- China

- /

- Metals and Mining

- /

- SZSE:000969

Undiscovered Gems Three Promising Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets grapple with volatility driven by AI competition and mixed economic signals, small-cap stocks are navigating a complex landscape shaped by steady interest rates and tariff uncertainties. In this environment, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential amidst fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Al Majed for Oud (SASE:4165)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Majed for Oud Company operates in the wholesale and retail trade of perfumes across the Kingdom of Saudi Arabia and the Gulf countries, with a market capitalization of SAR4.10 billion.

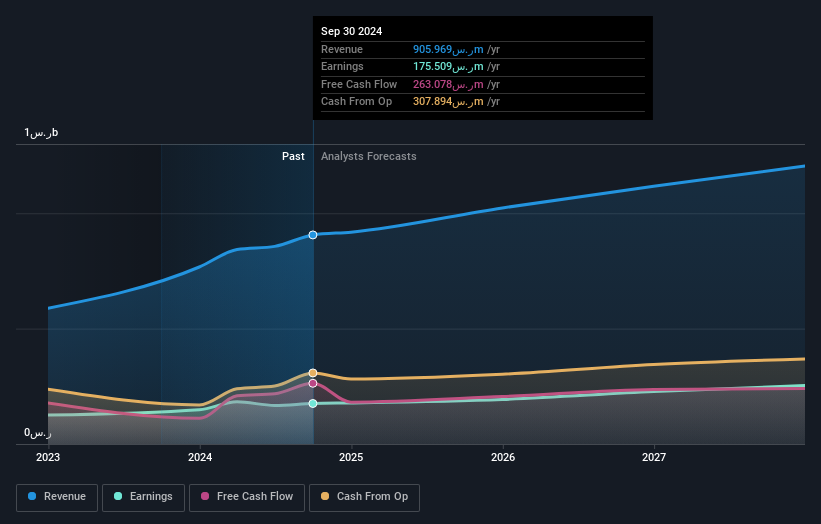

Operations: Al Majed for Oud generates revenue primarily from its retail trade in perfumes, amounting to SAR905.97 million.

Al Majed for Oud, a niche player in the specialty retail sector, boasts a Price-To-Earnings ratio of 23.6x, slightly under the South African market average of 24.2x. Impressively, its earnings surged by 22.9% last year, outpacing the industry growth rate of 21.6%. The company is debt-free and showcases high-quality earnings without concerns over interest coverage due to this lack of debt burden. With positive free cash flow and projected revenue growth at 8.66% annually, Al Majed for Oud seems poised for steady performance while maintaining financial stability amidst industry dynamics.

- Dive into the specifics of Al Majed for Oud here with our thorough health report.

Evaluate Al Majed for Oud's historical performance by accessing our past performance report.

Advanced Technology & Materials (SZSE:000969)

Simply Wall St Value Rating: ★★★★★★

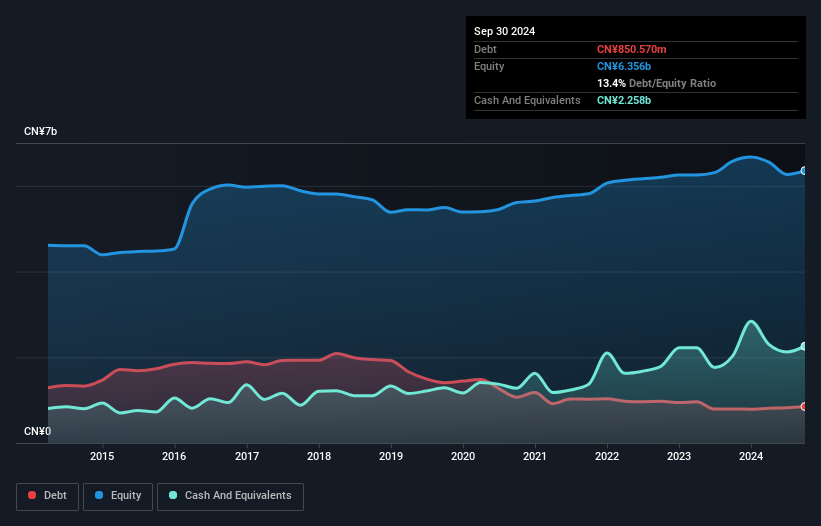

Overview: Advanced Technology & Materials Co., Ltd. operates in the advanced materials sector and has a market capitalization of CN¥12.10 billion.

