There's Reason For Concern Over Zhuhai Zhongfu Enterprise Co.,Ltd's (SZSE:000659) Massive 26% Price Jump

Despite an already strong run, Zhuhai Zhongfu Enterprise Co.,Ltd (SZSE:000659) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 26% in the last year.

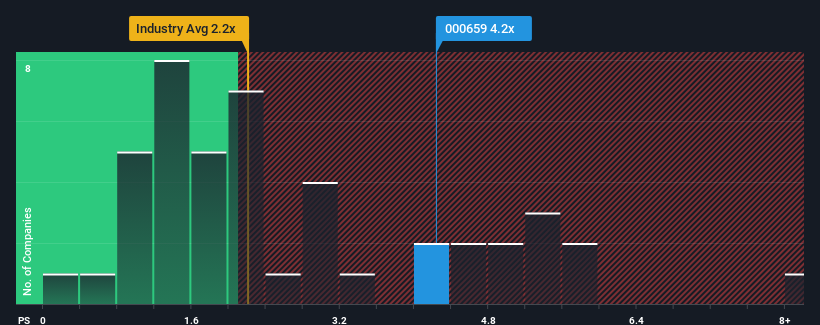

Since its price has surged higher, given around half the companies in China's Packaging industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Zhuhai Zhongfu EnterpriseLtd as a stock to avoid entirely with its 4.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Zhuhai Zhongfu EnterpriseLtd

What Does Zhuhai Zhongfu EnterpriseLtd's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Zhuhai Zhongfu EnterpriseLtd over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhuhai Zhongfu EnterpriseLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Zhuhai Zhongfu EnterpriseLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. This means it has also seen a slide in revenue over the longer-term as revenue is down 27% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 14% shows it's an unpleasant look.

With this information, we find it concerning that Zhuhai Zhongfu EnterpriseLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Zhuhai Zhongfu EnterpriseLtd's P/S Mean For Investors?

The strong share price surge has lead to Zhuhai Zhongfu EnterpriseLtd's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zhuhai Zhongfu EnterpriseLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you settle on your opinion, we've discovered 1 warning sign for Zhuhai Zhongfu EnterpriseLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhuhai Zhongfu EnterpriseLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000659

Zhuhai Zhongfu EnterpriseLtd

Researches, develops, manufactures, and sells PET beverage packaging materials in China.

Imperfect balance sheet and overvalued.

Market Insights

Community Narratives