3 Reliable Dividend Stocks To Consider With At Least 3.9% Yield

Reviewed by Simply Wall St

As global markets react to the Trump administration's emerging policies and AI-related excitement, major U.S. indices have reached record highs, with growth stocks outperforming value shares for the first time this year. In this environment of heightened optimism and market activity, dividend stocks with reliable yields can offer a sense of stability and income potential for investors seeking consistency amidst fluctuating economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

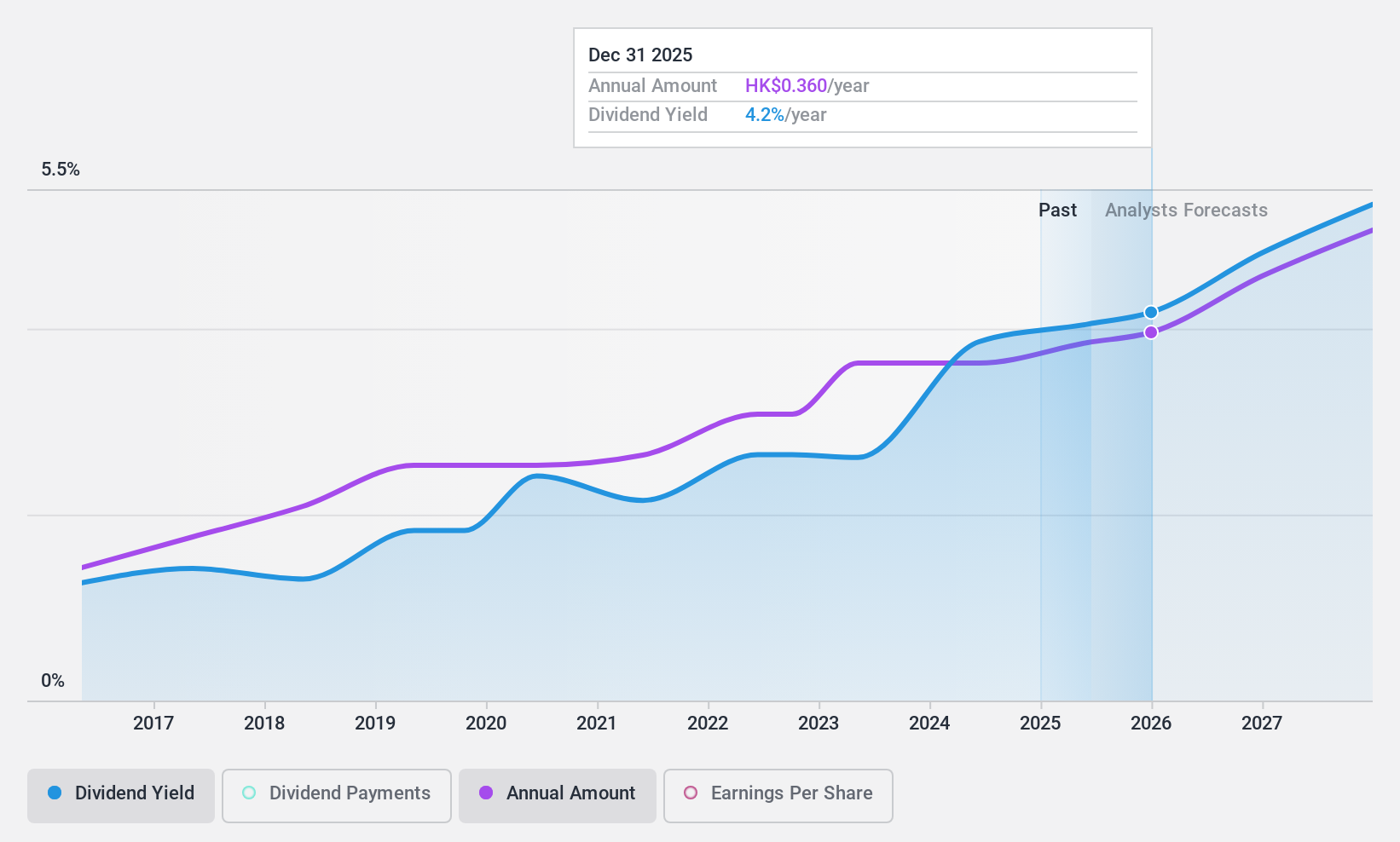

Beijing Tong Ren Tang Chinese Medicine (SEHK:3613)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Tong Ren Tang Chinese Medicine Company Limited, with a market cap of HK$6.95 billion, operates in the manufacture, retail, and wholesale of healthcare products and Chinese medicine to both wholesalers and individuals.

Operations: Beijing Tong Ren Tang Chinese Medicine Company Limited generates revenue from various regions, including HK$429.03 million from overseas markets, HK$979.91 million from Hong Kong, and HK$240.56 million from Mainland China.

Dividend Yield: 4%

Beijing Tong Ren Tang Chinese Medicine's dividend yield of 3.98% is relatively low compared to the top dividend payers in Hong Kong. While its dividends have been stable and reliable over the past decade, they are not well covered by free cash flows, raising sustainability concerns. Despite a reasonable payout ratio of 55.9%, the lack of free cash flow coverage suggests potential risks for future payments. The stock trades at a discount to its estimated fair value, offering some valuation appeal.

- Get an in-depth perspective on Beijing Tong Ren Tang Chinese Medicine's performance by reading our dividend report here.

- The analysis detailed in our Beijing Tong Ren Tang Chinese Medicine valuation report hints at an inflated share price compared to its estimated value.