Operations: The primary revenue stream for Advanced Technology & Materials Co., Ltd. comes from its Metal Materials and Products segment, generating CN¥7.99 billion. The company's market capitalization stands at CN¥12.10 billion.

Advanced Technology & Materials, a nimble player in its field, showcases impressive earnings growth of 67% over the past year, outpacing the broader Metals and Mining sector's -2%. Its debt-to-equity ratio has improved significantly from 25.6 to 13.4 over five years, highlighting prudent financial management. The company is trading at nearly 23% below its estimated fair value, suggesting potential undervaluation. With high-quality earnings and more cash than total debt, it seems well-positioned financially. A recent shareholder meeting to discuss auditor changes indicates active governance as it continues on its growth trajectory with forecasted annual earnings growth of about 13%.

- Delve into the full analysis health report here for a deeper understanding of Advanced Technology & Materials.

Understand Advanced Technology & Materials' track record by examining our Past report.

Ningbo Shuanglin Auto PartsLtd (SZSE:300100)

Simply Wall St Value Rating: ★★★★★★

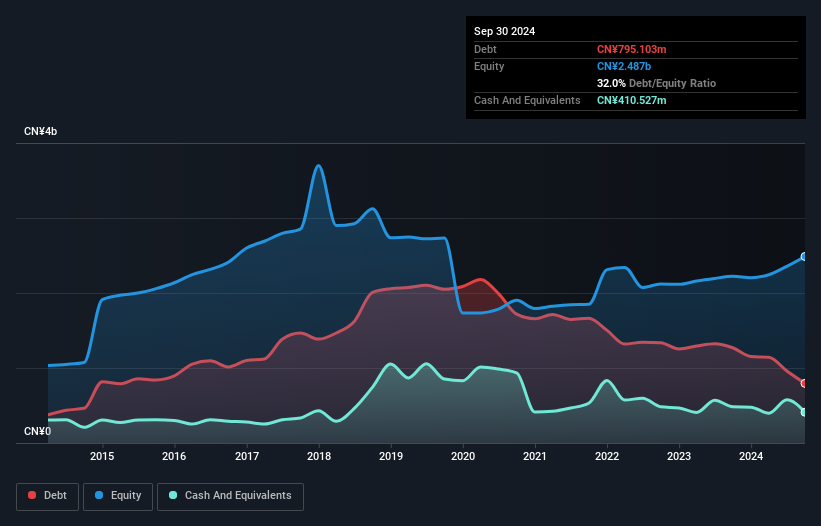

Overview: Ningbo Shuanglin Auto Parts Co., Ltd. is involved in the research, development, manufacture, and sale of auto parts both in China and internationally, with a market cap of CN¥14.43 billion.

Operations: Shuanglin Auto Parts generates revenue primarily from the sale of auto parts in both domestic and international markets. The company's financial performance includes a notable trend in its net profit margin, which has shown fluctuations over recent reporting periods.

Ningbo Shuanglin Auto Parts Ltd. stands out in the auto components sector with a remarkable 300% earnings growth over the past year, surpassing industry averages. This performance is backed by high-quality earnings and free cash flow positivity, suggesting robust operational efficiency. The company’s net debt to equity ratio sits comfortably at 15%, indicating prudent financial management. Over the last five years, Shuanglin has significantly reduced its debt to equity from 75% to 32%, enhancing its financial stability. Despite a volatile share price recently, these figures reflect a solid foundation for potential future growth within its niche market segment.

Taking Advantage

- Gain an insight into the universe of 4688 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000969

Advanced Technology & Materials

Advanced Technology & Materials Co., Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives