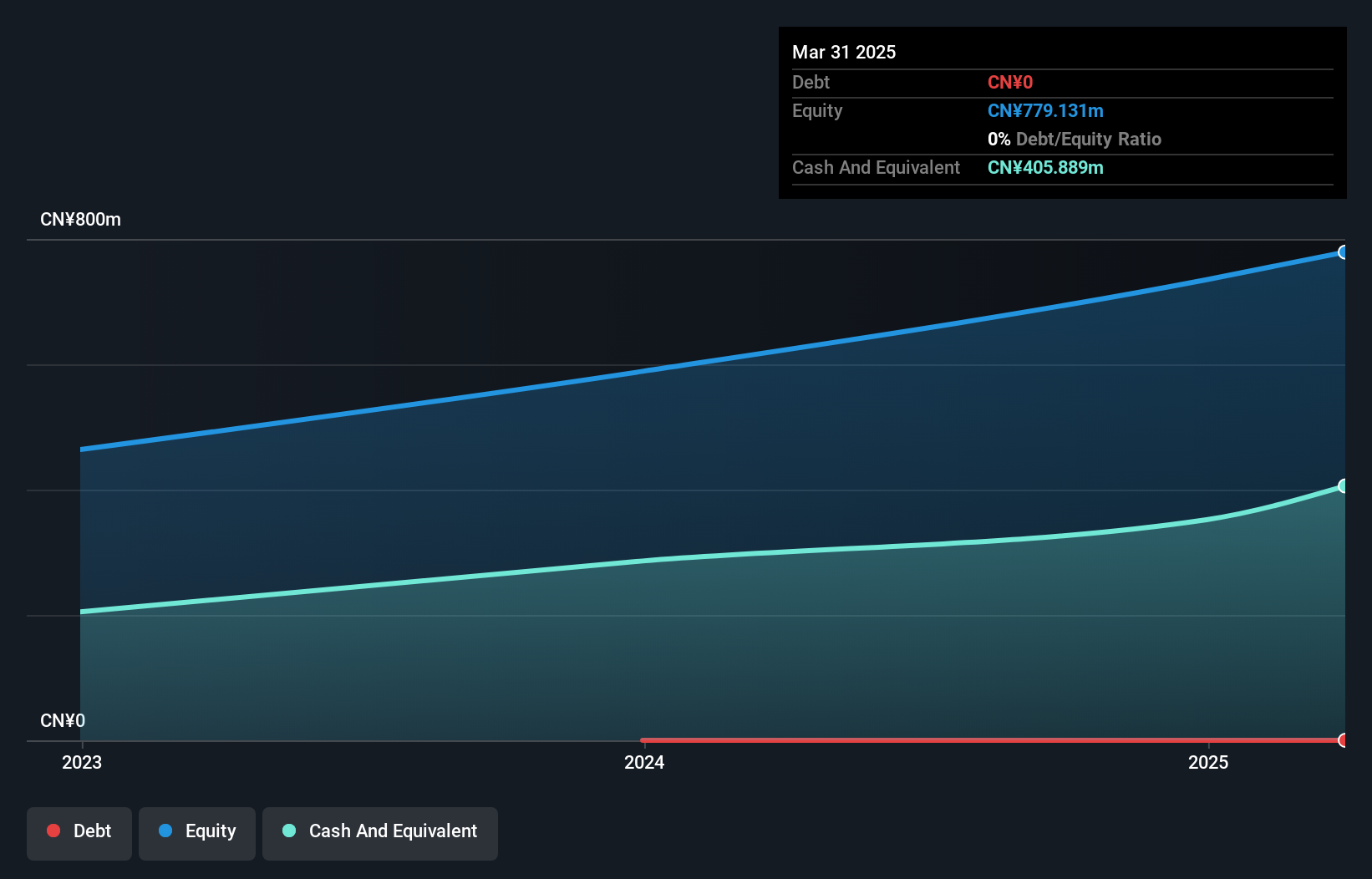

Hunan Tyen Machinery, a player in the auto components industry, has shown impressive earnings growth of 55% over the past year, outpacing the industry's 5%. Despite no debt and an improved net income of CN¥4.12 million for 2024 compared to CN¥2.85 million previously, its performance was influenced by a one-off gain of CN¥41 million. The company's sales dipped to CN¥432.51 million from last year's CN¥487.71 million, but Q1 2025 saw sales rise to CN¥110.69 million from CNY100.55 million in Q1 2024, suggesting some recovery momentum despite recent share price volatility.

- Click here and access our complete health analysis report to understand the dynamics of Hunan Tyen MachineryLtd.

Understand Hunan Tyen MachineryLtd's track record by examining our Past report.

Suzhou Huazhijie Telecom (SHSE:603400)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Huazhijie Telecom Co., Ltd. engages in the research, development, manufacturing, and marketing of electronic components for the automotive industry, with a market cap of CN¥7.88 billion.

Operations: The company generates revenue primarily from the sale of electronic components for the automotive sector. Its financial performance is highlighted by a net profit margin of 12.5%, reflecting its ability to convert sales into actual profit effectively.