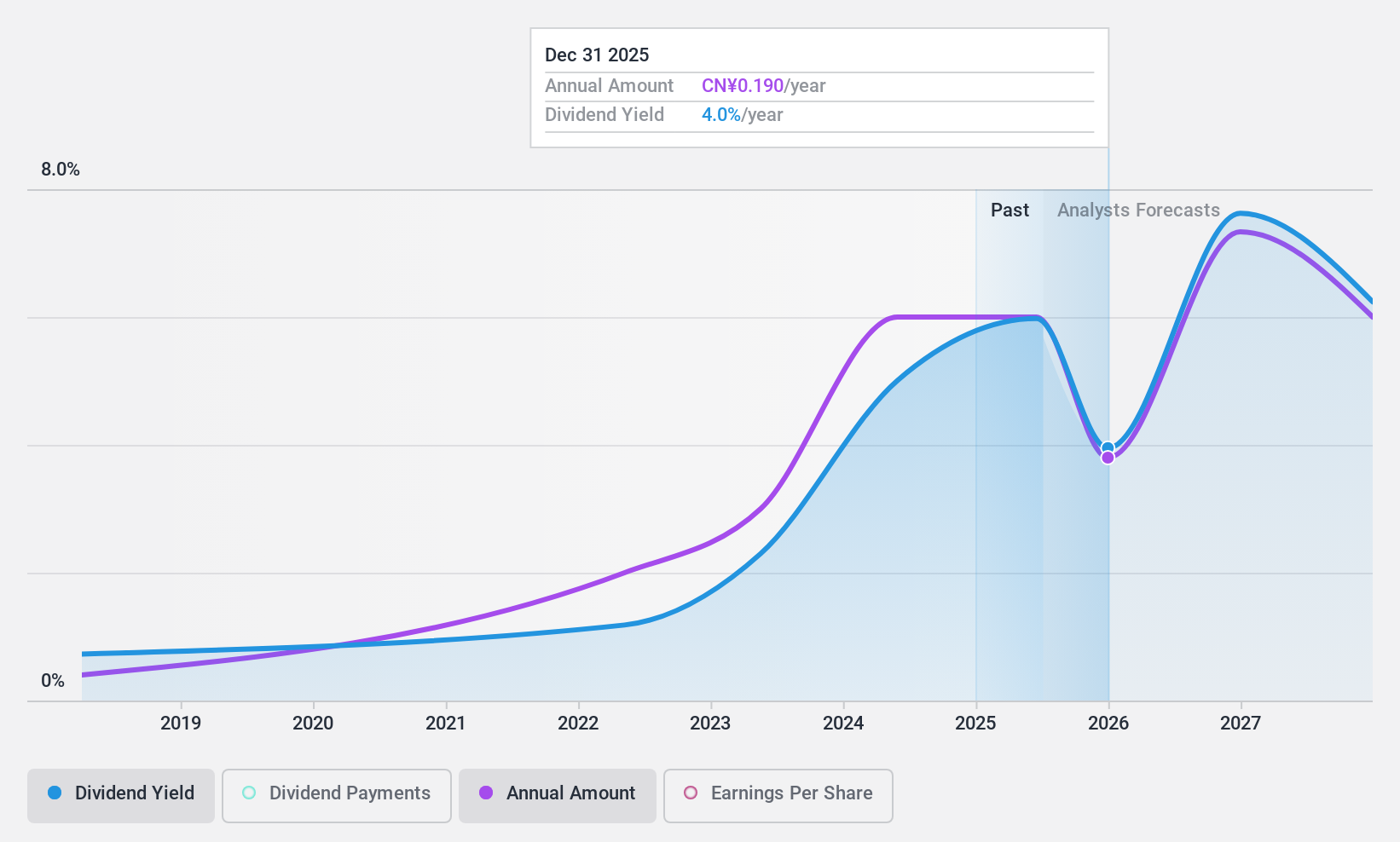

Inner Mongolia Yuan Xing Energy (SZSE:000683)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Inner Mongolia Yuan Xing Energy Company Limited operates in the soda ash, methanol, fertilizer, and agricultural production materials sectors in China with a market cap of CN¥20.82 billion.

Operations: Inner Mongolia Yuan Xing Energy Company Limited generates revenue from its operations in the soda ash, methanol, fertilizer, and agricultural production materials sectors in China.

Dividend Yield: 5.2%

Inner Mongolia Yuan Xing Energy's dividend yield of 5.22% is among the top 25% in China, with dividends covered by earnings (64.9% payout ratio) and cash flows (41.2% cash payout ratio). Despite this coverage, its dividend track record has been volatile over the past decade. The company trades at a good value relative to peers and below its estimated fair value, though profit margins have declined recently from 17.1% to 11.9%.

- Unlock comprehensive insights into our analysis of Inner Mongolia Yuan Xing Energy stock in this dividend report.

- Upon reviewing our latest valuation report, Inner Mongolia Yuan Xing Energy's share price might be too pessimistic.

