- China

- /

- Metals and Mining

- /

- SZSE:000933

Lacklustre Performance Is Driving Henan Shenhuo Coal Industry and Electricity Power Co. Ltd's (SZSE:000933) Low P/E

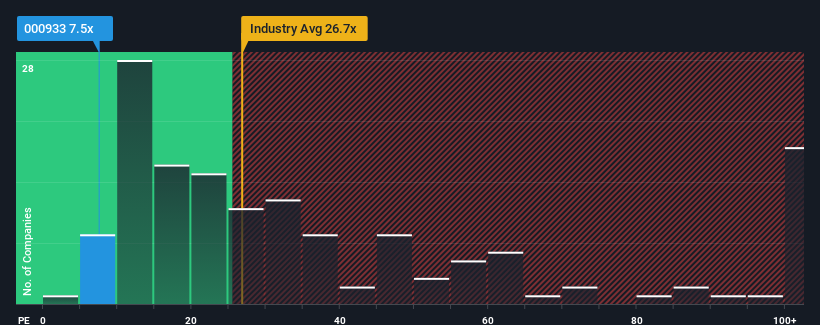

With a price-to-earnings (or "P/E") ratio of 7.5x Henan Shenhuo Coal Industry and Electricity Power Co. Ltd (SZSE:000933) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 35x and even P/E's higher than 67x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings that are retreating more than the market's of late, Henan Shenhuo Coal Industry and Electricity Power has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Henan Shenhuo Coal Industry and Electricity Power

How Is Henan Shenhuo Coal Industry and Electricity Power's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Henan Shenhuo Coal Industry and Electricity Power's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.9%. Even so, admirably EPS has lifted 135% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 0.3% during the coming year according to the eight analysts following the company. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Henan Shenhuo Coal Industry and Electricity Power's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Henan Shenhuo Coal Industry and Electricity Power's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Henan Shenhuo Coal Industry and Electricity Power maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Henan Shenhuo Coal Industry and Electricity Power that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Henan Shenhuo Coal Industry and Electricity Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000933

Henan Shenhuo Coal Industry and Electricity Power

Henan Shenhuo Coal Industry and Electricity Power Co.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026