Suzhou Huazhijie Telecom, with its recent IPO raising CNY 497 million, showcases a promising trajectory. The company is debt-free and has consistently delivered high-quality earnings. Over the past year, earnings surged by 24%, outpacing the electrical industry’s decline of 1%. Its price-to-earnings ratio stands at 36.7x, slightly below the CN market average of 39x, suggesting potential value for investors. Despite highly illiquid shares, its strong financial footing and growth exceeding industry norms position it as an interesting prospect in the telecom sector.

Guangdong Orient Zirconic Ind Sci & TechLtd (SZSE:002167)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Orient Zirconic Ind Sci & Tech Co., Ltd focuses on the research, development, production, and sale of zirconium products with a market capitalization of CN¥8.10 billion.

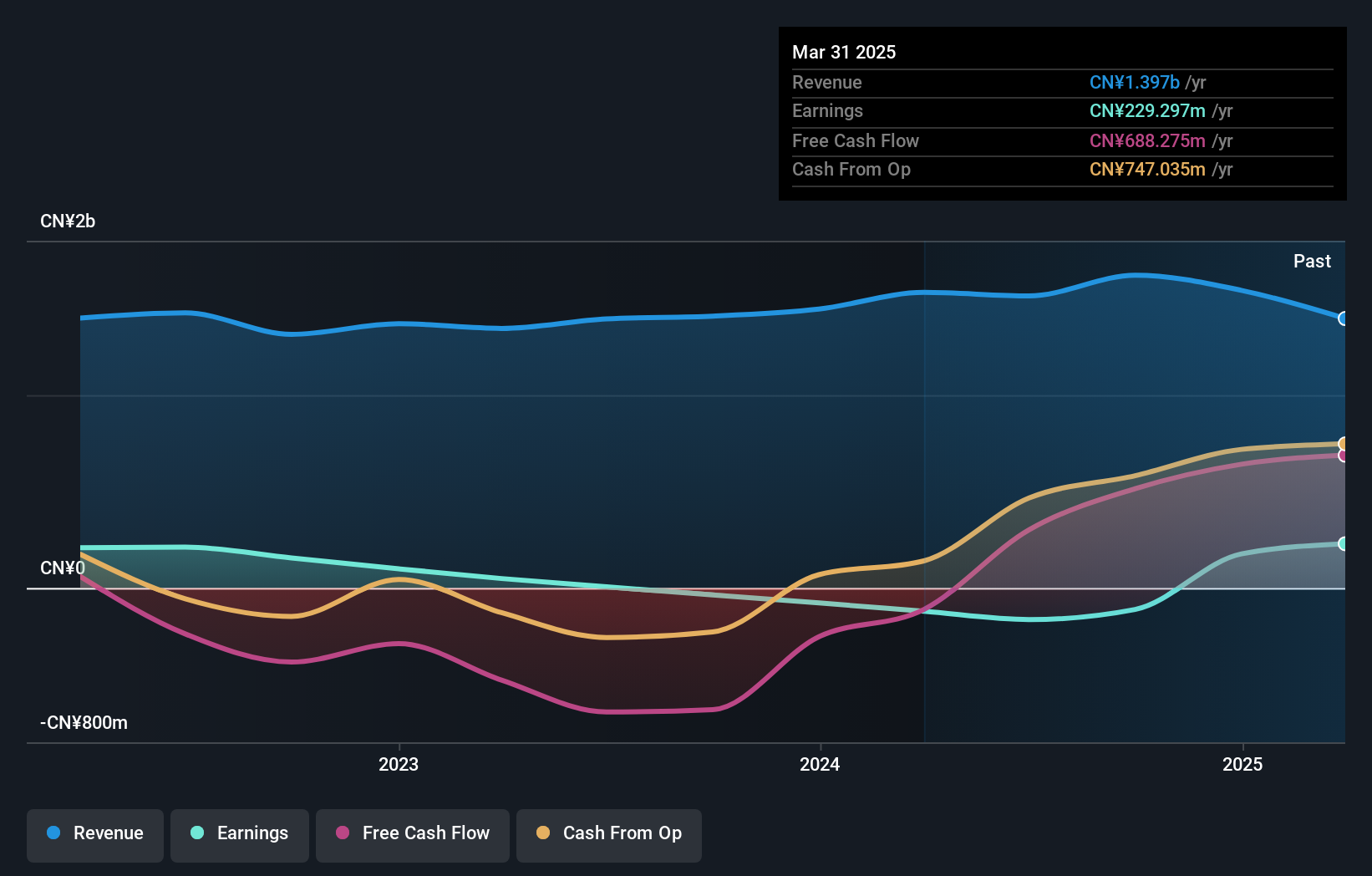

Operations: The company's revenue primarily comes from producing and selling titanium ore, zirconium series products, and structural ceramics, amounting to CN¥1.40 billion.

Guangdong Orient Zirconic Ind Sci & Tech Ltd, a smaller player in the market, has shown promising financial health with a net debt to equity ratio of 10.2%, which is satisfactory. The company recently became profitable, reporting a net income of CNY 18.85 million for Q1 2025 compared to a loss last year. Trading at 91% below its estimated fair value suggests potential undervaluation. Despite sales dropping to CNY 284.41 million from CNY 430.47 million year-on-year, the firm boasts high-quality earnings and positive free cash flow, indicating efficient operations amidst industry challenges.

Seize The Opportunity

- Get an in-depth perspective on all 3195 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Tyen MachineryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600698

Hunan Tyen MachineryLtd

Engages in the development, design, production, and sales of engine parts in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives