- China

- /

- Metals and Mining

- /

- SZSE:000426

Inner Mongolia Xingye Silver &Tin MiningLtd's (SZSE:000426) investors will be pleased with their impressive 173% return over the last five years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term Inner Mongolia Xingye Silver &Tin Mining Co.,Ltd (SZSE:000426) shareholders would be well aware of this, since the stock is up 171% in five years. On top of that, the share price is up 14% in about a quarter. But this could be related to the strong market, which is up 25% in the last three months.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Inner Mongolia Xingye Silver &Tin MiningLtd

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

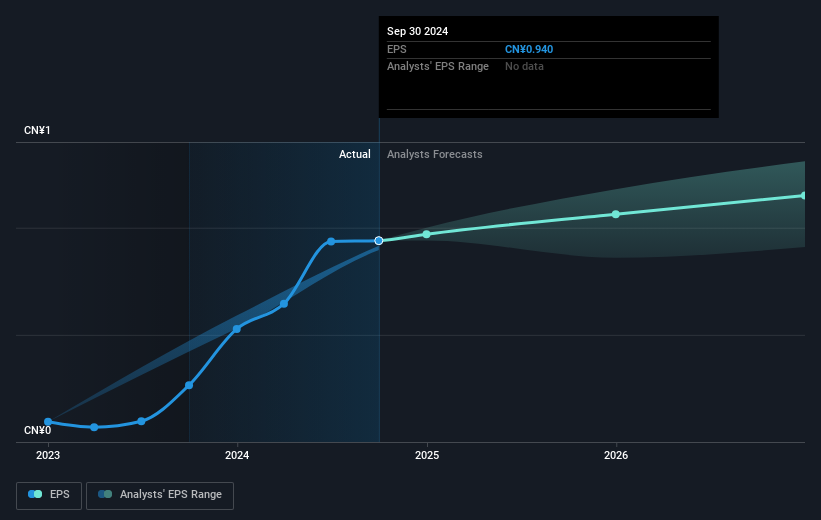

During the last half decade, Inner Mongolia Xingye Silver &Tin MiningLtd became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Inner Mongolia Xingye Silver &Tin MiningLtd share price is up 69% in the last three years. Meanwhile, EPS is up 104% per year. This EPS growth is higher than the 19% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Inner Mongolia Xingye Silver &Tin MiningLtd has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Inner Mongolia Xingye Silver &Tin MiningLtd shareholders have received a total shareholder return of 42% over the last year. That's including the dividend. That's better than the annualised return of 22% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before deciding if you like the current share price, check how Inner Mongolia Xingye Silver &Tin MiningLtd scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000426

Inner Mongolia Xingye Silver &Tin MiningLtd

Engages in mining, extracting, and smelting non-ferrous and precious metals.

Outstanding track record with excellent balance sheet.