Stock Analysis

The five-year decline in earnings might be taking its toll on Jilin Chemical Fibre StockLtd (SZSE:000420) shareholders as stock falls 7.4% over the past week

Jilin Chemical Fibre Stock Co.,Ltd (SZSE:000420) shareholders have seen the share price descend 23% over the month. Looking further back, the stock has generated good profits over five years. It has returned a market beating 13% in that time.

In light of the stock dropping 7.4% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

View our latest analysis for Jilin Chemical Fibre StockLtd

We don't think that Jilin Chemical Fibre StockLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Jilin Chemical Fibre StockLtd can boast revenue growth at a rate of 9.5% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 2% full reflects the underlying business growth. The key question is whether revenue growth will slow down, and if so, how quickly. There's no doubt that it can be difficult to value pre-profit companies.

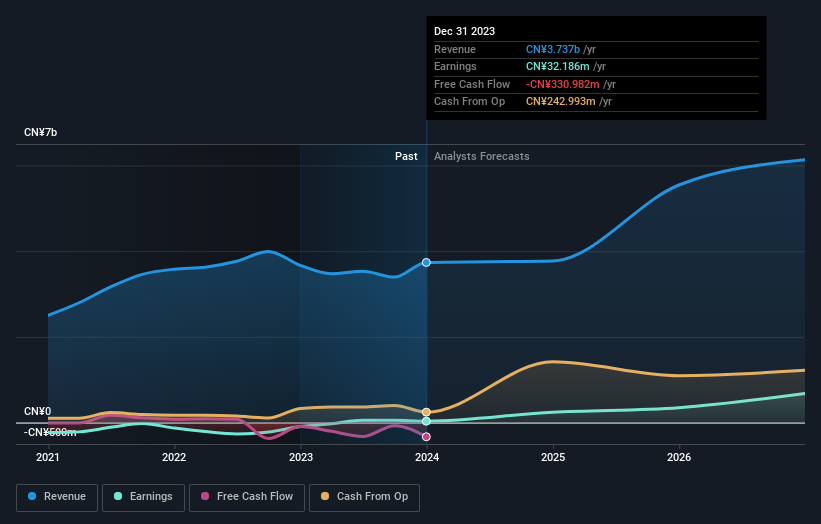

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Jilin Chemical Fibre StockLtd stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While it's never nice to take a loss, Jilin Chemical Fibre StockLtd shareholders can take comfort that their trailing twelve month loss of 7.9% wasn't as bad as the market loss of around 14%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 2% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Jilin Chemical Fibre StockLtd (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

We will like Jilin Chemical Fibre StockLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Jilin Chemical Fibre StockLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Jilin Chemical Fibre StockLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000420

Jilin Chemical Fibre StockLtd

Produces and sells chemical fiber in China.

Reasonable growth potential with questionable track record.