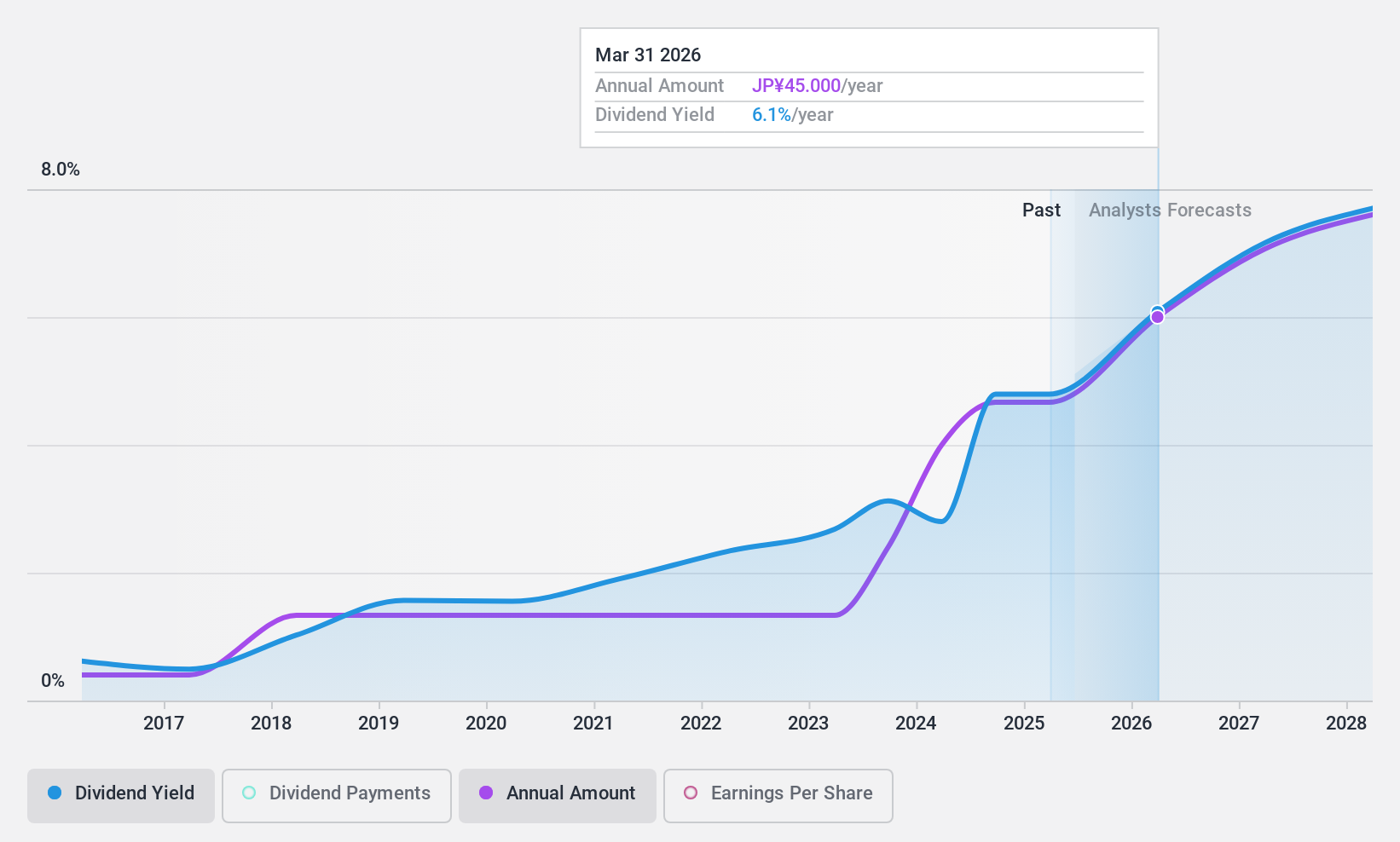

Futaba Industrial (TSE:7241)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Futaba Industrial Co., Ltd. is a company that manufactures and sells automotive parts, information environment equipment, equipment for external sales, and agricultural equipment both in Japan and internationally, with a market cap of ¥64.61 billion.

Operations: Futaba Industrial Co., Ltd.'s revenue segments include ¥52.63 billion from Asia, ¥72.18 billion from China, ¥338.24 billion from Japan, ¥68.75 billion from Europe, and ¥220.29 billion from North America.

Dividend Yield: 4.8%

Futaba Industrial offers a compelling dividend yield of 4.85%, placing it in the top 25% of Japanese dividend payers, with payments consistently growing and stable over the past decade. The dividends are well-supported by earnings and cash flows, evidenced by payout ratios of 43.1% and 20.5%, respectively. Trading significantly below its estimated fair value, Futaba presents good relative value despite a recent decline in profit margins from 2.3% to 1%.

- Click here and access our complete dividend analysis report to understand the dynamics of Futaba Industrial.

- Insights from our recent valuation report point to the potential undervaluation of Futaba Industrial shares in the market.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1959 more companies for you to explore.Click here to unveil our expertly curated list of 1962 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000683

Inner Mongolia Berun Chemical

Engages in the soda ash, methanol, fertilizer and agricultural production materials, and other businesses in China.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives