- China

- /

- Paper and Forestry Products

- /

- SZSE:000815

MCC Meili Cloud Computing Industry Investment Co., Ltd's (SZSE:000815) 25% Share Price Surge Not Quite Adding Up

Those holding MCC Meili Cloud Computing Industry Investment Co., Ltd (SZSE:000815) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

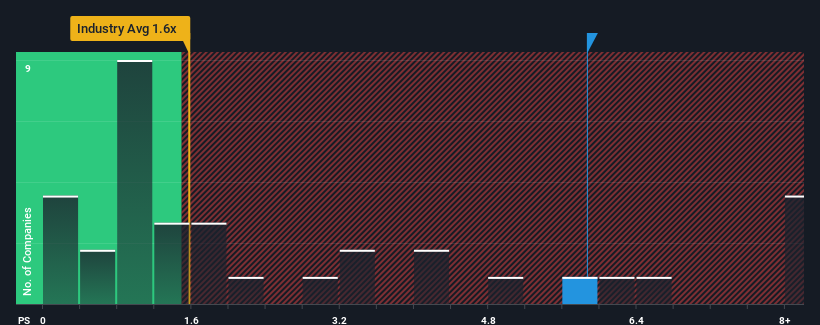

After such a large jump in price, when almost half of the companies in China's Forestry industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider MCC Meili Cloud Computing Industry Investment as a stock not worth researching with its 5.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for MCC Meili Cloud Computing Industry Investment

What Does MCC Meili Cloud Computing Industry Investment's Recent Performance Look Like?

For example, consider that MCC Meili Cloud Computing Industry Investment's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for MCC Meili Cloud Computing Industry Investment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is MCC Meili Cloud Computing Industry Investment's Revenue Growth Trending?

In order to justify its P/S ratio, MCC Meili Cloud Computing Industry Investment would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.0%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.2% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 14% shows it's noticeably less attractive.

With this in mind, we find it worrying that MCC Meili Cloud Computing Industry Investment's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On MCC Meili Cloud Computing Industry Investment's P/S

MCC Meili Cloud Computing Industry Investment's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of MCC Meili Cloud Computing Industry Investment revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 2 warning signs for MCC Meili Cloud Computing Industry Investment (1 is concerning!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000815

MCC Meili Cloud Computing Industry Investment

Engages in the data center business in China.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.